Shares of Critical Metals Corp (NASDAQ:CRML) are surging Monday morning after the company announced it entered into a securities purchase agreement for a $35 million private investment in public equity (PIPE) transaction with a new fundamental institutional investor. Here’s what investors need to know.

What To Know: Under the terms of the agreement, Critical Metals will issue 5 million ordinary shares and warrants to purchase 10 million ordinary shares at a strike price of $7.00 per share. The company anticipates total gross proceeds of $35 million.

Critical Metals intends to use the net proceeds from the offering to help fund the development of its 4.7 billion metric ton rare earth deposit, Tanbreez, in Greenland.

“This financing from a fundamental institutional investor further validates the opportunities ahead for Tanbreez and Critical Metals Corp and underscores the growing need for heavy rare earths in the West,” said Tony Sage, CEO and executive chairman of Critical Metals.

“We look forward to welcoming this new institutional investor as we advance our commercialization roadmap for Tanbreez and bring this game changing rare earth asset closer to production.”

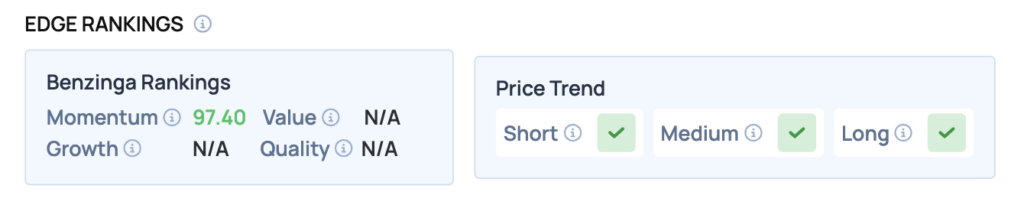

Benzinga Edge Rankings: According to Benzinga Edge, the stock shows significant strength with a Momentum score of 97.40 and a positive price trend across all timeframes.

CRML Price Action: Critical Metals shares were up 72.53% at $13.69 at the time of publication Monday, according to Benzinga Pro.

The stock is trading well above its 50-day moving average of $5.77, indicating strong bullish sentiment. The recent price action suggests a breakout from previous resistance levels, with potential support forming around the $11.50 mark.

Read Also: Stock Market Today: Nasdaq, S&P 500 Futures Rise As Government Enters 2nd Week Of Shutdown

How To Buy CRML Stock

By now you're likely curious about how to participate in the market for Critical Metals – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock