PS: Hot off the press, we take a look at that plan to raise €50bn in Greek asset sales....

So, with the Greek bailout talks delayed until at least Monday, we may be done for the day. I’ll pop back if anything important happens (but it seems unlikely right now....)

Have great weekends all. GW

Slowdown fears hit European markets

All the main European stock markets lost ground today.

The French and German markets weakened after this morning’s PMI surveys showed private sector growth slowing.

Elsewhere, the drop in Chinese factory output reported overnight hit sentiment:

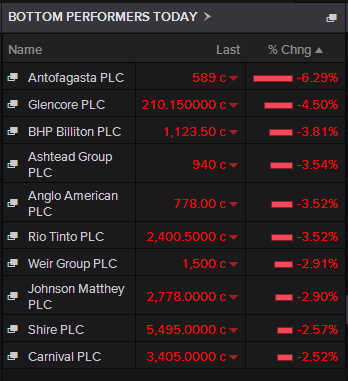

Mining stocks suffered another bad day in London, helping to wipe another 1.1% off the FTSE 100.

The steady fall in the prices of iron ore, platinum, zinc, copper, tin, gold (and pretty much every other commodity you can think of) had a predictable effect on the companies who dig the stuff up:

Updated

Greece has been given a big Fat French tick on its first report card since the July 12 European Summit where prime minister Alexis Tsipras made his spectacular u-turn and accepted lenders’ demands.

Our correspondent Helena Smith reports

The Greek leader’s office has released a statement saying Tsipras was applauded by French president Francois Hollande when the two men spoke by phone this afternoon.

It says:

“The French president congratulated Alexis Tsipras for the faithful implementation of what was agreed in so far as prior actions are concerned in the written text of the summit meeting of euro zone member states

And both confirmed the importance to keep to the letter of the law of commitments contained in the aforementioned written text.”

And as it’s so quiet, you should certainly read and digest this piece by Dan Davies into whether the 2010 Greek bailout was a big mistake, or not.

2010 and all that — Relitigating the Greek bailout (Part 2)

You might also enjoy:

2010 and all that — Relitigating the Greek bailout (Part 1)

Both are well worth reading, as Dan takes a serious and highly readable look at the events of five years ago to answer whether of not policymakers should have let Greece default....

Updated

Afternoon summary: Greek talks on ice

After the excitement of recent weeks, today has been quite a letdown. Here’s the state of play:

Negotiations between Greece and its creditors over a third bailout have hit a snag.

They appear to be on hold until at least Monday, as the two sides argue about exactly where they will meet.

“They haven’t arrived yet. There’s been a delay. We don’t know when talks will start but what we do know is that they will definitely start.”

.@EU_Commission sources "can't confirm" arrival of Troika in #Greece. Finmin officials say delay is due to procedural issues. All "on track"

— Nathalie (@savaricas) July 24, 2015

The IMF’s participation in the talks was also unclear this morning, after it emerged that Greece needed to send a formal invite....

#Greece submits formal bailout request to #IMF, Citi reports citing Twitter sources.

— Holger Zschaepitz (@Schuldensuehner) July 24, 2015

Greece’s leaders have been marking the 41st anniversary of the end of military rule.

While on the streets, long queues have been sighted as pensioners collect this month’s pensions.

The financial markets remain more concerned about commodities than Greece. Around 12,000 job cuts were announced this morning as miners react to the recent drop in prices.

There was no relief today, with platinum and copper sliding again and gold hitting a five and a half-year low.

Copper and aluminium both also hit their lowest levels since 2009, in a broad-based selloff:

Duro, duro contra las materias primas #commodities pic.twitter.com/lAOLYTAMzn

— F Trader (@SFPini) July 24, 2015

Drafi was meant to be a new, green, development away from the bustle of Athens. But then the financial crisis struck....as photographer Panayis Chrysovergis shows here:

Sounds like Greece’s letter to the IMF is now in the post....

#Greece gov't has sent official bailout request to the #IMF ~gov't official

— Yannis Koutsomitis (@YanniKouts) July 24, 2015

AP has also confirmed that ‘technical issues’ are holding back the start of the negotiations:

Greece, lenders still at talking-about-talks stage @AP story http://t.co/kYHm6uaE4B #Greece HT @Menhad @rcasert

— Derek Gatopoulos (@dgatopoulos) July 24, 2015

Political leaders lunch at presidential palace for the 41st anniversary of theRestoration of #Greek democracy #Greece pic.twitter.com/H5AZQ6l0Se

— Nektaria Stamouli (@nstamouli) July 24, 2015

Talks over Greek bailout suffer false start

Have negotiations between Greece and creditor institutions been put on hold?

Over in Athens officials have told us that it now looks as if they will be delayed by a few days.

Our correspondent Helena Smith reports

Few things are ever assured in the ever-changing debt crisis engulfing Greece but of one thing officials are now certain: negotiations on a third, three-year bailout plan will not begin, as planned, today. Mission chiefs representing the EU, ECB and IMF were due to fly into Athens this morning and hit the ground running.

One well-placed finance ministry official says:

“They haven’t arrived yet. There’s been a delay. We don’t know when talks will start but what we do know is that they will definitely start.”

Insiders say it is almost sure negotiations will now begin on Monday partly because of ongoing behind-the-scenes wrangling over where, exactly, the talks will take place.

The top-level auditors want access to ministries and files – just as they had had before the radical left Syriza assumed power in January.

“A lot of trust has been lost and the big issue is who they are going to see, what ministries they are going to be let into, what files are going to be made available,” said Anna Asimakopoulou, a shadow finance minister with the main opposition New Democracy party.

She tells me:

“That of course will be a big defeat for the government given that negotiations have moved to Brussels for the past six months but that is what they want, due diligence at a deeper level. Holding talks in a hotel is just not practical.”

Government officials confirmed that talks had also been delayed because of the IMF’s unexpected demand that Greece formally request its participation in a new bailout programme.

The Washington-based body’s top spokesman, Gerry Rice, took many by surprise late Thursday with the announcement that the IMF could only consider a third bailout for the debt-stricken country if Athens submitted a formal application.

There remains some uncertainty over whether the fund will extend its current financing program with Greece –which ends in March 2016 – or do away with that and move ahead with a new package. “The IMF wanted a formal request and that is what we have been working on,” the finance ministry official said.

“I don’t know if it is in the post, so to speak, but if it isn’t already, it is going to be very, very soon.”

Greece’s political leaders will soon be tucking into their lunch to mark the end of the military junta in 1974.

Lunch at presidential palace getting served #Greece pic.twitter.com/klUeumfln7

— Nektaria Stamouli (@nstamouli) July 24, 2015

Updated

The slump in the oil price today is having a knock-on effect on Russia.

The rouble has fallen 1.1% against the US dollar today, meaning it’s lost around 17% of its value since mid-May:

#Russia in the spotlight again aus another #Ruble collapse in the making: Ruble plunges in tandem with lower oil. pic.twitter.com/hFh1VVqqfq

— Holger Zschaepitz (@Schuldensuehner) July 24, 2015

Germans are divided over whether they support Greece’s third bailout, according to a new poll. But few believe it will stave off bankruptcy:

Will the third bailout save #Greece from bankruptcy? 71% of Germans say NO, 22% say YES. (@ZDF Politbarometer) pic.twitter.com/Y6NUy2bR2F

— Vincenzo Scarpetta (@LondonerVince) July 24, 2015

Time for some Friday fun. Check out the FT’s quiz on the Greek crisis, and see if you can beat my 75%:

Greek Crisis Quiz

@SpiegelPeter @FT @hallbenjamin 83%. Not sure whether to be proud or ashamed.

— Tom Nuttall (@tom_nuttall) July 24, 2015

(PS: there’s some chatter on twitter that it doesn’t work on some devices...)

Updated

Negotiations between Greece and its creditors have hit a snag -- they need to find a location that is secure enough to host the talks.

That means that only technical talks are taking place, not top-level negotiations, seemingly for fear that angry Greeks might disrupt them.

“There are some logistical issues to solve, notably security-wise,” a European Commission official said. “Several options are on the table,” the Commission official said, without giving more details.

We’ll have more on the state of play shortly....

More queues, this time outside the Deposits and Loans Fund (a credit institution) in Athens.

Oil has just joined the commodities selloff -- with Brent crude hitting a three-month low :

#Brent falls below $55 a barrel for first time since April

— Francine Lacqua (@flacqua) July 24, 2015

Back in Greece, party leaders should be getting spruced up for lunch with president Prokopis Pavlopoulos.

The meeting will mark the end of the Greek military dictatorship on this day in 1974, but recent developments will also be on the menu.

Pavlopoulos has already restated his position that Grexit is not an option, saying:

“Every other choice except that of remaining in the eurozone would clearly be disastrous for society, for the economy and for the nation.”

Lunch is expected to serve also as an unofficial meeting of party leaders over latest political & economic developments.

— Yannis Koutsomitis (@YanniKouts) July 24, 2015

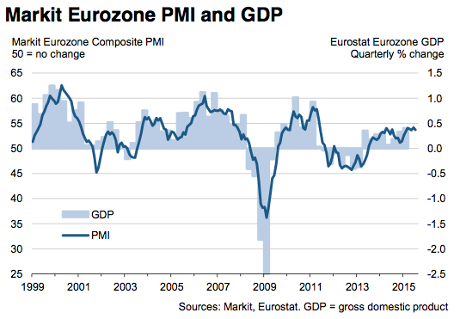

Eurozone private sector growth slows

Growth across the eurozone’s companies has slowed this month, suggesting Greece’s bailout drama had some impact on confidence.

Markit’s flash eurozone PMI composite output index, just released, fell to 53.7, from 54.2 in June.

That shows a slower pace of expansion (although safely above the 50-point stagnation mark).

The survey was taken just after Greece and its creditors struck a deal to open talks on a third bailout, at their weekend summit in Brussels.

Markit explains:

By country, growth slowed in Germany, albeit merely to a two-month low, while a three-month low was seen in France. Elsewhere in the region, the rate of expansion accelerated, pushing the pace of growth further ahead of both France and Germany yet failing to match the peaks seen earlier in the year.

The survey data were collected between July 13- 23, after the July 5 Greek referendum and commencing on the day that Greece and its creditors subsequently struck an agreement on the country’s third bailout, though there was little conclusive evidence from survey respondents as to the extent to which the events directly affected business activity either positively or negatively.

However, business expectations about the year ahead in the dominant services economy dropped to the lowest seen so far this year, fuelled by weakened confidence in Germany and France, in a sign that the crisis appears to have dented business prospects.

Looks like a busy day for banks in Athens too, as pensioners collect their monthly payments:

@damomac @SKalyvas #calm queue at Alpha Bank in small town Kallithea, Kassandra pic.twitter.com/vz1AV42ood

— anne megas (@anniemegas) July 24, 2015

Updated

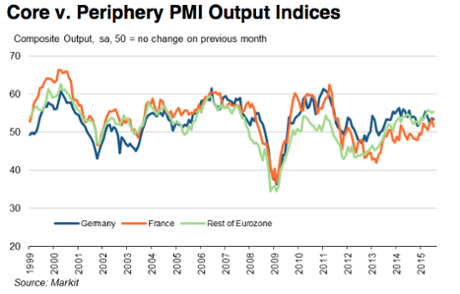

French and German factories disappoint

The euro is sliding against the US dollar, as the latest economic data from France and Germany misses expectations.

France’s private sector output is growing at the slowest rate in three months, according to Markit’s flash survey. And its factories are shrinking again, with manufacturing PMI dropping to 49.6 from 50.7 in June.

French firms reported a slowdown in new business, suggesting growth is easing this summer.

The picture was a little brighter in Germany, although growth across its service sectors and manufacturing firms both hit a two-month low:

Down she goes! #euro slumps.German PMI misses too...following France. Still expansion but not as strong as expected pic.twitter.com/Np9aJ6RqXO

— Caroline Hyde (@CarolineHydeTV) July 24, 2015

We get the overall eurozone PMI report in around 15 minutes.

Updated

The commodities rout is now the biggest issue in the capital markets, according to Chris Weston of IG:

The slump in the prices of platinum, gold, copper, zinc et al is now more serious than either Greece and the volatile Chinese stock market, he explains.

This seems to be premised on a toxic mix of increasing future surplus figures (in the forecasts), but Chinese growth and concern of a September move from the Federal Reserve are also in play.

I am personally sceptical as to whether we will start seeing downgrades to global growth forecasts of 3.5%. However, there are signs inflation expectations are starting to move lower.

It’s been a bleak weak for goldbugs too.

Spot gold hit a new five-year low overnight, and is currently trading around $1,083 per ounce - down 4,5% since Friday night. It’s on track for its worst weak since last October.

Copper is also getting hammered again today. That’s particularly concerning, as the metal is seen as a barometer of the health of the global economy

Copper trading @ 2009 low pic.twitter.com/elXQT9LK2z

— Jonathan Ferro (@FerroTV) July 24, 2015

A quick glance at the platinum price explains why producers such as Lonmin are finding life so tough - it’s not been this low since the global recession of 2008-09.

Miners announce 12,000 job cuts

Two mining giants are slashing thousands of jobs each, as the recent slide in commodity prices hits home.

Lonmin, the platinum producer, is to close or mothball several mines in South Africa, putting 6,000 jobs at risk.

It blamed the slump in platinum prices, which are currently below the break-even point:

“Lonmin is highly geared to platinum group metal prices. At current metal price levels, the company is EBITDA negative and our cost minimisation plans are designed to improve this position as much as possible.”

And Anglo American, the platinum and iron ore mining giant, is also finding conditions tough. It also announced plans to slash 6,000 jobs, and warned that the market could get worse.

CEO Mark Cutifani cautioned:

“At the moment I am not sure we are at the bottom, I hope we are but you can never be sure.

Worrying news from China overnight - activity across its factories fell at the fastest pace since April 2014.

The flash Caixin/Markit China Purchasing Managers’ Index (PMI) dropped to 48.2 in July. It’s the 5th month running that activity has been below the 50-point mark that separates contraction from expansion.

It’s going to add to concerns that the Chinese economy is struggling:

TROUBLE: Activity in #China's factory sector contracted at fastest pace in 15 mths in Jul. http://t.co/bVoKOvsTJH pic.twitter.com/YNxrU0uf9d

— Holger Zschaepitz (@Schuldensuehner) July 24, 2015

Greece’s creditors are arriving back in a country that is hamstring by capital controls.

The Irish Times’s Damian Mac Con Uladh reports seeing queues at banks in Corinth this morning, as people try to withdraw their maximum cash allowance for this week.

#CapitalControls in #Greece. Queues outside every bank in Corinth #now pic.twitter.com/UbVtwvIopG

— Damian Mac Con Uladh (@damomac) July 24, 2015

@damomac Pensions paid today + last day of the week to withdraw up to €300. Otherwise €60 tomorrow.

— Makis AtShadwell (@MakisN) July 24, 2015

Pensions have also been paid today, and people are understandably keen to get their hands on the money:

#Greece. Pensions paid today. Lots of shoving, pushing and horsing the queue at National Bank, Corinth, as doors open pic.twitter.com/44IMoc8eLT

— Damian Mac Con Uladh (@damomac) July 24, 2015

Introduction: Troika back in town

Good morning, and welcome to our rolling coverage of the Greek debt crisis and other events across the world economy, the financial markets and business.

Six months is a long, long time in the eurozone. Back in January, Yanis Varoufakis declared that Greece would no longer negotiate with the hated Troika, and that things would be different from then on.

Well, he gave it his best shot. But today, Varoufakis is no longer in the finance ministry and officials from Greece’s creditors are heading back to the capital.

They’ll begin formal talks over a third Greek bailout, after MPs agreed to sweeping austerity measures and economic reforms.

Our Athens correspondent, Helena Smith, sets the scene:

The return of the triumvirate, a day after internationally mandated reforms were pushed through the parliament by MPs, marks a personal defeat for the prime minister, Alexis Tsipras, who had pledged never to allow the auditors to step foot in Greece again.

How Greeks will react remains unclear, with much depending on media coverage.

“The press will almost certainly make a big deal out of this and the government will try to play it down,” said Aristides Hatzis, a leading political commentator. “But given what people have gone through recently it might seem rather trivial and that is to Tsipras’ advantage. Their presence will definitely reinforce the realisation that another bailout is here.”

It appears, though, that the full troika may not be in town together. The Kathimerini newspaper reckons the International Monetary Fund won’t be in attendance:

It says:

IMF spokesman Gerry Rice said on Thursday that Athens had not yet officially requested the Fund’s participation in the third program. “The modalities and the process for the discussions are still to be decided.”

Also coming up today

Economic surveys from across the globe will show how the world’s factories are performing this month. China has already got off to a bad start (more on that in a moment).

And the big story in the markets is the commodities selloff, as demand for metals slides sharply.

Bloomberg Commodity Index hits a fresh 13y low on Metals rout as Chinese demand grew at the slowest pace in 2 decades pic.twitter.com/56BFJaIadG

— Holger Zschaepitz (@Schuldensuehner) July 23, 2015

We’ll be tracking all the main developments through the day....

Updated