With a market cap of $23.6 billion, Atlanta, Georgia-based Corpay, Inc. (CPAY) is a global payments company. The company provides a wide range of payment solutions that help businesses and consumers manage vehicle, lodging, and corporate expenses across the U.S. and internationally. CPAY is expected to announce its fiscal Q2 2025 earnings results after the market closes on Wednesday, Aug. 6.

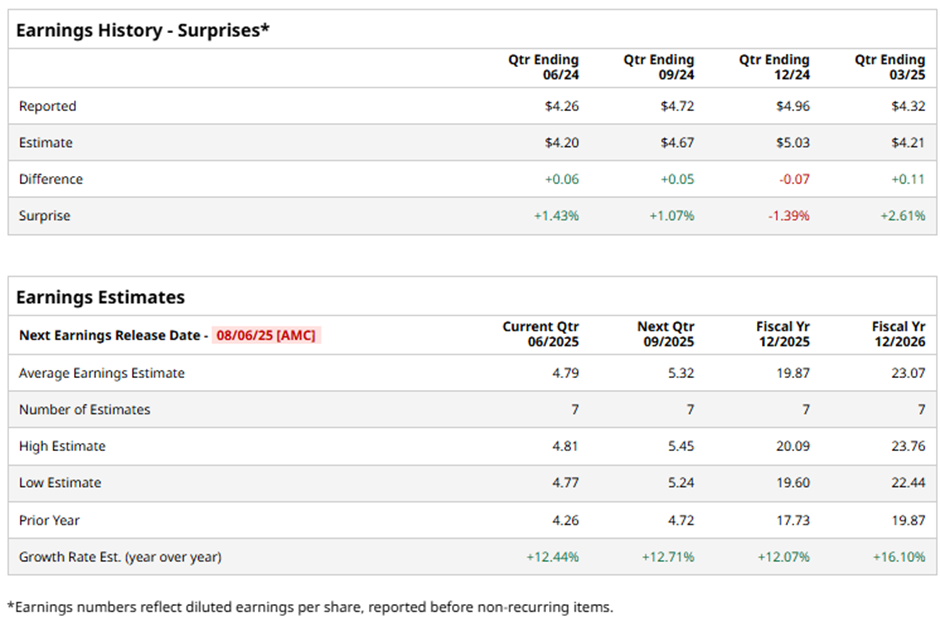

Ahead of this event, analysts expect Corpay to report a profit of $4.79 per share, up 12.4% from $4.26 per share in the year-ago quarter. The company has surpassed Wall Street's earnings estimates in three of the last four quarters while missing on another occasion.

For fiscal 2025, analysts expect the provider of fuel card and payment products for businesses to report an EPS of $19.87, an increase of 12.1% from $17.73 in fiscal 2024. Moreover, EPS is anticipated to grow 16.1% year-over-year to $23.07 in fiscal 2026.

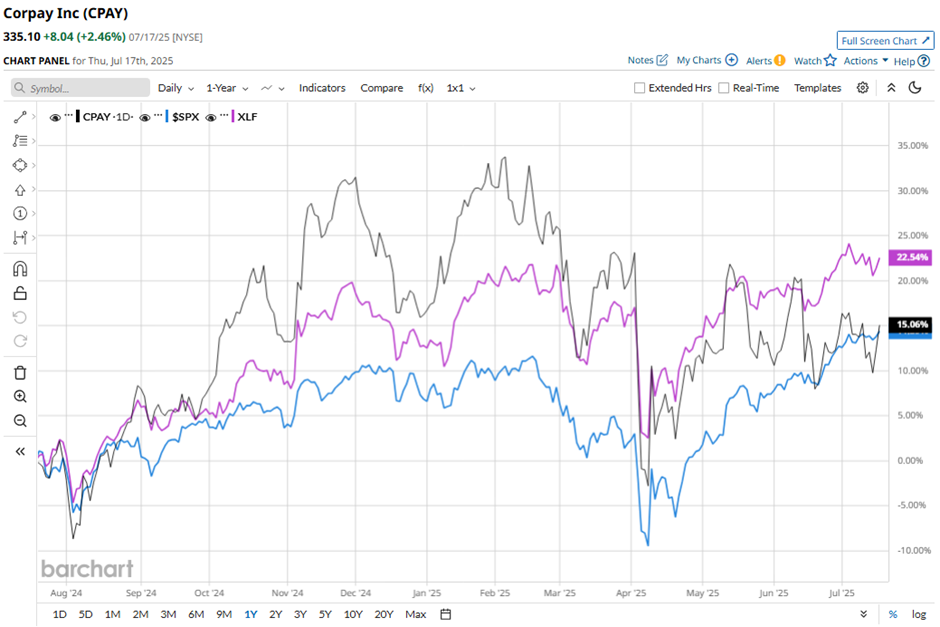

Shares of Corpay have gained 12.6% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 12.7% rise and the Financial Select Sector SPDR Fund's (XLF) 19.8% return over the same period.

Despite reporting a better-than-expected Q1 2025 adjusted EPS of $4.51 on May 6, shares fell marginally the next day. Vehicle payments revenue declined to $487.1 million, and lodging payments dropped to $110.2 million, raising concerns about demand softness. Additionally, while 2025 revenue guidance was raised to $4.4 billion - $4.5 billion, the midpoint of EPS guidance ($21) slightly trailed the consensus, tempering investor enthusiasm.

Analysts' consensus view on Corpay’s stock is cautiously optimistic, with a "Moderate Buy" rating overall. Among 18 analysts covering the stock, 11 recommend "Strong Buy," two "Moderate Buys," and five suggest "Hold." As of writing, the stock is trading below the average analyst price target of $391.93.