Some of the largest cryptocurrency exchanges are suspending or starting to delist the tokens associated with the collapsing Terra blockchain, even those that were investors in the troubled network.

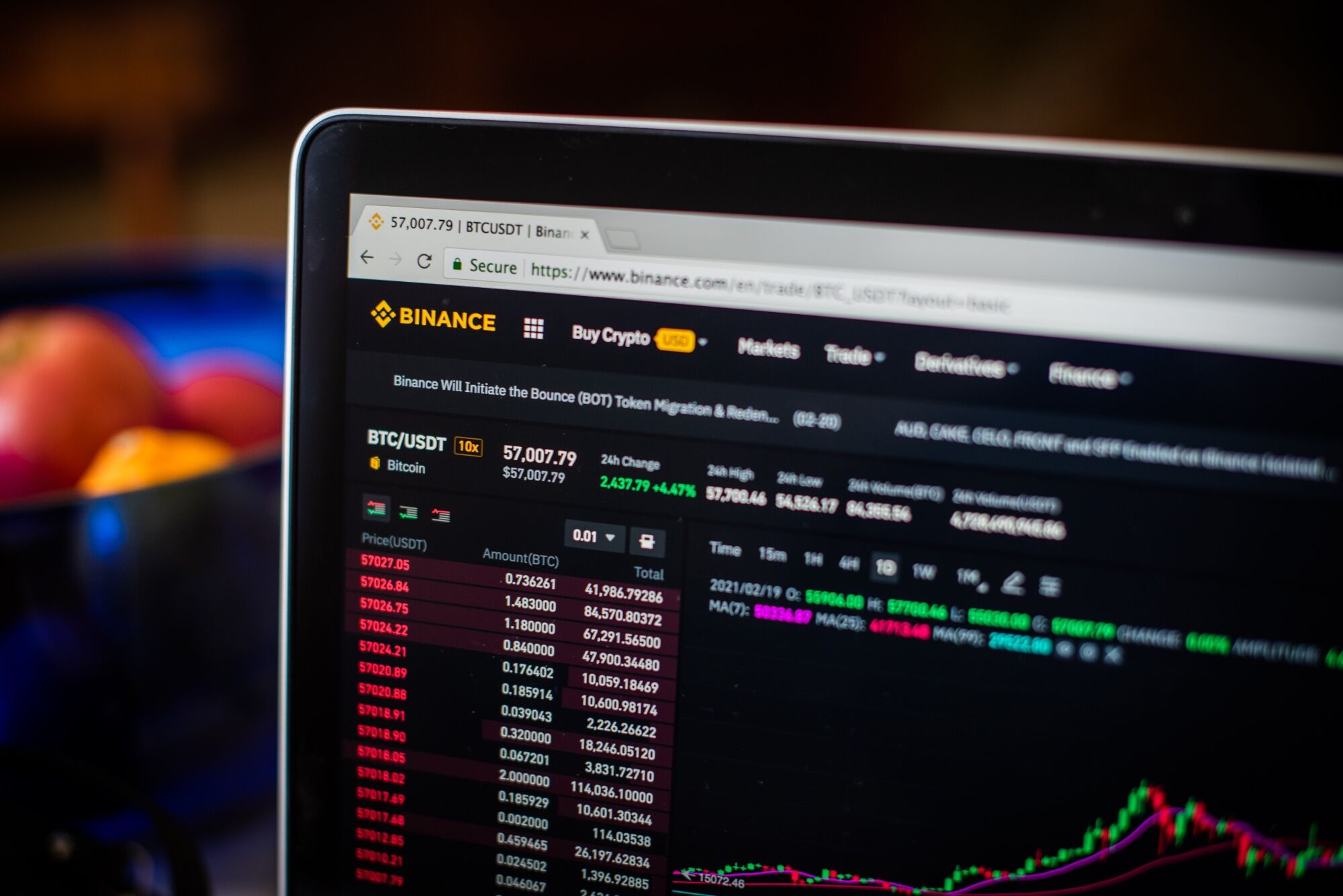

OKX, one of the largest crypto exchanges, is terminating all trading of UST, LUNA, as well as two other tokens on the blockchain, Anchor and Mirror. FTX is delisting LUNA perpetual swaps. Before resuming earlier Friday, Binance, the world’s largest exchange by trading volume, said that it suspended spot trading for LUNA, the native token of Terra blockchain and TerraUSD, or UST, the dollar stablecoin that lost its peg, against Binance’s stablecoin Binance USD. Huobi took similar measures. Crypto.com announced that it has suspended trading of LUNA, Anchor and Mirror. Coinbase, Global Inc. will suspend trading May 27.

Some of the exchanges were among Terra’s best-known investors. The venture arms of Binance, Huobi, OKX and Coinbase all had invested in Terra previously.

Changpeng Zhao, chief executive of Binance, said in a tweet that the decision was made after Terra blockchain halted its network the second time. The halt of the network resulted in “no deposits or withdrawals possible to or from any exchange,” he tweeted.

The Terra blockchain stopped processing new transactions for a second time late Thursday, after Terraform Labs, the main developer firm of the blockchain, said in a Twitter announcement that entities responsible of verifying transactions on Terra, had taken the step to “come up with a plan to reconstitute” the Terra blockchain. The blockchain resumed activities about nine hours later, according to the latest tweet by Terraform Labs.

UST was trading at $0.103, down 83.7% in the past 24 hours, according to CoinGecko. LUNA at the same time, was down to virtually zero. It had climbed to about $120 in mid-April before the collapse.

“I am very disappointed with how this UST/LUNA incident was handled (or not handled) by the Terra team,” Binance’s Zhao wrote. “We requested their team to restore the network, burn the extra minted LUNA, and recover the UST peg. So far, we have not gotten any positive response, or much response at all.”

Before everything went down last weekend, UST was one of the largest stablecoins in the world by market value. Its sister token LUNA that’s used to keep UST’s 1-1 peg to the dollar was also one of the biggest cryptocurrencies. The unraveling of the collapse of UST and LUNA sent shock waves through crypto, as Terra, once a crypto darling, grew so big and was connected to the rest of the crypto world.

According to Lily Zhang, chief financial officer of Huobi, the exchange resumed the trading “in order to protect the trading rights of” their users.

©2022 Bloomberg L.P.