Many people dream of leaving their jobs and making the decision to retire early.

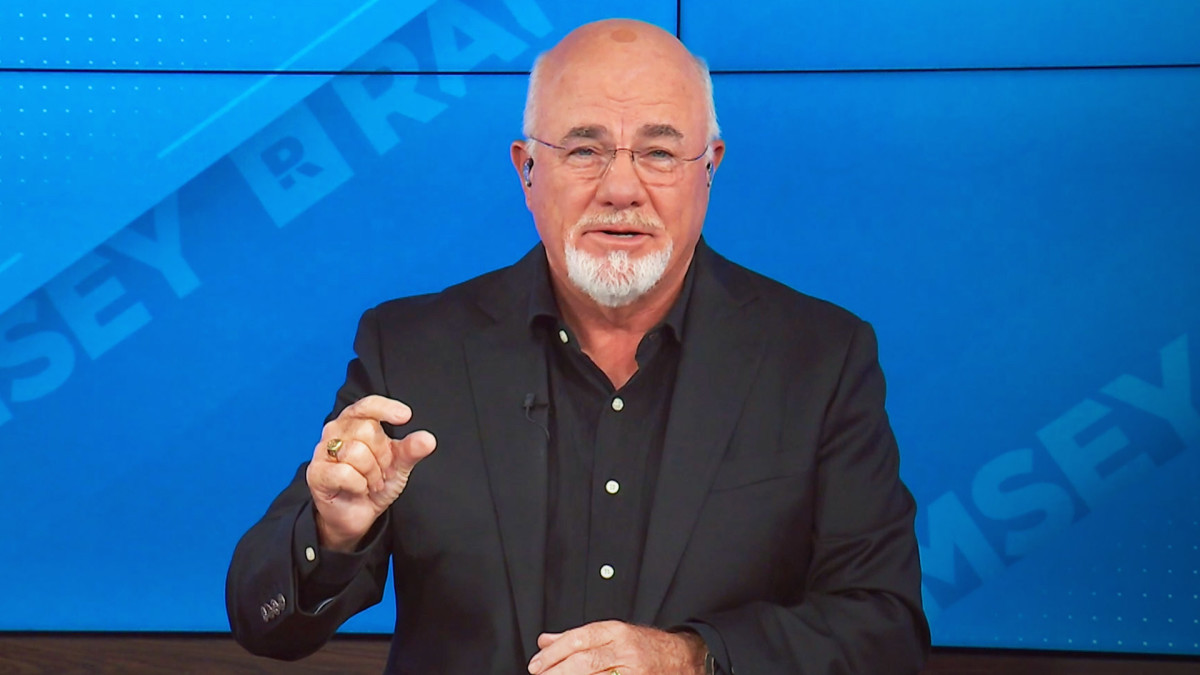

Personal finance coach Dave Ramsey says it's possible and that people considering the dramatic move should evaluate a few factors — including their mortgage payments — and develop a plan.

Related: Dave Ramsey shares advice on mortgages and buying a home now

Because Medicare benefits become available at age 65, early retirement generally means retiring before you reach that age.

But many people hope to retire at ages much younger than that. In order to do so, having a plan that involves low expenses, becoming debt-free and concentrating on saving and investing is a must.

Ramsey believes the first thing to do when planning for early retirement is to have a good understanding of specific goals.

The type of lifestyle you want to live will determine the size of the budget you need to plan for.

To understand specifically what this means, Ramsey suggests creating a mock retirement budget that sets guidelines for expenses on a monthly basis.

Dave Ramsey says a mock retirement budget does not include a mortgage payment

Ramsey lists a number of items to include an expected financial total for in a monthly budget such as utilities, insurance, medical costs, food, phone, internet, gas and entertainment.

But that list, notably, does not include a mortgage payment.

"That's because you want to pay off the mortgage (and any other debt) before you retire," Ramsey wrote. "Debt will destroy your plans to retire early. It will eat up your monthly income and drain your retirement savings."

The next step is to evaluate your current financial situation, Ramsey explained.

He likens it to planning a long road trip in the sense that knowing your destination isn't the only consideration. A person needs to know exactly where they are starting from and how far they need to go.

Other than paying off your house early so mortgage payments are no longer a factor, Ramsey says there are a few other important things to consider.

One is to figure out ways to lower your retirement budget, which means living on a smaller amount of money per month over time. That involves progressively cutting back on expensive hobbies such as travel.

Another is to add to your income during your working years by finding additional employment.

"Let's say you get a part-time job that brings in an extra $1,000 a month," Ramsey wrote. "If you invested that extra income into good growth stock mutual funds month after month, year after year, that could add hundreds of thousands of dollars to your retirement."

Shutterstock

Dave Ramsey suggests another key to early retirement

Ramsey explained another tool to use when planning for early retirement: a bridge account.

This refers to setting up a taxable investment account for the purpose of bridging the gap between your early retirement and when you can begin taking money out of your retirement accounts without a penalty.

Ramsey believes mutual funds are best when investing in a bridge account.

Another investment option is real estate, Ramsey wrote, but he mentions a few rules to follow.

One is being sure you've already paid off your own home before investing in any other real estate. Getting rid of the mortgage payment for the home you live in is a must before buying other property.

Ramsey also says you should pay for other real estate with cash and that hiring a real estate agent to help is important.

"This is one of the biggest investments you ever make, so having a pro in your corner is the way to go," he wrote.

Another big consideration is to be ready to make serious lifestyle changes that involve sacrifices.

These can involve taking less expensive vacations, cutting grocery budgets and looking ways for ways to save on clothing, entertainment, dining out and subscription services such as streaming video.

Finally, Ramsey suggests thinking about where you want to live when you are retired.

Moving is an expense all its own. So considerations such as cost of living and whether it's important to be near family become important.

Related: Veteran fund manager picks favorite stocks for 2024