Hackers have once again managed to syphon millions of dollars from a cryptocurrency thanks to a fundamental weakness in its underlying technology.

A so-called 51 per cent attack on ethereum classic, a spin-off of the world's second most popular cryptocurrency, saw cyber criminals make away with more then $1.5 million (£1.2m) and forced popular exchange Coinbase to cease trades of the cryptocurrency.

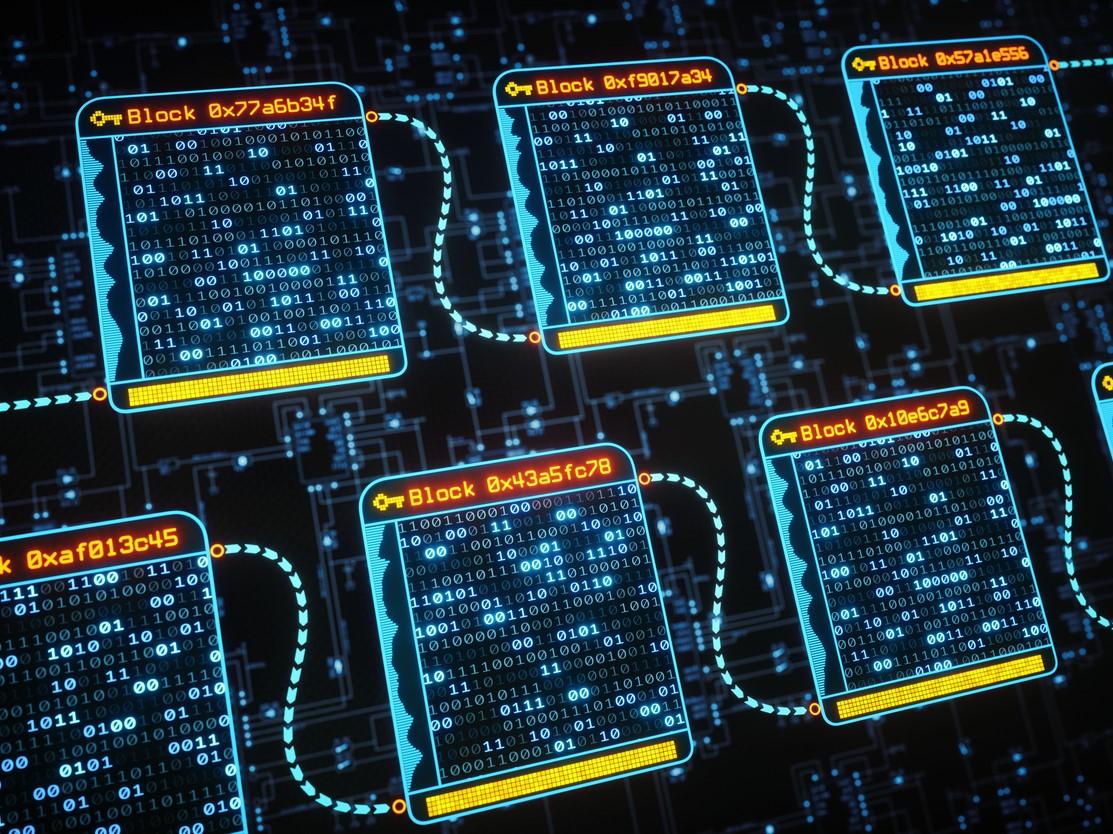

The heist once again highlighted issues with the blockchain network and the cryptocurrency mining process that supports it.

The attack method involves taking control of 51 per cent of a cryptocurrency’s network in order to manipulate its blockchain and reverse transactions that have taken place.

While a 51 per cent attack on major networks like bitcoin and ethereum are almost impossible due to their size, smaller cryptocurrencies are increasingly falling victim to them.

The attacks take place on cryptocurrency exchanges, but are not actually attacks on the exchanges themselves. Instead the attack takes place on the blockchain, or online ledger, of the cryptocurrency.

By controlling the majority of the network’s computing power, hackers can alter the blockchain and reverse transactions that they have made, effectively allowing them to spend the cryptocurrency twice.

Increased attacks inevitably lead to slower transaction times as cryptocurrency exchanges attempt to identify attackers.

The attacks take place on cryptocurrency exchanges, but are not actually attacks on the exchanges themselves. Increased attacks inevitably lead to slower transaction times as cryptocurrency exchanges attempt to identify attackers.

Around 388,000 units of bitcoin gold were stolen in one attack in 2018, amounting to $16.6 million at today's prices.

“Any blockchain – even bitcoin – can theoretically be attacked by a malicious actor who can control more hashing (computing) power than all the honest miners,” bitcoin gold developers wrote in a blogpost responding to the attacks.

“Of course, the biggest risk is to a smaller network in the shadow of a bigger one… We’re monitoring the situation carefully in a variety of ways to rapidly alert the exchanges when we can tell an attack is in progress.”

The vulnerability of cryptocurrencies that have formed by splitting from more established cryptocurrencies was highlighted in a recent study by researchers at FECAP University in Brazil.

According to the researchers, bitcoin gold could be compromised by hackers spending around $200,000 on hashing power per day. In contrast, larger networks like bitcoin cash would cost around $2 million per day to attack.

"A growing number of institutional investors are watching crypto-currencies, ruthless intimidating wizards and trolls, standing on the tips of their toes aiming to exploit opportunities for quick and big profits," the researchers said.

"They aren’t the type of ‘dudes’ you’re used to, the ones that care about the community, the ecosystem and the future of decentralization."