Wedbush Securities' investor and Tesla Inc. (NASDAQ:TSLA) bull Dan Ives thinks that the EV giant's robotaxis can pose a major threat to Uber Technologies Inc.'s (NYSE:UBER) business amid robotics and autonomous push. He had earlier called Tesla the most "undervalued" name in AI.

Check out the current price of TSLA here.

‘A Golden Chapter For Tesla,' Says Dan Ives

Speaking to Yahoo Finance in an interview on Thursday, Ives reiterated his bullish views on the automaker's AI, autonomous, and robotics efforts. "This is going to be a golden chapter for Tesla in terms of autonomous and robotics, the AI roadmap. That's why you own the stock," Ives said.

Ives also said that Tesla's autonomous driving tech is going to be the best consumer application of the technology, adding that if Tesla could get "a million vehicles out there," it's going to be a Robotaxi network, which Ives said Tesla is going to own.

"It speaks to what I view as the biggest competitive threat to an Uber," Ives said. He also added that Tesla owners could put their vehicles on the network, which could give the company a scale advantage over rivals.

Robots Will Be In People's Houses

"In two or three years, it's going to become commonplace to have robots in houses," Ives said. The investor added that the robots would be doing functions like walking the dog or taking care of the laundry.

"That's why you're paying Musk a trillion dollars, if he hits all the goals. That's why Musk is the most important asset for Tesla," Ives said, reiterating his support for Elon Musk's trillion-dollar pay package, which has seen opposition from proxy advisory firms.

Elon Musk Predicts Robotaxi Expansion

During the company's Q3 earnings call, Musk said that Robotaxis in Austin would be going driverless by the end of the year. However, the billionaire backtracked on the promise of Robotaxis serving half the population of the U.S. by the end of the year. He said that Tesla was aiming to expand the Robotaxi to 8-10 major cities across the U.S.

Tesla's earnings report presented a mixed picture, with the company's $28.095 billion revenue beating the Wall Street consensus of $26.239 billion. However, Tesla missed Wall Street estimates of $0.54 EPS, reporting $0.50 instead, which illustrated a fourth straight EPS miss for the automaker.

Musk Hits Back At Pay Package Critics

Musk recently hit back at critics of his compensation award, reiterating that Tesla is worth more than all of its competitors in the automotive industry under his leadership, with a market capitalization of over $1.4 trillion.

He also called proxy advisory firms International Shareholder Services (ISS) and Glass Lewis "corporate terrorists" who advise shareholders to vote on random political lines. Musk was also supported by Tesla Board of Directors Chair Robyn Denholm.

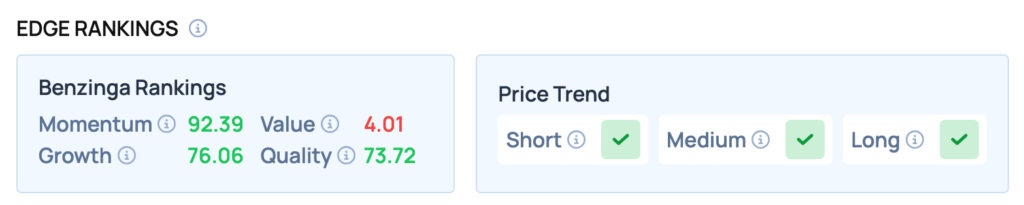

Tesla scores well on Momentum, Quality and Growth metrics, but offers poor Value. Tesla also offers a favorable price trend in the Short, Medium and Long term. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga's Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Around the World Photos via Shutterstock.com