Coterra Energy Inc. (CTRA) is a Texas-based independent exploration and production company focused on natural gas, oil, and natural gas liquids. Valued at $20.9 billion by market cap, it has a diversified asset base across major shale regions, including the Marcellus Shale, Permian Basin, and Anadarko Basin.

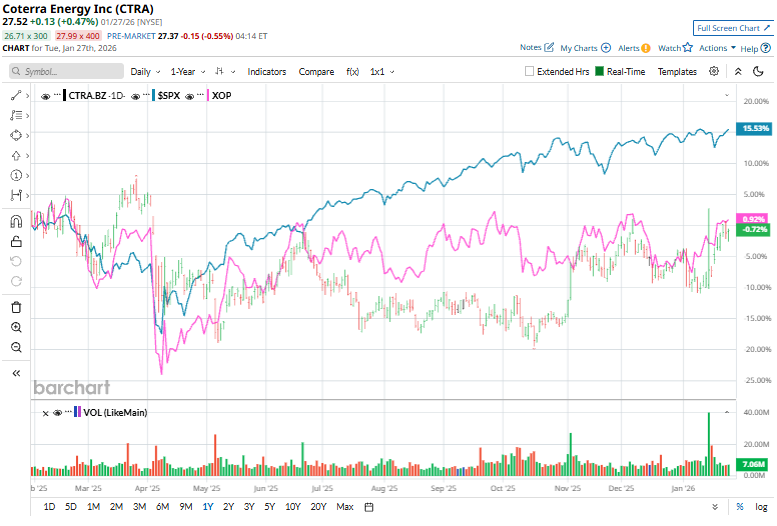

CTRA has declined 1.1% over the past year, trailing the broader S&P 500 Index ($SPX), which rallied nearly 16.1%. However, the stock has staged a notable turnaround in recent months, rallying 16.5% over the past six months, comfortably outpacing the index’s 9.2% year-to-date gain.

Narrowing the focus, CTRA has surpassed the SPDR S&P Oil & Gas Exploration & Production ETF (XOP), which declined about 1.9% over the past year and climbed 5.8% over the past six months.

Coterra Energy shares rose more than 1% on Jan. 21 as natural gas prices surged to a six-week high, lifting U.S. gas producers for a second straight session.

For FY2025 that ended in December, analysts expect CTRA’s EPS to grow 29.2% to $2.08 on a diluted basis. The company’s earnings surprise history is mixed. It beat the consensus estimate in three of the last four quarters while missing the forecast on another occasion.

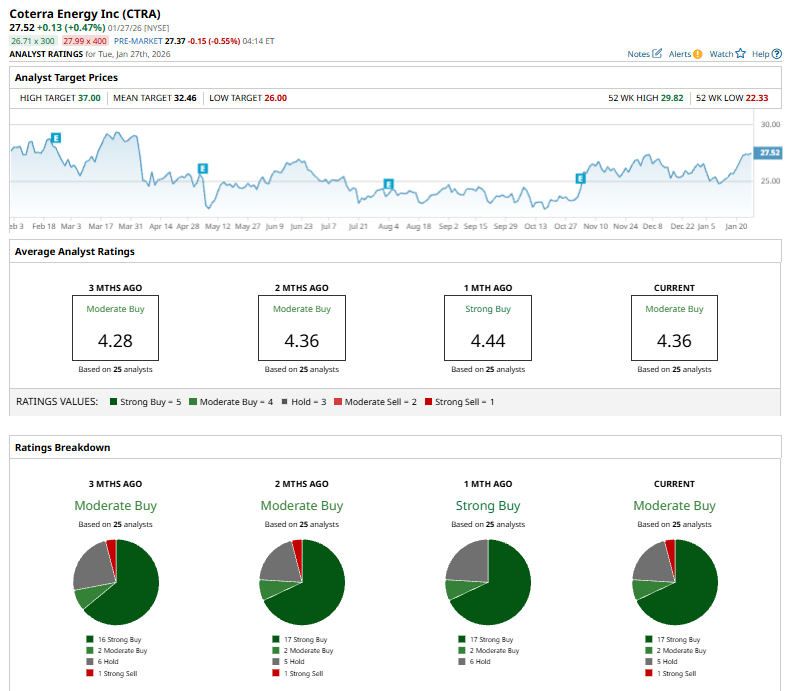

Among the 25 analysts covering CTRA stock, the consensus is a “Moderate Buy.” That’s based on 17 “Strong Buy” ratings, two “Moderate Buys,” five “Holds,” and one “Strong Sell.”

The current overall rating is bearish than a month ago when the stock had an overall “Strong Buy” rating.

On Jan. 26, Susquehanna analyst Biju Perincheril reaffirmed a “Positive” rating on Coterra Energy and raised the price target to $32 from $31, reflecting increased optimism about the company’s outlook.

The mean price target of $32.46 represents an 18% premium to CTRA’s current price levels. The Street-high price target of $37 suggests an ambitious upside potential of 34.4%.