Just three days into the new year, the crypto space is already tearing itself apart in public.

A conflict that was being played out behind the scenes has just been publicized.

This conflict is one of the consequences of the bankruptcy of the empire of the former crypto emperor Sam Bankman-Fried. It pits three of the biggest names in the industry against each other.

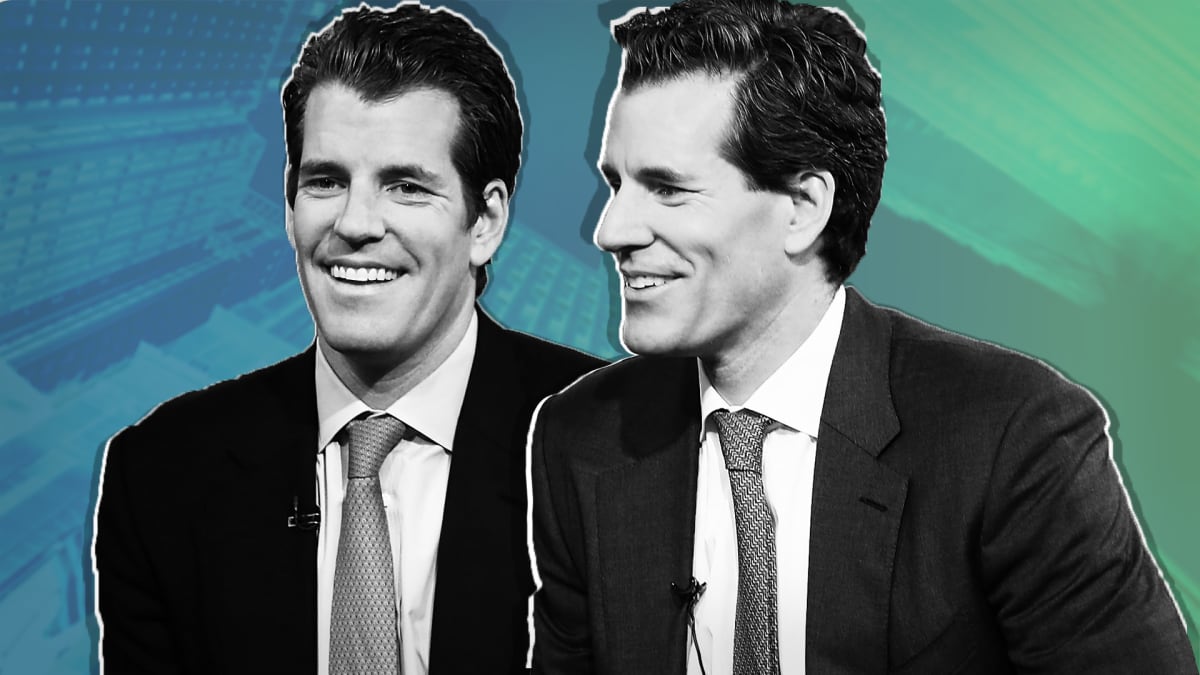

On one side, there are the millionaire twin brothers Cameron and Tyler Winklevoss and on the other Barry Silbert, one of the barons of the industry. The former founded cryptocurrency exchange Gemini, while the other is the founder and CEO of Digital Currency Group (DCG) which owns struggling crypto lender Genesis.

'Bad Faith Stall Tactics'

Genesis was Gemini's partner in a reward program offered by the platform to attract customers. This program is called Gemini Earn. It's a high-yield savings product that promises customers of the cryptocurrency exchange up to an 8% annual return on crypto deposits, depending on which assets are held. Under this program, Genesis serves as Gemini's primary lender.

It all went south after the bankruptcy of FTX and its sister company Alameda Research, a hedge fund that also acted as a trading platform for institutional investors. Genesis, which was in business with FTX, was forced to suspend withdrawals last November, forcing Gemini to do the same for Earn program clients.

Genesis owes $900 million to Gemini's Earn users. The two companies have been trying for several weeks now to solve the problem but apparently things are not moving forward. So says Cameron Winklevoss in an open letter to Silbert posted on Twitter. He accuses him of bad faith.

"For the past six weeks, we have done everything we can to engage with you in a good faith and collaborative manner in order to reach a consensual resolution for you to pay back the $900 million that you owe, while helping you preserve your business," Cameron Winklevoss wrote. "We appreciate that there are startup costs to any restructuring, and at times things don't go as fast as we would all like."

But, he continued, "it is now becoming clear that you have been engaging in bad faith stall tactics."

To justify this accusation, Cameron claims that Silbert does everything not to sit around the table with them to find a solution in order to end the litigation.

"For example, on December 2nd we expressed our belief that getting everyone in a room together as soon as possible will be the most productive path towards reaching a resolution. You agreed, but stated you would only do so after there was a proposal on the table," Winklevoss said.

January 8

But "on December 17th, a proposal was delivered to you. On December 25th, Christmas Day, an updated version of this proposal was delivered to you. Despite this, you continue to refuse to get into a room with us to hash out a resolution."

He also said that Silbert refuses to agree to a timeline with key milestones.

"Every time we ask you for tangible engagement, you hide behind lawyers, investment bankers, and process. After six weeks, your behavior is not only completely unacceptable, it is unconscionable," Winklevoss lambasted.

He then blames Silbert for the problem, pointing out that DCG owes Genesis money.

"To be clear, this mess is entirely of your own making," Winklevoss declared. "Digital Currency Group (DCG) - of which you are the founder and CEO - owes Genesis (its wholly owned subsidiary) ~$1.675 billion. This is money that Genesis owes to Earn users and other creditors. You took this money - the money of schoolteachers - to fuel greedy share buybacks, illiquid venture investments."

This figure is what Silbert shared with investors last November. It includes a $575 million loan due in May, plus a $1.1 billion promissory note due in June 2032 tied to the collapse of hedge fund Three Arrows Capital, or 3AC.

"DCG did not borrow $1.675 billion from Genesis," Silbert refuted in a response on Twitter. "DCG has never missed an interest payment to Genesis and is current on all loans outstanding; next loan maturity is May 2023."

He added that DCG responded to a Gemini's proposal but hasn't heard back.

"DCG delivered to Genesis and your advisors a proposal on December 29th and has not received any response," Silbert asserted.

Those remarks were immediately rejected by Winklevoss who maintained his accusations and asked Silbert if the latter could commit to resolving the dispute by January 8.

"There you go again. Stop trying to pretend that you and DCG are innocent bystanders and had nothing to do with creating this mess. It's completely disingenuous," Winklevoss objected. "So how does DCG owe Genesis $1.675 billion if it didn't borrow the money?"

"Will you, or will you not, commit to solving this by January 8th in a manner that treats the $1.1 billion promissory note as $1.1 billion?"

The Crypto Exception

This dispute reveals the complexity of the links between the various players in the young financial services industry powered by blockchain technology. The firms are often interdependent but they never reveal these links which can prove harmful to their clients.

Unsurprisingly, the public clash between these crypto titans drew a lot of comments from Twitter users who remarked that the dispute once again showed the opacity of the young industry and how the founders and managers of firms use their clients' funds shamelessly.

"Cameron, the difference between this & SBF is somewhat clear," commented entrepreneur Jeremy Padawer, referring to Sam Bankman-Fried, known under the initials SBF in the crypto space. "Instead of loaning money fraudulently to yourself, there’s a 3rd party who hasn’t paid back the money? If that’s the issue, to what extent are u the CEO financially, ethically, criminally liable for 3rd party acts?