/CVS%20Health%20Corp%20location-by%20jetcityimage%20via%20iStock.jpg)

CVS Health Corporation (CVS) is a leading American healthcare company headquartered in Woonsocket, Rhode Island. Valued at a market cap of $104.6 billion, CVS provides prescription medications, health services, and insurance solutions, serving millions of customers nationwide. It is scheduled to announce its fiscal Q3 earnings for 2025 before the market opens on Wednesday, Oct. 29.

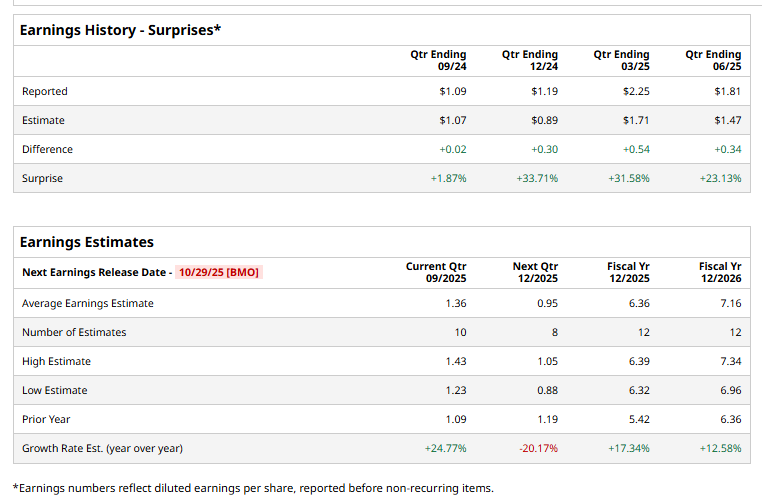

Before this event, analysts project this healthcare solutions provider to report a profit of $1.36 per share, up 24.8% from $1.09 per share in the year-ago quarter. The company has surpassed Wall Street’s bottom-line estimates in each of the last four quarters.

For the current year, analysts expect CVS to report EPS of $6.36, up 17.3% from $5.42 in fiscal 2024. Its EPS is expected to further grow 12.6% year over year to $7.16 in fiscal 2026.

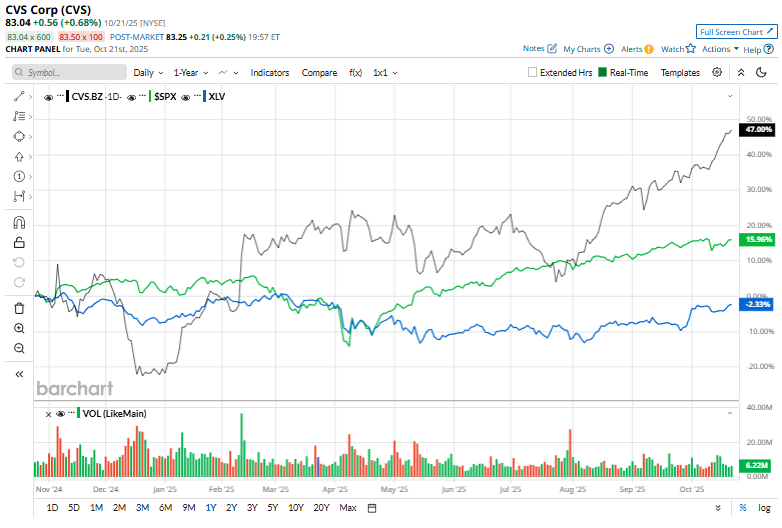

CVS has gained 42.8% over the past 52 weeks, outperforming the S&P 500 Index's ($SPX) 15.1% return and the Health Care Select Sector SPDR Fund’s (XLV) 4.1% loss over the same period.

On October 15, CVS Health shares rose 1.3% following the completion of its acquisition of select Rite Aid and Bartell Drugs assets. The deal adds 63 stores in Idaho, Oregon, and Washington and prescription files from 626 pharmacies across 15 states, bringing over nine million former Rite Aid and Bartell Drugs patients under CVS’s care.

Wall Street analysts are highly optimistic about CVS stock, with a "Strong Buy" rating overall. Among 25 analysts covering the stock, 20 recommend "Strong Buy," two indicate "Moderate Buy," and three suggest "Hold.” The mean price target for CVS is $85.26, implying a 2.7% premium from the current levels.