/Darden%20Restaurants%2C%20Inc_%20phone%20and%20website%20by-%20T_Schneider%20via%20Shutterstock.jpg)

Orlando, Florida-based Darden Restaurants, Inc. (DRI) owns and operates full-service restaurants in North America. With a market cap of $21.4 billion, Darden Restaurants operates various brands including Olive Garden, LongHorn Steakhouse, Cheddar's Scratch Kitchen, Seasons 52, Yard House, and more.

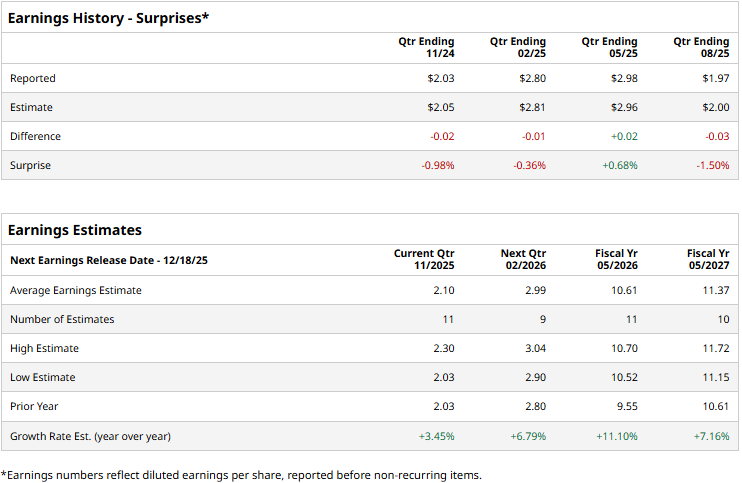

The restaurant giant is expected to release its Q2 results by mid-December. Ahead of the event, analysts expect DRI to report an adjusted EPS of $2.10, up 3.5% from $2.03 reported in the year-ago quarter. While the company has surpassed analysts' bottom-line expectations once over the past four quarters, it has missed the projections on three other occasions.

For the full fiscal 2026, Darden’s adjusted EPS is expected to come in at $10.61, up 11.1% from $9.55 reported in 2025. While in fiscal 2027, its earnings are expected to grow 7.2% year-over-year to $11.37 per share.

DRI stock prices have gained 11.8% over the past 52 weeks, notably lagging behind the Consumer Discretionary Select Sector SPDR Fund’s (XLY) 19.8% surge and the S&P 500 Index’s ($SPX) 18.3% gains during the same time frame.

Darden Restaurants’ stock prices plummeted 7.7% in a single trading session following the release of its mixed Q2 results on Sept. 18. Driven by solid 5.9% growth in Olive Garden’s comps and 5.5% increase in LongHorn Steakhouse’s comps, the company’s overall same-store sales increased by 4.7% year-over-year. After including the impact of the acquisition of 103 Chuy's Tex Mex (Chuy's) restaurants and 22 net new restaurants, the company’s overall topline grew 10.4% year-over-year to $3 billion, beating the consensus estimates by a small margin.

However, Darden’s profit margins remained below expectations, leading to its adjusted EPS of $1.97 missing the consensus estimates by 1.5%.

Analysts remain optimistic about the stock’s prospects. DRI has a consensus “Moderate Buy” rating overall. Of the 29 analysts covering the stock, opinions include 17 “Strong Buys,” two “Moderate Buys,” and 10 “Holds.” Its mean price target of $224.61 suggests a 23.9% upside potential from current price levels.

.jpg?w=600)