Shares of Critical Metals Corp (NASDAQ:CRML) are off their session highs Monday after a Bloomberg report, citing a White House official, stated the Trump administration is not currently considering a deal to take an equity stake in the company. Here’s what investors need to know.

What To Know: According to Bloomberg, the official clarified that while the administration has received hundreds of proposals for equity stakes from the private sector, it is not actively pursuing an agreement with Critical Metals for its rare earths project in Greenland.

The report directly counters earlier news that had contributed to the stock’s significant rally on Monday.

While Critical Metals shares remain up on the day following a separate announcement of $35 million in PIPE financing, the denial reported by Bloomberg has tempered investor enthusiasm, causing shares to pull back from 52-week highs achieved earlier in the session.

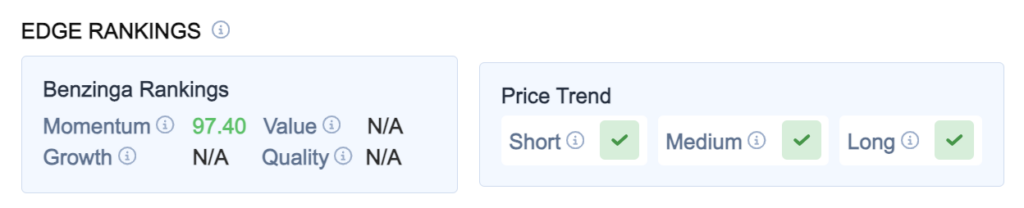

Benzinga Edge Rankings: Despite the intraday pullback, Benzinga Edge data highlights the stock’s exceptionally strong recent performance with a Momentum score of 97.40.

CRML Price Action: Critical Metals shares were up 58.27% at $12.63 at the time of publication Monday, according to Benzinga Pro.

Read Also: Gold Will Reach $5,000 Next Year, $10,000 By 2030: Ed Yardeni

How To Buy CRML Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in Critical Metals’ case, it is in the Materials sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock