Consumer price growth eased in May as the cost of fresh fruits and vegetables, fresh food, dairy products and energy dropped.

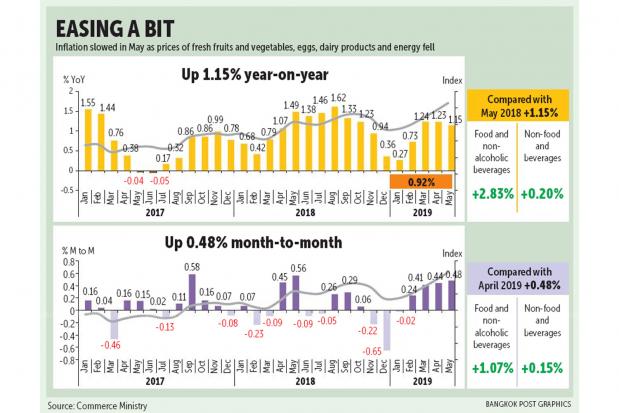

According to the Commerce Ministry's report, the consumer price index (CPI), which gauges headline inflation, rose by 1.15% year-on-year last month after rising 1.23% in April and 1.24% in March. The uptick was 0.73% year-on-year in February and 0.27% in January.

The increase was led by fresh vegetables such as chillies, green onions and eggplants, whose prices rose 29.3% from the same month of last year because of low supply caused by hot and dry weather.

Milled rice and flour prices increased 3.7%, and those of meat, poultry and fish were up 3.3% from the same month last year. The cost of public transport services rose 5.6% on the same period last year.

On a month-to-month basis, prices rose 0.48% in May after 0.44% in April, mainly boosted by fresh food -- especially for fresh vegetables led by eggplants, long beans and Chinese kale -- as well as milled rice and flour, meat, poultry, fish, dairy products and public transport services.

Core CPI, which excludes volatile food and energy prices, rose 0.54% year-on-year in May and 0.10% from April.

For the first five months of the year, headline inflation averaged 0.92%, with core inflation standing at 0.60%.

Pimchanok Vonkorpon, director-general of the Trade Policy and Strategy Office, said consumer prices are expected to increase in the second half because of higher fresh vegetable prices and other food products that are being affected by the hot season.

"We are scheduled to revise up the annual inflation target next month," Ms Pimchanok said. "The new forecast rates are likely higher than the average of 1.2%, in a range of 0.7% to 1.7%, from the previous forecast."

Thanavath Phonvichai, vice- president for research at the University of the Thai Chamber of Commerce, said a relatively low core inflation rate indicated an economic slowdown in the second quarter.

Higher inflation was driven largely by food and oil prices, not from higher consumer purchasing power, he said, adding that there is accordingly no inflationary pressure for the central bank to raise the policy interest rate.

Mr Thanavath urged the government to come up with new economic stimulus packages in the second quarter.