Nearly 1 in 3 Americans have no retirement savings, according to a 2024 GOBankingRates survey. Among those ages 55 to 64 — the group closest to retirement — 25% are in the same boat.

Find Out: This Common Habit Can Ruin Your Retirement, According to Dave Ramsey

Read Next: 7 Ways Your Paycheck Indicates If You're Rich or Middle Class

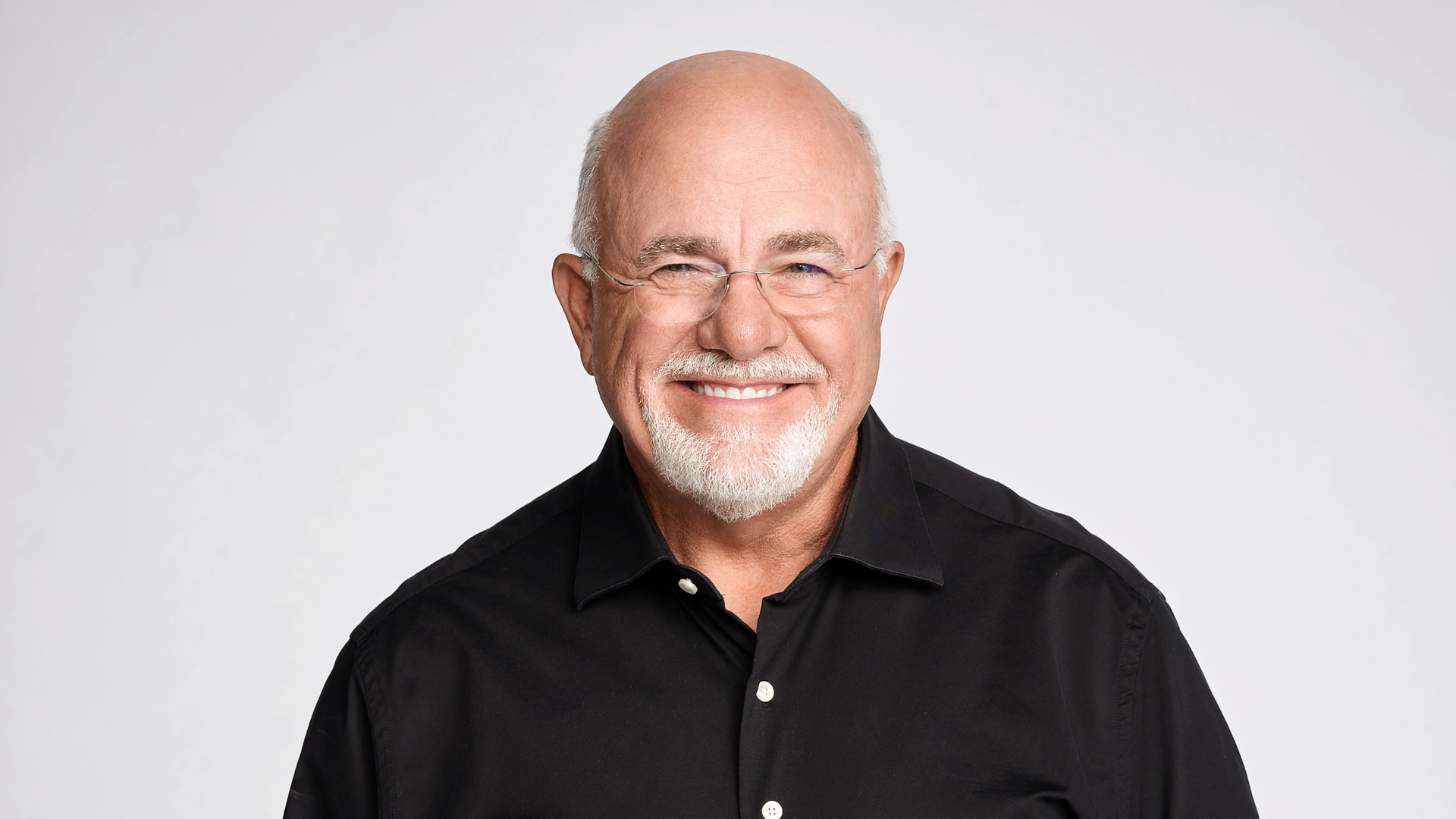

Money expert Dave Ramsey came face-to-face with this all-too-common predicament when he received a call on “The Ramsey Show” from a woman in Idaho named Jenny who said she was 61 and had nothing saved for retirement. Here’s the advice he gave her.

Why Income — Not Savings — May Be the Bigger Problem

Jenny was dealing with a number of financial stressors — she was divorced, living in low-income housing and was working 25 hours a week as a cashier. She had $22,000 in the bank left over from the sale of her home and no additional retirement savings. Ramsey immediately honed in on one key aspect of Jenny’s situation — her job as a part-time cashier.

“OK, so, what are we doing to get a better job?” Ramsey said. “That one sucks. … Mathematically, you don’t have any money. … And the reason is you don’t have much income. So, we’ve got to work on your career.”

He said that if Jenny were making $50,000 a year, much of her financial stress would go away.

“Let’s pretend you have $4,000 a month coming in, you’re 61, you have $22,000 in the bank,” Ramsey said. “All of a sudden, everything changes. My point of this pretend ride is that your problem is an income problem. So, when I fix the income problem … all the stress and the fear starts to go away because it all really … goes back to that one thing.”

Be Aware: The Biggest 401(k) Mistake People Make, According to Dave Ramsey

How To Earn More in Your 60s Without a Degree

Jenny said that she was unable to do much physical labor due to problems with her knees. She also did not have a degree that would qualify her for higher-paying jobs. But Ramsey came up with a solution.

“I want to be thinking about what we can do that gets Jenny’s income rocking,” he said. “And it might be a self-employed thing because that way, you can control [your income] rather than just looking for a job.”

Ramsey said that she should aim for work that she would be able to do for 40 to 50 hours a week that would make her $25 to $30 an hour. Because Jenny has physical limitations, he recommended that she start a side gig reselling items on eBay and Facebook Marketplace.

“Let’s start buying stuff at garage sales and reselling it,” he said. “You can go buy a chair for $2 at a garage sale and sell it for $50 on eBay. You can make $100,000 a year screwing around with that.”

If you’re nearing retirement with little or no savings, it’s not too late to turn things around. As Ramsey emphasized, increasing your income — even through unconventional means — can be the first step toward financial stability.

More From GOBankingRates

- 9 Costco Items Retirees Need To Buy Ahead of Fall

- 5 Ways 'Loud Budgeting' Can Make You Richer, According to Vivian Tu

- 5 Types of Cars Retirees Should Stay Away From Buying

- 6 Popular SUVs That Aren't Worth the Cost -- and 6 Affordable Alternatives

This article originally appeared on GOBankingRates.com: Dave Ramsey: Do This First If You’re 60+ With No Retirement Savings