Dan Ives, Chairman of Eightco Holdings Inc. (NASDAQ:OCTO), said Tuesday that the company is geared to acquire 800 million World Network (WLD) tokens as part of its “Power of 8” program.

The ‘Power Of 8’

The Wall Street tech analyst announced via X his upcoming travels to San Francisco for the World store event, followed by visits to World locations in Asia in October.

Ives highlighted the firm’s commitment to the “Power of 8” initiative, aiming to acquire 800 million WLD tokens, worth $992 million currently, and verify 8 billion humans.

Why Is Ives Optimistic?

Eightco revealed on Monday that the World Network added 1.9 million verified humans since launching its treasury strategy, bringing the total to 16.9 million. The goal is to authenticate 100 million within the next 12 months.

Ives has been upbeat about his role at Eightco, citing his passion for AI and the potential of the decentralized identity verification project. He described the World project as the “intersection of AI and crypto” and the iris scanning technology used by Orb devices as the future standard for identifying humans and separating them from bots.

World’s Privacy Question

World, formerly Worldcoin, co-founded by OpenAI CEO Sam Altman, is an identity verification project that captures people's irises to confirm their humanness and build a digital ID, allowing them to receive free WLD tokens.

However, concerns around personal data privacy have restricted its growth, with Hong Kong, Kenya and Spain banning it.

Ives, who likened the project to Tesla Inc. (NASDAQ:TSLA) and NVIDIA Corp. (NASDAQ:NVDA) in their early days, calls it the most “privacy-driven solution” where users are in full control of their data.

Price Action: At the time of writing, WLD was exchanging hands at $1.24, down 1.23% in the last 24 hours, according to data from Benzinga Pro. The coin has surged 44% over the last month.

Eightco shares rose 2.51% in after-hours trading after closing 18.45% lower at $9.150 during Tuesday’s regular trading session.

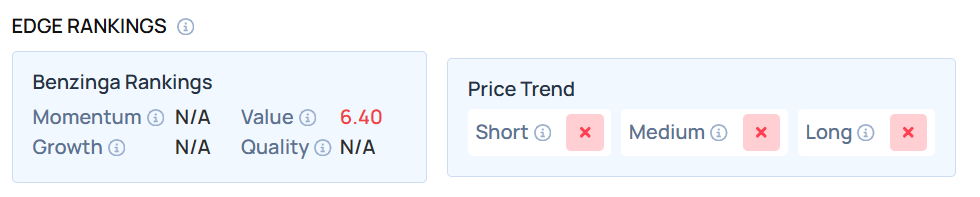

According to Benzinga’s Edge Stock Rankings, the stock was in a downward trend over the short, medium and long term. Here’s how it ranks in other metrics as of this writing.

Read Next:

Photo Courtesy: ARTEMENKO VALENTYN on Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.