Darden Restaurants, Inc. (NYSE:DRI) will release earnings for the first quarter, before the opening bell on Thursday, Sept. 18.

Analysts expect the company, which owns brands like Olive Garden and LongHorn Steakhouse, to report quarterly earnings at $2.01 per share. That's up from $1.75 per share in the year-ago period. Darden projects quarterly revenue of $3.04 billion, compared to $2.76 billion a year earlier, according to data from Benzinga Pro.

On June 20, Darden Restaurants reported better-than-expected fourth-quarter financial results.

Darden shares fell 0.6% to trade at $210.83 on Tuesday.

Benzinga readers can access the latest analyst ratings on the Analyst Stock Ratings page. Readers can sort by stock ticker, company name, analyst firm, rating change or other variables.

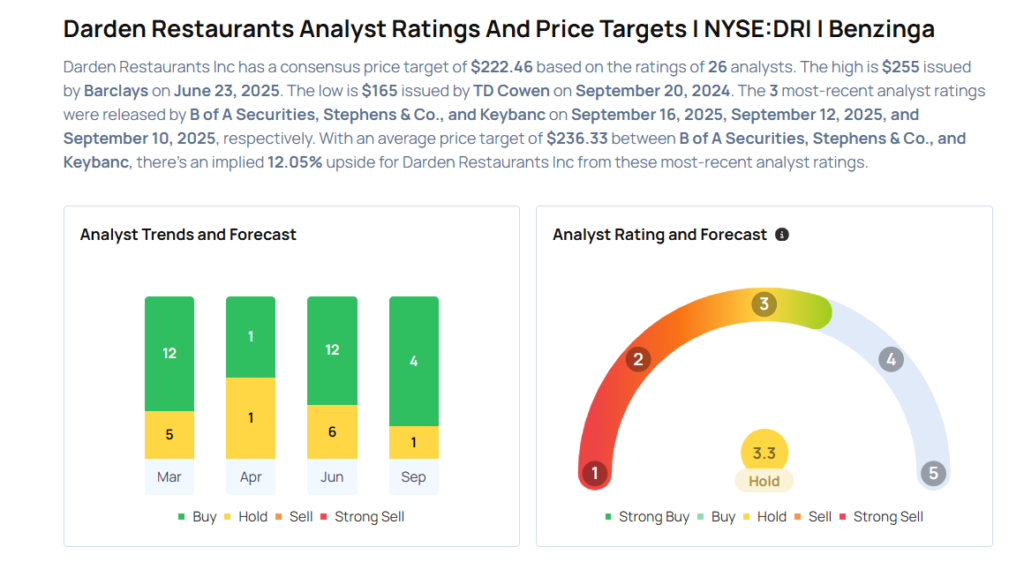

Let's have a look at how Benzinga's most-accurate analysts have rated the company in the recent period.

- Keybanc analyst Eric Gonzalez maintained an Overweight rating and cut the price target from $245 to $240 on Sept. 10, 2025. This analyst has an accuracy rate of 67%.

- Truist Securities analyst Jake Bartlett reiterated a Buy rating with a price target of $252 on Sept. 2, 2025. This analyst has an accuracy rate of 68%.

- BMO Capital analyst Andrew Strelzik maintained a Market Perform rating and increased the price target from $190 to $215 on June 25, 2025. This analyst has an accuracy rate of 62%.

- JP Morgan analyst John Ivankoe maintained an Overweight rating and boosted the price target from $218 to $240 on June 25, 2025. This analyst has an accuracy rate of 71%.

- Raymond James analyst Brian Vaccaro maintained an Outperform rating and raised the price target from $230 to $240 on June 23, 2025. This analyst has an accuracy rate of 78%

Considering buying DRI stock? Here’s what analysts think:

Read This Next:

Photo via Shutterstock