Wedbush Securities' analyst and Tesla Inc. (NASDAQ:TSLA) bull Dan Ives hailed the company, saying that the “fireworks come early” for Tesla following Q2 deliveries, which fared better than some analysts' expectations despite a decline in sales.

What Happened: The analyst hailed Tesla's 384,122 deliveries, which Ives said beat "Street whisper numbers of ~365k vehicles," in a note released on Wednesday. The investor reiterated a $500 Price Target for TSLA, which is a 58% upside on the stock and maintained an ‘Outperform' rating.

A major chunk of the deliveries came from the Tesla Model 3 and the Model Y, with the automaker delivering over 373,728 units, according to the figures shared by Elon Musk's company.

Ives also outlined that Tesla's Chinese sales improved after a period of "significant weakness" as the company saw a "rebound in June with sales increasing for the first time in eight months reflecting higher demand for its updated Model Y."

The analyst also said that Musk's proactiveness has helped Tesla and predicts the company will see further growth should Musk remain focused on the brand.

"If Musk continues to lead and remain in the driver's seat, we believe Tesla is on a path to an accelerated growth path over the coming years with deliveries expected to ramp in the back-half of 2025 following the Model Y refresh cycle," Ives said.

Elsewhere, the investor also shared that Tesla has the potential to "own the autonomous market" in the U.S. with FSD as well as "license its technology to other auto players both in the U.S. and around the globe," Ives said.

However, Ives also noted that Musk must put Tesla ahead of his political views, fearing that the feud with the Trump administration could lead to more "hawkish" sentiment on Tesla and reduce government spending on the company, given the Robotaxi operation in Austin and Cybercab ambitions.

Why It Matters: The news comes in as Tesla stock surged following the release of the delivery data by the company, which beat analysts' expectations, given the poor sales figures in multiple markets.

The company also confirmed it will introduce more affordable models in its lineup, though it hasn't provided any confirmation about whether it'll be stripped-down versions of already-existing models or brand new.

Elsewhere, Musk will assume oversight of Tesla sales in the U.S. and Europe after close aide Omead Afshar's exit from the company, according to reports in the media.

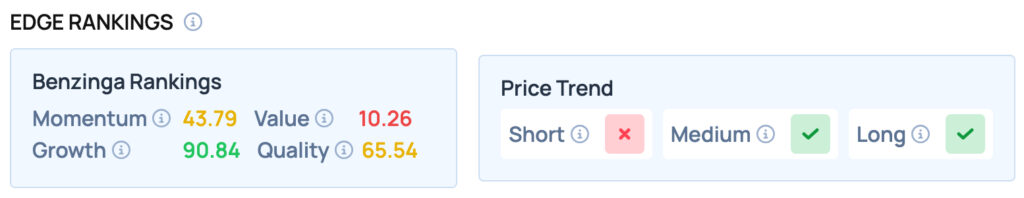

Tesla offers satisfactory Momentum and Quality, while scoring well on the Growth metric, but the stock offers poor Value. For more such insights, sign up for Benzinga Edge Stock Rankings today!

Check out more of Benzinga’s Future Of Mobility coverage by following this link.

Read Next:

Photo courtesy: Shutterstock