/Cummins%20Inc_%20generator-by%20Lutsenko_Oleksandr%20via%20Shutterstock.jpg)

Columbus, Indiana-based Cummins Inc. (CMI) designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide. Valued at $58.2 billion by market cap, the company offers products to original equipment manufacturers (OEMs), distributors, and dealers through a network of company-owned and independent distributor facilities. The global power solutions leader is expected to announce its fiscal third-quarter earnings for 2025 in the near future.

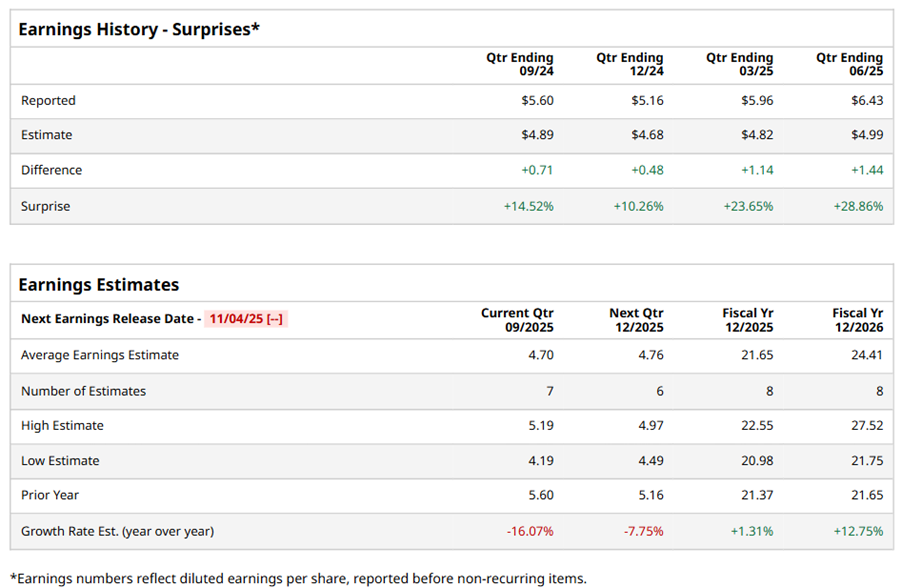

Ahead of the event, analysts expect CMI to report a profit of $4.70 per share on a diluted basis, down 16.1% from $5.60 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect CMI to report EPS of $21.65, up 1.3% from $21.37 in fiscal 2024. Its EPS is expected to rise 12.8% year over year to $24.41 in fiscal 2026.

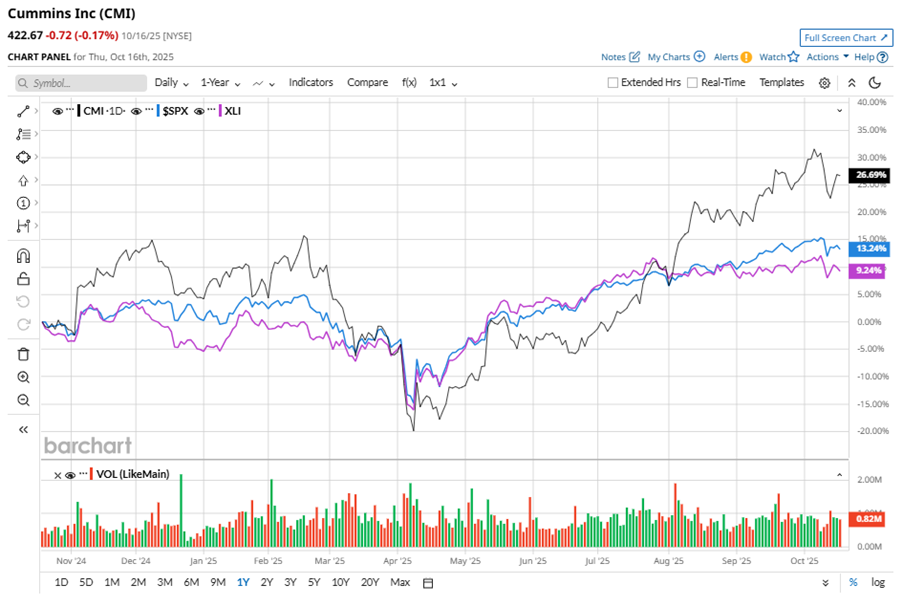

CMI stock has outperformed the S&P 500 Index’s ($SPX) 13.5% gains over the past 52 weeks, with shares up 26.6% during this period. Similarly, it outperformed the Industrial Select Sector SPDR Fund’s (XLI) 8.9% rise over the same time frame.

CMI's strong performance is driven by robust demand for power generation products, especially for AI-driven data center investments, as the company emerges as a key supplier of essential power systems for the rapidly expanding data center infrastructure.

On Aug. 5, CMI shares closed up more than 3% after reporting its Q2 results. Its EPS of $6.43 beat Wall Street expectations of $4.99. The company’s revenue was $8.6 billion, exceeding Wall Street forecasts of $8.5 billion.

Analysts’ consensus opinion on CMI stock is reasonably bullish, with a “Moderate Buy” rating overall. Out of 20 analysts covering the stock, eight advise a “Strong Buy” rating, 11 give a “Hold,” and one recommends a “Strong Sell.” CMI’s average analyst price target is $429, indicating a potential upside of 1.5% from the current levels.