The coronavirus pandemic has brought drastic changes to the cosmetics industry. Face-to-face sales have been limited for the sake of infection control, and the use of digital technology has been growing rapidly.

This is the first installment in a series examining how the "pursuit of beauty" is taking on a new face.

--Power of social media

In an office in the Hamamatsucho district of Tokyo in late June, Haruka Fujino and Miyu Shuto, both 25, spoke into a camera about the new cleanser and other products they wanted to present.

Fujno and Shuto were doing an Instagram Live session in their role as beauty consultants for Shiseido Co.'s luxury brand Cle de Peau Beaute.

As they spoke, real-time comments such as "What's the color of the consultants' lipstick?" and "How much does it cost?" poured in. Off-screen, staff members wrote down responses on a notepad for them to read out. More than 1,300 people watched the livestream that day.

When the pandemic hit, Cle de Peau Beaute began holding livestreams several times a month that focus on new products.

Unlike in-person sales, this method of "live commerce" allows many customers to be reached at once. The two consultants rehearsed six times before going live, figuring out the best way to show off the products.

Of course, some aspects of a product, such as its fragrance, can only be conveyed in person. But "some customers come to the store because of the livestreams. It's enabled us to make connections," Shuto said.

--Going digital

The offer of a touch-up has long been a secret weapon of cosmetics counters at department stores. A consultant applies skincare products and makeup directly to a customer's skin, recommending certain items. But this type of sales approach is changing.

Kose Corp. opened Maison Kose in Tokyo's Omotesando district last December. When customers enter the store, they can put on one of the wristbands near the entrance, indicating that they don't require assistance from the store's beauty consultants.

There is also a contactless, auto-tester device for Kose's luxury brand Cosme Decorte that allows customers to try out serum. This helps people find the right products without talking to a consultant before their purchase.

"An increasing number of customers want contactless service. We want them to enjoy a shopping experience that uses digital technology," said store manager Hiroki Takemura, 37.

Nevertheless, a lot of regular customers still want to get a touch-up. The cosmetic counters in Matsuya Ginza in Chuo Ward, Tokyo, stopped touch-ups when the pandemic started, but resumed them in late October due to customer demand.

To safely facilitate this desire, beauty consultants wear masks and face shields when performing touch-ups. They also don't touch customers with their bare hands, and disposable tips are used to apply eyeshadow.

As there is no single right answer to providing customer service, especially when preventing infections is part of the mix, they continue to try and find effective ways to respond to customers' various needs.

-- The mask look

Customer service is not the only thing that has changed with the pandemic. The coronavirus crisis has also led to new products.

The KATE brand of Kanebo Cosmetics Inc. offers a "Kate Mask" that is supposed to make a person's face look smaller. The company says the dot pattern on the three-dimensional mask sharpens the contours of the face. And applying makeup to the lower eyelids enhances the impression of a small face.

Shiseido's BB cream is a new product that has a makeup base combined with foundation to provide a transfer-proof formula that does not stick to masks. Products usually take years to develop, but this only took about four months from planning to release.

"The pursuit of convenience and digitization will advance in the industry in line with lifestyle changes linked to the pandemic," said Wakako Sato, 54, a senior analyst at Mitsubishi UFJ Morgan Stanley Securities Co.

-- Shrinking domestic market

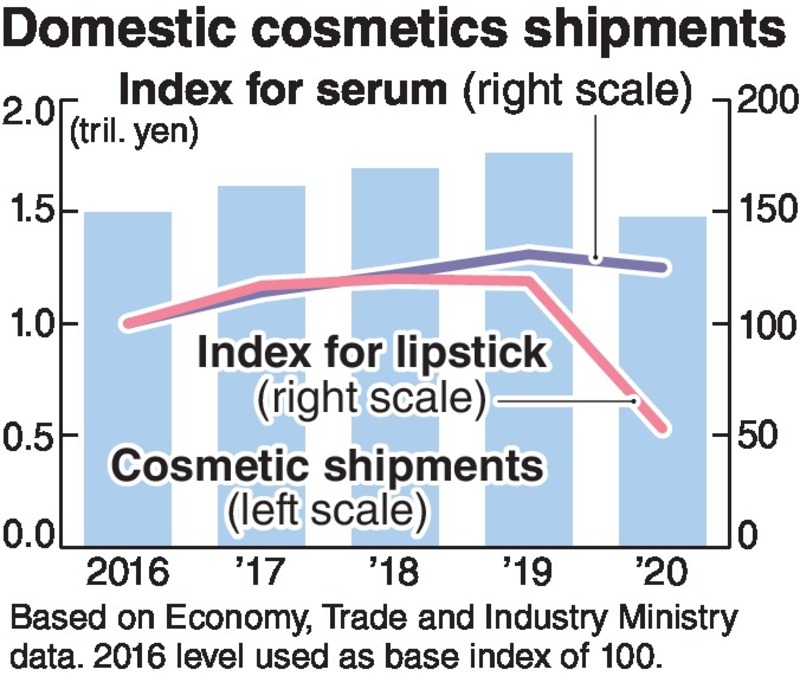

The domestic cosmetics market was growing steadily, partly due to bulk purchases by Chinese tourists. But with virtually no foreign tourists and people refraining from going out, sales contracted rapidly.

According to the Economy, Trade and Industry Ministry, cosmetics shipments in 2020 fell 16.1% year-on-year to 1.48 trillion yen. Lipstick shipments, in particular, fell to 22.2 billion yen, less than half of the previous year's level, as the practice of wearing masks essentially diminishes the need for beautifying the lips. Blush also suffered a sharp drop in shipments.

In contrast, sales of skin care products such as toners, emulsions and serums have been steady.

Cosmetics manufacturers' income has taken a hit. Shiseido's net income in its consolidated financial report for the fiscal year ending in December was negative 11.6 billion yen. Kose and Kao Corp., which owns Kanebo, also saw a significant decline in profits from cosmetics.

Improving sales techniques and developing new products will undoubtedly be essential in overcoming these difficulties.

Read more from The Japan News at https://japannews.yomiuri.co.jp/