A book on the theme “Rainfed Agriculture and Droughts in India” (2022) brought out by the National Bank for Agriculture and Rural Development (NABARD) argues that crop insurance is not a “perfect medication” any more for farmers hit by natural calamities such as floods and droughts and it has become more an institution governed by the private interests.

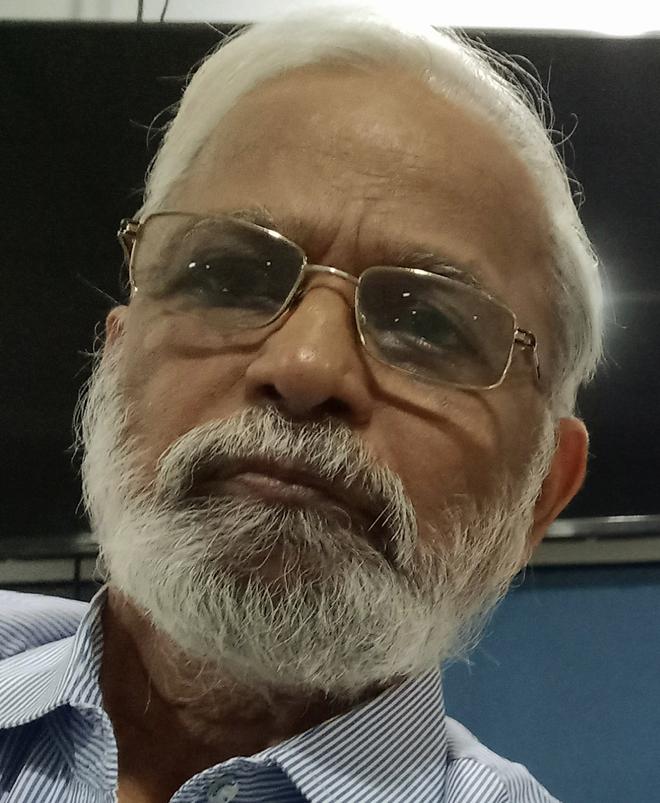

NABARD, which brought out the book authored by economist R.S. Deshpande, as part of its Azadi Ka Amrit Mahotsav series, said that Pradhan Mantri Fasal Bima Yojana carries along with it the baggage of the earlier failed crop insurance schemes. The private insurance companies have been given full authority to insure and pay the indemnity, and they get the State support in this operation.

Crop cutting experiment

Moreover, the insurance firms follow an area-wise approach and this would depend on the crop-cutting experiments or the meteorological data which causes delay in the payment of insurance amount to farmers. In the event of the farmers’ kharif crop failure, she/he would not be able to undertake cultivation immediately in the second season due to delay in claiming the insurance amount, according to Prof. Deshpande, former Director, ISEC, Bengaluru.

Noting that the insurance scheme needs “a full revamping”, he said, unfortunately, most of the State governments declare an agricultural drought on the basis of crop-cutting experiments. Only after the experiment is completed, crop insurance claims are allowed. “This actually puts the farmer under stress and he is compelled to borrow from money lenders. So, the agitations by the farmer on non-receipt of the insurance indemnity are quite legitimate,” says the author.

Legislators such as H.K. Patil and Krishna Byre Gowda, during last month’s session of the legislature, had said the insurance firms have not come to the rescue of farmers during the crisis and firms earned profits of hundreds of crores of rupees.

Rain-fed farming

The book also covers the history of the Indian rainfed farming and droughts. Prof. Deshpande says that many watershed programmes, including those funded by the World Bank, are not implemented effectively and “a lot of investment in these programmes has gone down the drain.”

Noting that the rainfed area covered over 50% of the total cropped area in India, he says the National Rainfed Area Authority (NRAA), should not remain just as a toothless advisory body. It should participate in the administration of the rainfed programme, he said.

Prof. Deshpande suggested that NRAA should put in place an early warning system connected from taluk to district and through the State government following the model for the early warning system available in the Karnataka State Natural Disaster Management Centre’s (KSNDMC) programme of establishing a network of telemetric rain gauge stations and obtaining data on real-time basis.