/Darden%20Restaurants%2C%20Inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

With a market cap of $21.6 billion, Darden Restaurants, Inc. (DRI) is a leading full-service restaurant company that owns and operates a diverse portfolio of well-known dining brands across the United States and Canada. The company includes popular concepts such as Olive Garden, LongHorn Steakhouse, and Ruth’s Chris Steak House.

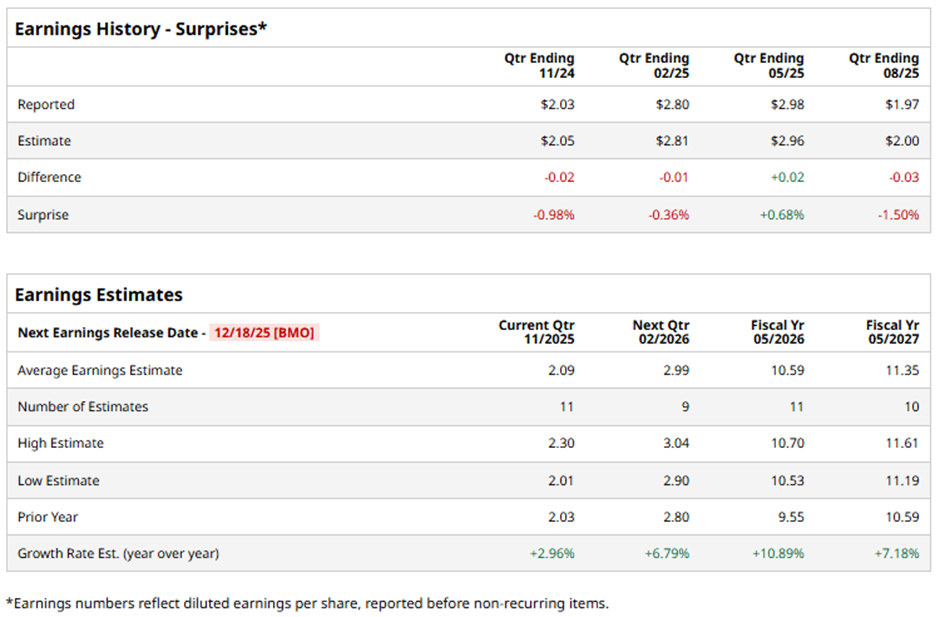

The Orlando, Florida-based company is expected to announce its fiscal Q2 2026 results before the market opens on Thursday, Dec. 18. Ahead of this event, analysts predict Darden Restaurants to report an adjusted EPS of $2.09, up nearly 3% from $2.03 in the year-ago quarter. It has exceeded Wall Street's earnings estimates in one of the last four quarters while missing on three other occasions.

For fiscal 2026, analysts forecast the Olive Garden parent to post an adjusted EPS of $10.59, an increase of 10.9% from $9.55 in fiscal 2025.

Shares of Darden Restaurants have risen 10.7% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) nearly 12% gain. However, the stock has outpaced the Consumer Discretionary Select Sector SPDR Fund's (XLY) 2.2% return over the period.

Shares of Darden Restaurants tumbled 7.7% on Sept. 18 after the company reported Q1 2026 adjusted EPS of $1.97, missing Wall Street estimates. Despite quarterly sales of $3.04 billion meeting forecasts, operating costs surged 8.8% to $2.71 billion, driven by higher ingredient and marketing expenses. Additionally, while management raised its annual sales growth outlook to 7.5% - 8.5%, the midpoint of the range fell slightly below analysts’ average expectation, dampening investor sentiment.

Analysts' consensus view on DRI stock is cautiously optimistic, with an overall "Moderate Buy" rating. Among 30 analysts covering the stock, 17 recommend "Strong Buy," two suggest "Moderate Buy," and 11 indicate “Hold.” The average analyst price target for Darden Restaurants is $220.45, suggesting a potential upside of 18.8% from current levels.