Over the weekend, Wedbush Securities analyst Dan Ives said Tesla Inc. (NASDAQ:TSLA) is on the verge of its most significant phase yet, arguing that the company's artificial intelligence and robotaxi ambitions could unlock at least $1 trillion in value.

AI Revolution And Robotaxi Potential

"We believe Tesla and Musk are heading into a very important chapter of their growth story as the AI revolution takes hold and the robotaxi opportunity is now a reality on the doorstep," Ives wrote on X, formerly Twitter. "We estimate the AI and autonomous opportunity is worth at least $1 trillion alone for Tesla."

Ives' remarks followed a Wall Street Journal report that Stephen Hawk, a 56-year-old Tesla investor from Florida, had filed a shareholder proposal urging Tesla's board to approve an investment in xAI.

Following the report, SkyBridge Capital founder Anthony Scaramucci also said that a Tesla–xAI merger "feels inevitable."

Delivery Momentum Fuels Near-Term Gains

Earlier this month, Gary Black, managing partner at The Future Fund LLC, said Tesla's stock surge in the past few days stems from expectations that the company will exceed Wall Street's third-quarter delivery forecasts.

"Let's not kid ourselves," Black wrote on X. "$TSLA has been strong the past few days NOT because of progress on robotaxi but because every hedge fund has come to the realization that $TSLA will crush 3Q delivery estimates in two weeks."

Black estimates Tesla will deliver 470,000 vehicles in the quarter, well above Wall Street's consensus of 432,000, aided by buyers rushing to take advantage of the expiring $7,500 EV tax credit on Sept. 30.

What Are The Mixed Global Signals

Tesla's performance remains uneven across markets. In China, sales fell 10% in August, marking the sixth monthly decline in 2025. Still, early September saw a rebound, with registrations hitting 14,300, a 41% jump from the previous quarter's weekly average.

In the U.S., rising vehicle prices have weighed on Tesla's market share even as overall EV sales climb.

Skepticism On Autonomy And Leadership

Not all observers are convinced Tesla can deliver on Ives' trillion-dollar thesis.

Ross Gerber, co-founder of Gerber Kawasaki, earlier questioned Tesla's approach to autonomy, saying Musk has ignored hardware issues critical to self-driving safety.

An ex-employee also criticized Musk's leadership as "seriously compromised," alleging it had damaged Tesla's mission.

Tesla Stock Lags Behind S&P 500 And Nasdaq 100

In July, Tesla reported second-quarter revenue of $22.5 billion, down 12% year-over-year and short of analyst estimates.

At the time, the company reiterated plans to launch a more affordable model later in 2025 while preparing the Tesla Semi and Cybercab for volume production in 2026.

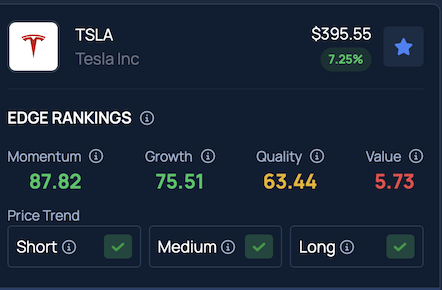

On the analyst front, Tesla carries a consensus price target of $311.81 based on 29 ratings. The three latest updates include Wedbush, RBC Capital and China Renaissance, with their average target of $391.33 suggesting a slight 1.07% downside.

Price Action: So far in 2025, Tesla's stock is down about 2%, underperforming the S&P 500's 11.95% gain and the Nasdaq 100's 14.66% increase, according to Benzinga Pro.

Benzinga's Edge Stock Rankings indicate that TSLA continues to show strength across short, medium and long-term horizons, with additional insights available for investors.

Read Next:

Photo Courtesy: Josiah True on Shutterstock.com

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.