People invest and save their money for many life events as they make decisions about how to approach them.

Planning for retirement, for example, is one of the most important reasons people invest.

Related: Coca-Cola surprisingly ending most sales of popular beverage line

Some financial circumstances are optional, including whether to attend college or whether to start a business.

Major purchases, such as buying a home or car, require having enough money saved to make a significant down payment.

Many people also have strategies for other financial goals, including establishing an emergency fund and saving for vacations and other entertainment expenses.

One thing everyone has in common, but is sometimes difficult to talk about, is that at some point our lives will come to an end.

This reality itself carries with it a number of significant financial considerations, such as preparing a will and making decisions about how to distribute one's assets.

Another fact to confront is that funerals are expensive. But there are a number of ways people can handle preparing for them.

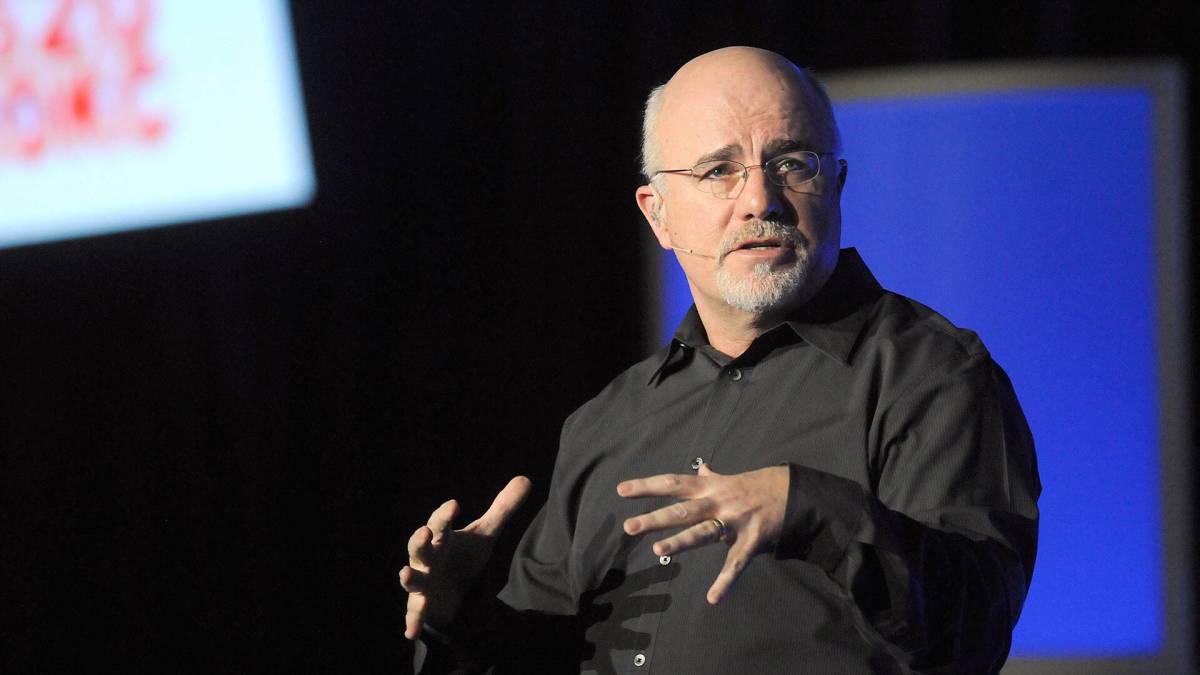

Dave Ramsey explains his thoughts on planning for funeral expenses

Recently, personal finance personality Dave Ramsey was asked about precisely this issue.

"Dear Dave," wrote an advice seeker named Shannon, according to KTAR News in Phoenix. "I'm 67, and I've been wondering what your position is on preplanning for a funeral versus prepaying. Is one a better idea than the other, or should you do both?"

Ramsey seemed grateful for the opportunity to explain his opinion on the subject.

"This is a great question. I wish more folks would think about these kinds of things ahead of time," he wrote. "Preplanning a funeral is truly a gift to your family. But if you prepay, it's a gift to the funeral home."

Ramsey believes that, if a person has the financial means to prepay funeral expenses, it is a better idea to put the money into an investment account and see it grow.

"Doing the legwork and setting things up ahead of time so your family doesn't have to make a lot of financial decisions in the middle of an emotional situation shows them respect and consideration," he wrote.

TheStreet

Some important numbers to consider

Ramsey discussed a few of the drawbacks he sees in using a prepaid plan.

"When you buy a prepaid plan, you could be years or decades away from needing it," he wrote. "Plus the inflation rate on funerals is about 4%, so in essence, you'd be making 4% on your money. And, of course, you're locked into everything at that point."

"If you took the cost of a funeral and invested it at age 30, instead of 4% on your money, you’d get an actual investment return," Ramsey added. "By the time you’re 80, you’d have about $600,000. So prepaying in your 30s or 40s is mathematically ridiculous."

"Now, if you're in your 60s, like you and me, there aren't as many years for that money to grow," he wrote. "You wouldn't see a huge return on investment, but it would still provide for a nice service."

The bestselling author and radio show host also addressed the funeral business in general.

"Believe it or not, it took me a while to figure out that the funeral world is an industry — an extremely profitable industry," Ramsey wrote. "And like with many things, when you add on stuff like financing or prepayment to a purchase, you're adding to their profits. Most funeral providers make as much money on prepayment plans as they do in actual margin on the goods and services that go along with this kind of thing."

"That being said, I’ve got no problem with a business or industry making money," he continued. "If they treat their customers well, no one's taken advantage of, and a quality product or service is provided, it's all good."

"But when it comes to funerals, I tell people to preplan. Don't prepay."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.