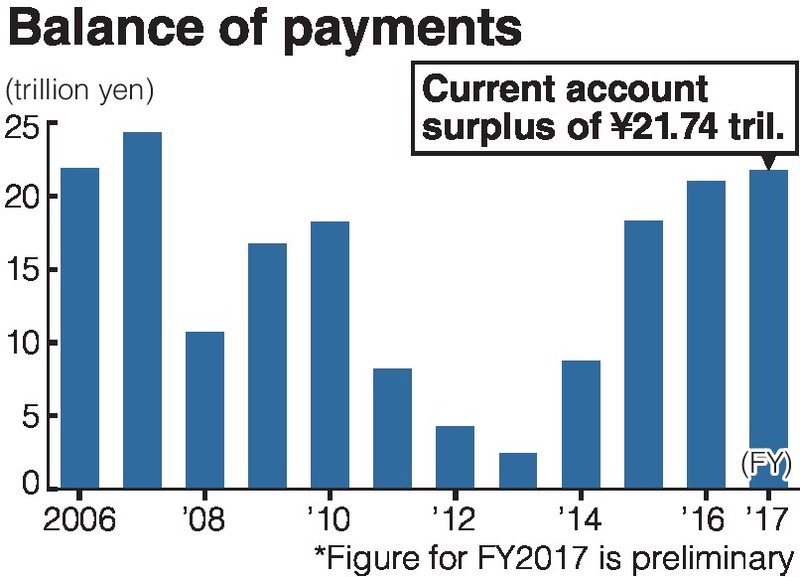

Japan's current account surplus in fiscal 2017 rose 3.4 percent from the previous fiscal year to 21.73 trillion yen -- the fourth consecutive yearly increase and the third-highest surplus ever, according to a Finance Ministry preliminary report released Thursday.

The biggest factor behind the increase is the surplus in primary income -- investment income including dividends that Japanese companies receive from subsidiaries overseas and interest from foreign bonds -- which reached 19.91 trillion yen, up 6.3 percent from the previous fiscal year.

In addition to brisk overseas business, the depreciation of the yen from fiscal 2016 boosted the figure when the dividends were converted into the Japanese currency.

The deficit in services, which includes travel expenses and copyright fees, halved to 602.9 billion yen. The reduction, which also helped push up the current account surplus, was mainly down to the travel account surplus, which hit a record 1.93 trillion yen thanks to a sharp increase in the number of foreigners visiting Japan. The travel balance is calculated by subtracting the amount Japanese travelers spent overseas from the amount foreign travelers spent in Japan.

Meanwhile, the country's surplus in goods trade -- calculated by subtracting the value of imported goods from the value of exported goods -- fell by 20.8 percent from the previous fiscal year to 4.58 trillion yen. Although exports increased due to an expansion of the global economy, soaring crude oil prices caused import growth (13.4 percent) to exceed export growth (10.6 percent).

According to a preliminary report of balance of payments for March 2018 released on the same day, Japan logged a current account surplus of 3.12 trillion yen, up 4.2 percent from a year before.

Read more from The Japan News at https://japannews.yomiuri.co.jp/