/The%20CrowdStrike%20logo%20on%20an%20office%20building%20by%20bluestork%20via%20Shutterstock.jpg)

Shares of cybersecurity company CrowdStrike (CRWD) have soared 80% in just 12 months, driven by renewed investor confidence in its business model, a reacceleration in growth, and optimism about its long-term strategy.

The last year was challenging for CrowdStrike as a software update led to significant system failures for its customers. This outage raised fears about customer churn, but those worries have faded as clients stuck with the company and expanded their adoption of its platform. This resilience has set the stage for reacceleration in its growth, as the company’s fundamentals remain intact.

CrowdStrike’s rebound has been driven in part by a reacceleration in growth. The company delivered solid financials in Q2, highlighted by $221 million in net new annual recurring revenue (ARR). Its ending ARR reached $4.66 billion, up 20% year-over-year. That growth came sooner than the company itself had projected, strengthening investor confidence.

Momentum picked up further after the company issued strong long-term guidance at its recent Fal.Con event. CrowdStrike announced it expects net new annual recurring revenue (ARR) to grow by at least 20% in 2027. This exceeded Wall Street’s forecasts. Moreover, management laid out a roadmap for ARR to hit $10 billion by 2031, before doubling again to $20 billion by 2036. This sent shares up about 12.8% on Thursday, Sept. 18.

CrowdStrike’s Customer Adoption Remains Solid

One of the most encouraging signs for cybersecurity companies is how sticky their platform is. As for CrowdStrike, it is seeing strong demand for its AI-powered Falcon platform and Falcon Flex subscription model. Customers are not just signing on, they’re expanding their usage.

For instance, the number of large deals over $10 million in value doubled year over year, and the company reached 800 customers with more than $1 million in ARR. Its module adoption numbers remain solid, with 48% of customers now using six modules, 33% are using seven, and 23% have adopted eight or more. Among customers generating at least $100,000 in ARR, 60% now use eight or more modules. This level of adoption demonstrates strong cross-selling opportunities and the effectiveness of CrowdStrike’s strategy to become the all-in-one solution for enterprise cybersecurity.

CrowdStrike Is Expanding the Platform through Deals and Partnerships

CrowdStrike has also been expanding its capabilities through strategic deals and partnerships. Earlier this week, it announced the acquisition of the AI security platform Pangea, a deal that is expected to strengthen its enterprise AI offerings. In addition, the company revealed a new partnership with Salesforce (CRM), opening the door to deeper integrations with enterprise customers.

These steps highlight CrowdStrike’s strategy of building a comprehensive, AI-first cybersecurity platform that enterprises can consolidate their security needs around.

CrowdStrike Offers Solid FY26 Guidance

Looking ahead, CrowdStrike expects momentum to continue in the second half of fiscal 2026. Management has projected year-over-year growth acceleration in net new ARR and ending ARR, putting the company on track to surpass $5 billion in ARR by fiscal year-end.

For the third quarter, revenue is expected to land between $1.208 billion and $1.218 billion, representing growth of about 20% to 21% year-over-year. For the full fiscal year 2026, total revenue is projected between $4.75 billion and $4.81 billion, reflecting growth in the 20% to 22% range.

CRWD Stock: The Valuation Question

While CrowdStrike’s growth is reaccelerating, the stock has become expensive on valuation. After its recent rally, CRWD trades at a price-sales (P/S) multiple of 28.28x. By comparison, industry peer Palo Alto Networks (PANW) trades at a P/S ratio of 14.73x, about half of CrowdStrike’s valuation. Moreover, Palo Alto projects next-generation security ARR growth of 26% to 27% in fiscal 2026.

This premium valuation suggests that much of the optimism surrounding CrowdStrike’s growth trajectory is already reflected in the stock.

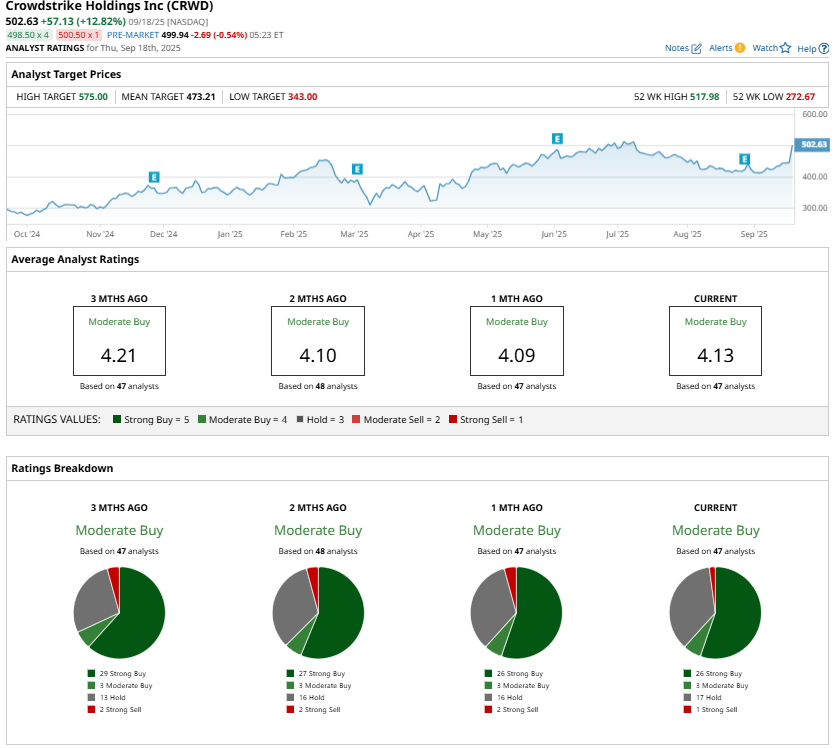

Wall Street’s Take: Optimistic but Cautious

Analysts remain broadly positive on CrowdStrike, maintaining a consensus rating of “Moderate Buy.” The company’s strong fundamentals and accelerating growth outlook support its bull case. However, valuation remains a concern, restricting a few analysts from endorsing CRWD stock.

Conclusion: CRWD Is a Solid Company, but the Stock Is Expensive

CrowdStrike is a leading cybersecurity company. With a rapidly growing customer base and sticky subscription model, the company appears well-positioned to capture the growing demand for AI-driven security solutions.

That said, the market has already rewarded the stock, pushing its valuation higher. While CrowdStrike is a solid long-term investment, it may not be the best entry point at this time.