/A%20concept%20image%20showing%20binary%20code%20with%20the%20ERROR%20message_%20Image%20by%20Danich%20Marmai%20via%20Shutterstock_.jpg)

Once again, CrowdStrike Holdings (CRWD) solidified its position as one of the most dominant players in modern cybersecurity with a solid Q2 report.

Fueled by robust demand for its Falcon platform, new innovations in artificial intelligence (AI) security, and broad adoption of its licensing models, it appears CrowdStrike has recovered from the challenges it faced last year.

CRWD stock is up 24.92% year-to-date, compared to the S&P 500 Index ($SPX) gain of 9.74%. Let’s find out if the stock is a buy now.

Reacceleration Arrives Ahead of Schedule

In the second quarter, CEO George Kurtz emphasized that, while the company had promised growth reacceleration in the second half of the year, it is now here. This reacceleration was fueled by an increase in AI-related demand and strong execution across its portfolio.

CrowdStrike reported net new annual recurring revenue (ARR) of $221 million, with an ending ARR of $4.6 billion. Total revenue of $1.17 billion rose 21% year on year, exceeding expectations. Its Falcon Flex platform saw rapid growth in the quarter, with over 1,000 customers averaging more than $1 million ARR, driven by “reflex” renewals. Adjusted earnings per share (EPS) increased by 5.7% to $0.93.

The Rising Urgency of AI Security Is Driving Growth

Management stated that a central theme of the quarter was the increasing importance of AI security. Next-Gen SIEM is one of CrowdStrike’s fastest-growing businesses. With over $430 million in ARR, up 95% year over year, it represents a modern, AI-driven service transformation. To further accelerate its security, information, and event management (SIEM) strategy, CrowdStrike announced its intent to acquire ONEM, a leading data pipeline platform. The acquisition gives Falcon SIEM customers more control over their security and IT data, while also establishing CrowdStrike as the data foundation for enterprise security.

Additionally, CrowdStrike’s AI-driven SOC analyst, Charlotte, continued to gain traction with 85% quarter-over-quarter growth. Charlotte is being integrated throughout the Falcon platform to automate workflows, threat hunting, and incident response. CrowdStrike’s cloud security business also surpassed $700 million in ARR, up more than 35% year over year. As enterprises accelerate their AI adoption, securing cloud workloads has become critical.

CrowdStrike’s strategy of combining multiple security functions into its Falcon platform remains effective. Exposure Management surpassed $300 million in ending ARR and was named a market leader in the 2025 IDC Worldwide Exposure Management MarketScape. Meanwhile, CrowdStrike has been named the top vendor for endpoint protection platforms by Gartner for the sixth consecutive year. CrowdStrike also expanded its reach into the small and medium business (SMB) segment through a partnership with Amazon (AMZN) Business Prime. Millions of Business Prime subscribers will now have access to Falcon Go as part of their package.

Furthermore, Nvidia (NVDA) strengthened its partnership with CrowdStrike. Falcon Cloud Security will be integrated with Nvidia’s Universal LLM NIM microservices and Nemo Safety framework, protecting over 100,000 large language models (LLMs) throughout the AI lifecycle. These partnerships highlight CrowdStrike’s ecosystem strength.

Strong Outlook and Path to $10 Billion ARR

Looking ahead to Q3, Crowdstrike expects 20% to 21% growth in revenue, with full fiscal 2026 revenue growth of 20% to 22% ranging between $4.75 billion and $4.81 billion. Adjusted earnings per share could be between $3.60 and $3.72, compared to $3.93 in fiscal 2025. CrowdStrike reaffirmed that it has a clear path to exceeding $5 billion in ending ARR this fiscal year, putting it on track to meet its long-term goal of $10 billion by fiscal 2031.

Investors must watch out for Crowdstrike’s flagship Falcon 2025 conference beginning Sept. 15, and its investor briefing on Sept. 17. These events will provide insight into how leadership plans to expand its AI-driven strategy, product innovation roadmap, and financial outlook.

CrowdStrike appears to have recovered well from last year’s headwinds and skepticism, as it has accelerated net new ARR growth, strengthened profitability, and broadened its ecosystem reach through partnerships with Amazon and Nvidia. This cybersecurity stock is a good buy and hold for the long term.

Is CRWD Stock a Buy, Hold, or Sell on Wall Street?

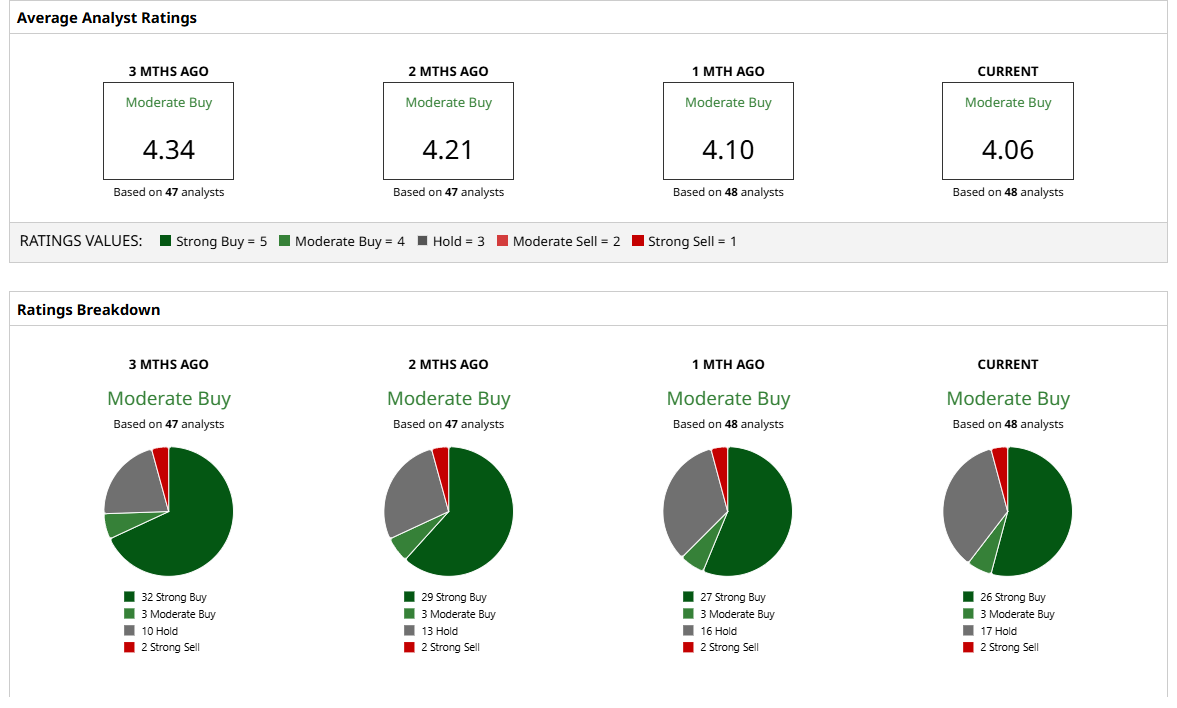

Overall, the word on the Street is a “Moderate Buy” for CRWD stock. Of the 48 analysts that cover the stock, 26 rate it a “Strong Buy,” three say it is a “Moderate Buy,” 17 rate it a “Hold,” and two rate it a “Strong Sell.” The average target price for the stock is $481.72, which implies the stock can rally 13% above current levels. The high price estimate of $575 suggests the stock can climb 30% over the next 12 months.