With a market cap of $112.4 billion, CrowdStrike Holdings, Inc. (CRWD) is a global cybersecurity company that provides cloud-delivered protection for endpoints, cloud workloads, identity, and data through its subscription-based Falcon platform. It offers a broad portfolio of security, threat intelligence, and AI-powered solutions to organizations worldwide.

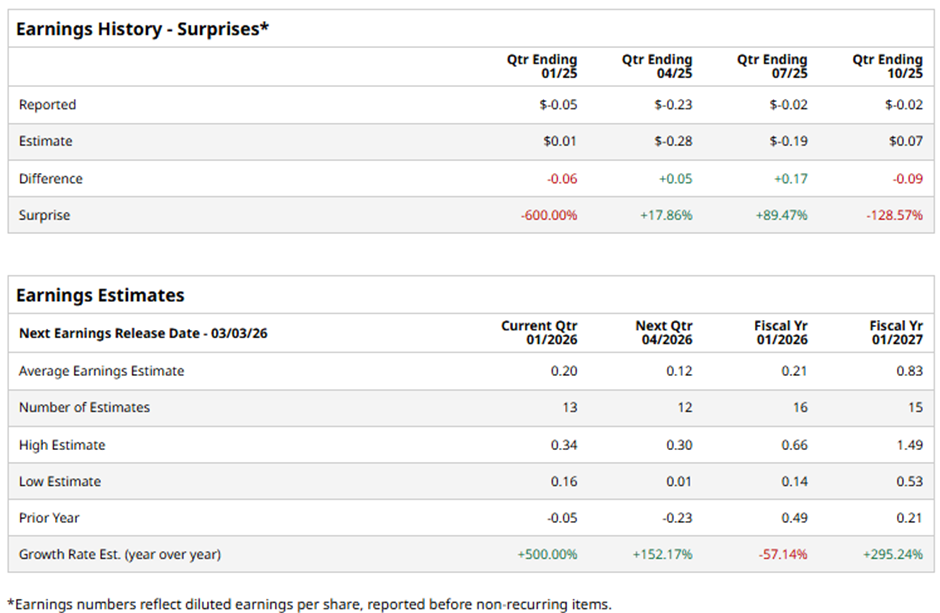

The Austin, Texas-based company is slated to announce its fiscal Q4 2026 results soon. Ahead of this event, analysts predict CRWD to report a profit of $0.20 per share, a 500% surge from a loss of $0.05 per share in the year-ago quarter. It has exceeded Wall Street's earnings expectations in two of the past four quarters while missing on two other occasions.

For fiscal 2026, analysts project the cloud-based security company to report EPS of $0.21, a decrease of 57.1% from $0.49 in fiscal 2025. However, EPS is expected to climb 295.2% year-over-year to $0.83 in fiscal 2026.

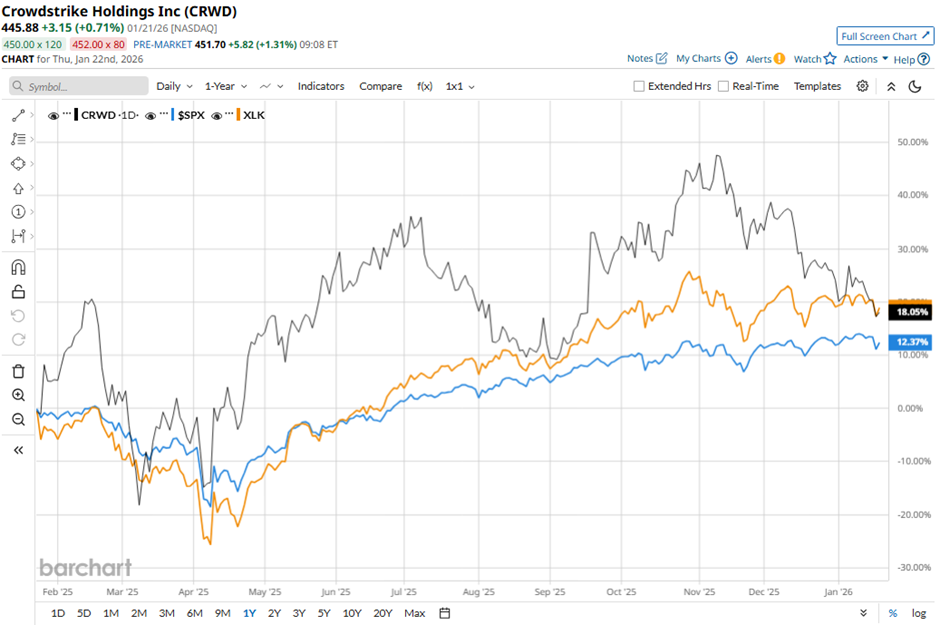

Shares of CrowdStrike Holdings have increased 19.3% over the past 52 weeks, outperforming the broader S&P 500 Index's ($SPX) 13.7% gain. However, the stock has slightly lagged behind the State Street Technology Select Sector SPDR ETF's (XLK) 20.4% return over the same period.

Shares of CrowdStrike rose 1.5% following its Q3 2026 results on Dec. 2, with stronger-than-expected adjusted EPS of $0.96 and revenue of $1.23 billion. Investor sentiment was further boosted by record net new ARR of $265 million, a 73% year-over-year acceleration, lifting ending ARR to $4.92 billion, up 23%, and signaling strong demand across its Falcon platform.

Analysts' consensus view on CRWD stock remains cautiously optimistic, with a "Moderate Buy" rating overall. Out of 48 analysts covering the stock, 27 recommend a "Strong Buy," three "Moderate Buys," 16 give a "Hold" rating, and two have a "Strong Sell." The average analyst price target for CrowdStrike Holdings is $559.21, suggesting a potential upside of 25.4% from current levels.