In a potential game-changer for the cryptocurrency mining sector, Morgan Stanley has forecasted that CoreWeave Inc.‘s (NASDAQ:CRWV) proposed acquisition of Core Scientific Inc. (NASDAQ:CORZ) could boost the Bitcoin (CRYPTO: BTC) miner’s market capitalization by an impressive $2.8 billion.

What Happened: This Morgan Stanley analysis was shared by Eric Jackson from EMJ Capital amid renewed takeover discussions between the two companies, as reported by the Wall Street Journal, with a deal possibly finalizing within weeks if negotiations proceed smoothly.

“While the potential terms of a deal were not released, the estimated profits from the current contracts exceed Core Scientific's market cap by ~$2.8B,” said Jackson in his X post, quoting Morgan Stanley.

Core Scientific, currently valued at approximately $4.87 billion, rejected $5.75 per share offer from CoreWeave a year ago. The company operates one of North America's largest digital infrastructure platforms focused on bitcoin mining and hosting.

The company's strategic 12-year hosting partnership with CoreWeave, which provides 590 MW of capacity across 12 contracts valued at $10 billion, underpins this growth.

“Core Scientific receives a 75%-80% profit margin on the CoreWeave contract, which implies that Core Scientific receives a profit of ~$7.75bn at the midpoint,” Jackson highlighted in another post.

Why It Matters: CoreWeave, a $75.87 billion cloud infrastructure giant serving AI workloads for clients like Microsoft Corp. (NASDAQ:MSFT) and Meta Platforms Inc. (NASDAQ:META), is funding up to $750 million in data center build-outs, with Core Scientific contributing just $104 million.

“Core Scientific receives a 75%-80% profit margin on the CoreWeave contract, which implies that Core Scientific receives a profit of ~$7.75bn at the midpoint,” explained Jackson.

Price Action: CRWV shares were up 1.97% in premarket on Friday and ended 0.89% lower on Thursday. It has risen by 295.20% since its listing in March.

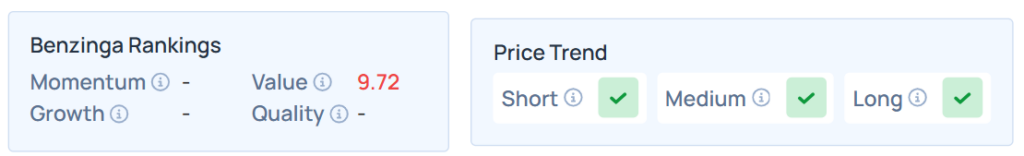

Benzinga Edge Stock Rankings shows that CRWV had a stronger price trend over the short, medium, and long term. Its value ranking was poor at the 9.72nd percentile. The details are available here.

CORZ shares were up 7.89% in premarket on Friday and ended 33.01% higher on Thursday. It has risen by 12.98% on a year-to-date.

Benzinga Edge Stock Rankings shows that CORZ had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid; however, its value ranking was poor at the 16.3rd percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, were higher in premarket on Thursday. The SPY was up 0.39% at $614.24, while the QQQ advanced 0.46% to $548.73, according to Benzinga Pro data.

Read Next:

Image Credit: Shutterstock