During its second-quarter earnings call on Wednesday, CrowdStrike Holdings Inc.’s (NASDAQ:CRWD) CEO, George Kurtz, warned about artificial intelligence emerging as a critical threat in the cybersecurity landscape.

CRWD is encountering selling pressure. Get the market research here.

AI Is ‘Democratizing Destruction At Mass Scale’

Kurtz said during the call that “adversaries are now using AI democratizing destruction at mass scale,” citing new intelligence from CrowdStrike's own threat research unit.

The company identified “Chelima,” a North Korean nexus group, which it says is using GenAI to infiltrate more than 320 enterprises using automated “fabricated resumes” and conducting “deep fake interviews,” highlighting a new set of threats that organizations need to guard against.

See Also: What’s Going On With CrowdStrike Stock Wednesday?

Amid the rising wave of AI-driven attacks, Kurtz positioned CrowdStrike as the foundational security layer for enterprises deploying AI. “We secure where AI happens,” he said, adding that AI security “must be on the devices, workloads, data, and identities anywhere, everywhere, and always on.”

Kurtz emphasized that the proliferation of agentic AI systems and nonhuman identities is accelerating the complexity of the cybersecurity landscape. “AI has made the role of CISOs and COs more complicated than ever,” he said.

The company sees this as a massive opportunity, helping it reaffirm its long-term target of reaching $10 billion in annual recurring revenue by 2031. Kurtz underscored the broad tailwinds in favor of CrowdStrike as “enterprises are quickly realizing AI security is not a network problem.”

Earnings Beat, But Weak Guidance Sends Stock Lower

CrowdStrike released its second-quarter results on Wednesday, reporting $1.17 billion in revenue, up 21% year-over-year, and beating consensus estimates of $1.15 billion. The company posted a profit of $0.93 per share, beating analyst estimates of $0.83 per share.

Its guidance for the third quarter, however, fell short of expectations, with the company forecasting between $1.208 billion and $1.218 billion versus estimates of $1.228 billion.

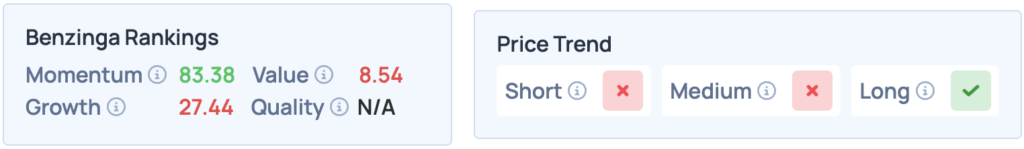

Shares of CrowdStrike were up 1.20% on Wednesday, trading at $422.61, but are down 3.58% pre-market, following the earnings announcement. The stock scores high on Momentum in Benzinga’s Edge Stock Rankings, but does poorly elsewhere. It has a favorable price trend in the long term. Click here for more insights on the stock.

Read More:

Photo courtesy: Shutterstock