With a market cap of $54.6 billion, Datadog, Inc. (DDOG) is a SaaS observability and security platform that provides real-time monitoring and insights across an organization’s entire technology stack. By integrating infrastructure monitoring, application performance, log management, and more, it helps teams accelerate digital transformation, improve collaboration, and secure their cloud applications.

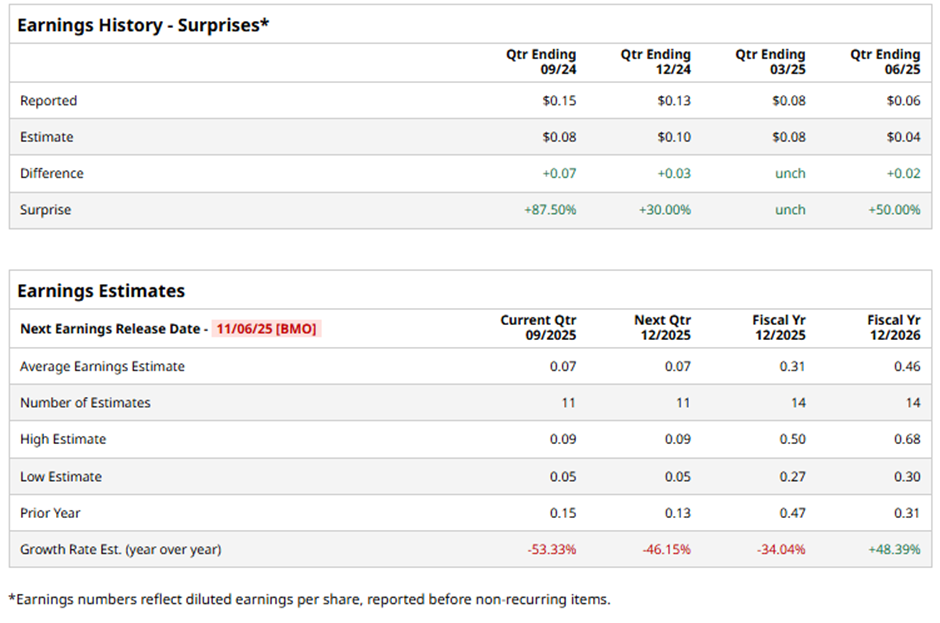

The New York-based company is slated to announce its fiscal Q3 2025 results before the market opens on Thursday, Nov. 6. Ahead of this event, analysts expect Datadog to report a profit of $0.07 per share, a 53.3% decline from $0.15 per share in the year-ago quarter. However, it has exceeded or met Wall Street's earnings expectations in the past four quarters.

For fiscal 2025, analysts expect the data analytics and cloud monitoring company to report EPS of $0.31, down over 34% from $0.47 in fiscal 2024. Nevertheless, EPS is expected to grow 48.4% year-over-year to $0.46 in fiscal 2026.

Shares of Datadog have increased 27.7% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) nearly 17% gain. However, the stock has lagged behind the iShares U.S. Technology ETF's (IYW) 31.6% return over the same period.

Datadog reported Q2 2025 results on Aug. 7. The company posted adjusted EPS of $0.46 and revenue of $826.8 million, above forecasts. The company also projected Q3 revenue between $847 million and $851 million, surpassing Wall Street’s estimate, signaling strong demand driven by enterprise adoption of AI and cloud technologies. Despite the strong results and outlook, shares of DDOG fell slightly that day.

Analysts' consensus view on DDOG stock remains bullish, with an overall "Strong Buy" rating. Out of 41 analysts covering the stock, 31 recommend a "Strong Buy," three "Moderate Buys," six give a "Hold" rating, and one has a "Strong Sell." The average analyst price target for Datadog is $169.03, indicating a potential upside of 6.9% from the current levels.