Wedbush Securities analyst Dan Ives has raised the price target for CrowdStrike Holdings Inc. (NASDAQ:CRWD) to $575, signaling robust optimism about the cybersecurity leader's trajectory.

What Happened: The announcement, shared via an X post, highlights a projected 16% upside for the stock over the next year from its current level.

This is underpinned by Ives' assessment of recent checks, "coming in very strong with healthy momentum." This bullish forecast arrives as the cybersecurity sector faces heightened demand amid escalating global cyber threats.

Wedbush’s price target of $575 exceeds the current average analyst target of $477.76, by 15.9% derived from 40 analysts tracked by Benzinga.

These targets range from $371 to $575, and three recent ratings imply a downside of 14.62% for CrowdStrike.

Why It Matters: A Texas-based cybersecurity pioneer since 2011, CrowdStrike’s premier product, the Falcon platform, delivers cloud-based protection for endpoints, cloud workloads, and identities.

Ives reiterates his optimism in the company's resilience and growth potential, particularly as it navigates a dynamic threat landscape.

During its first quarter earnings call, George Kurtz, the founder and CEO of CrowdStrike said, “Our conviction in net new ARR re-acceleration and margin expansion in the second half of fiscal year 2026 is reinforced by Falcon Flex deal momentum and early Falcon Flex expansions, strong competitive win rates and robust pipeline for the second half of fiscal year 2026.”

Price Action: CRWD stock ended 0.82% higher at $496.10 apiece on Wednesday and rose 0.11% in premarket on Thursday. The shares have risen by 42.83% on a year-to-date basis and 28.13% over the last year.

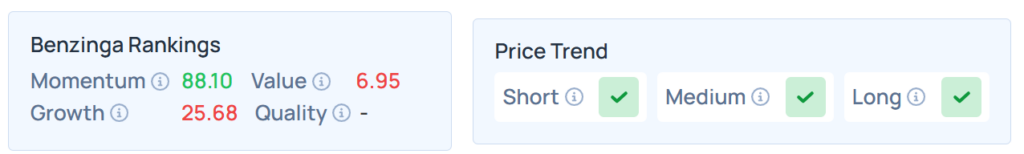

Benzinga Edge Stock Rankings shows that CRWD had a stronger price trend over the short, medium, and long term. Its momentum ranking was solid, and its value ranking was also poor at the 6.25th percentile. The details of other metrics are available here.

The SPDR S&P 500 ETF Trust (NYSE:SPY) and Invesco QQQ Trust ETF (NASDAQ:QQQ), which track the S&P 500 index and Nasdaq 100 index, respectively, edged higher in premarket on Thursday. The SPY was up 0.047% at $620.74, while the QQQ advanced 0.058% to $551.12, according to Benzinga Pro data.

Read Next:

Disclaimer: This content was partially produced with the help of AI tools and was reviewed and published by Benzinga editors.

Image Via Shutterstock