Shares of Critical Metals Corp (NASDAQ:CRML) are trading sharply higher Wednesday morning. The surge follows the announcement of an offtake agreement with REalloys, a U.S.-based rare earth processor. Here’s what investors need to know.

What To Know: Under the terms of the new letter of intent, Critical Metals will supply REalloys with 15% of the annual rare earth concentrate from its Tanbreez project in Southern Greenland. The company said the agreement is a key step in establishing a U.S.-based supply chain for critical minerals, reducing reliance on foreign sources.

“REalloys and Critical Metals Corp share a common commitment to reducing China’s dominance in the global rare earth supply chain,” said Lipi Mainheim, chairman and CEO of REalloys.

Additionally, Critical Metals on Monday announced the company will issue 5 million ordinary shares and warrants to purchase 10 million ordinary shares at a strike price of $7 per share. The company anticipates total gross proceeds of $35 million.

The news comes amid a volatile week for the stock. Shares had previously rallied on speculation of a potential investment from the Trump administration, a report the White House later denied.

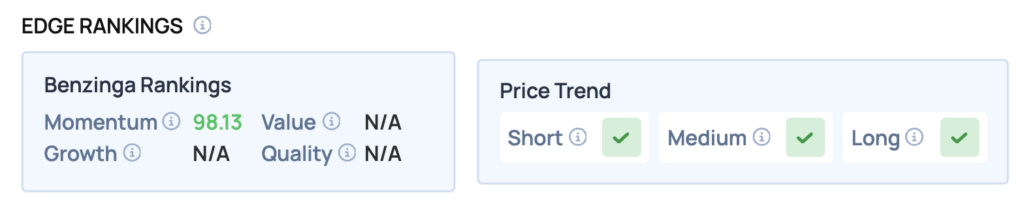

Benzinga Edge Rankings: According to Benzinga Edge rankings, the stock exhibits an exceptionally strong Momentum score of 98.13, reflecting its powerful recent price trend.

CRML Price Action: Critical Metals shares were up 16.17% at $11.64 at the time of publication Wednesday, according to Benzinga Pro. The stock is trading within its 52-week range of $1.23 to $16.68.

The current share price is well above the 50-day moving average of $6.04, suggesting a robust upward trend. Key resistance is observed near the recent high of $12.40, while support can be identified around the 50-day moving average.

Read Also: Trump Ignites Metal Stock Frenzy—These Names Could Be Next

How To Buy CRML Stock

By now you're likely curious about how to participate in the market for Critical Metals – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock