Wedbush analyst Dan Ives has slammed “Big Short” investor Michael Burry, calling his massive bearish bet against Palantir Technologies Inc. (NASDAQ:PLTR) “dead wrong.”

Check out PLTR’s stock price here.

Ives Dismisses Burry’s Massive PLTR Short

During a recent video interview with Tom Nash, Ives dismissed Burry’s warnings as just “yelling fire in a crowded theater,” arguing the famed investor is fundamentally misjudging the company’s long-term trajectory.

The sharp criticism follows Palantir’s latest earnings, which Ives described as “one of the best quarters… maybe ever in software,” with numbers that “almost seem unreal.”

In a post on X, Ives dubbed Palantir as the “Messi Of AI.”

Despite the strong results, Palantir’s stock sold off, a reaction Ives attributes to the “goldfish memory” of investors and an “over obsession” with price-to-earnings or P/E ratios.

Ives argued that Burry is making a classic mistake by focusing on short-term metrics. “People have missed every transformational growth stock the last 20 years focused on just like… one-year valuation,” Ives said. He added, “I get the Michael Burry… been, you know, dead wrong the last few years.”

Ives Hails PLTR’s US Commercial Business

Ives countered the bearish narrative by pointing to Palantir’s explosive growth in its U.S. commercial business, which he believes will be “bigger than the company itself today” within three years.

He compared Palantir’s current growth phase to the “early days” of Salesforce Inc. (NYSE:CRM), Amazon.com Inc.‘s (NASDAQ:AMZN) AWS, and Microsoft Corp.‘s (NASDAQ:MSFT) services business.

“This is basically a business [that’s] the next Oracle Corp. (NYSE:ORCL), the next Salesforce, the next… mini Microsoft,” Ives stated, adding that Nvidia Corp. (NASDAQ:NVDA) wouldn’t have partnered with them if it weren’t the “gold standard.”

Ives Suggests To Value PLTR Based On Future Cash Flows

He urged investors to look past the short-term market reaction and Burry’s “bubble” narrative.

Instead, Ives argued Palantir should be valued on its future free cash flow (FCF) trajectory, which is set to expand dramatically as its more profitable commercial business grows.

“You can’t just look at it over the next year,” he concluded. “You have to look at the trajectory.”

PLTR Logs Massive Returns Above 150% In 2025

Despite closing 7.94% lower at $190.74 apiece and tumbling further by 3.01% after-hours, PLTR has scaled 153.68% year-to-date returns. It has advanced 273.05% over the year.

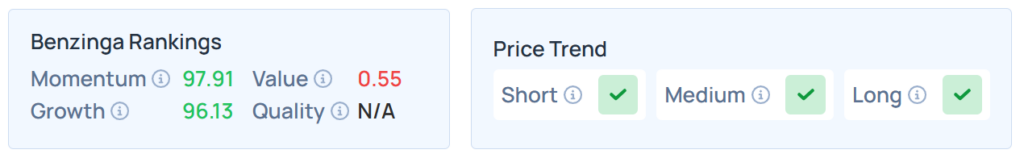

It maintains a stronger price trend over the long, short, and medium terms, with a poor value ranking. Additional performance details, as per Benzinga’s Edge Stock Rankings, are available here.

While the S&P 500, Dow Jones, and Nasdaq 100 closed lower on Tuesday, the futures were mixed on Wednesday.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Photo courtesy: Shutterstock