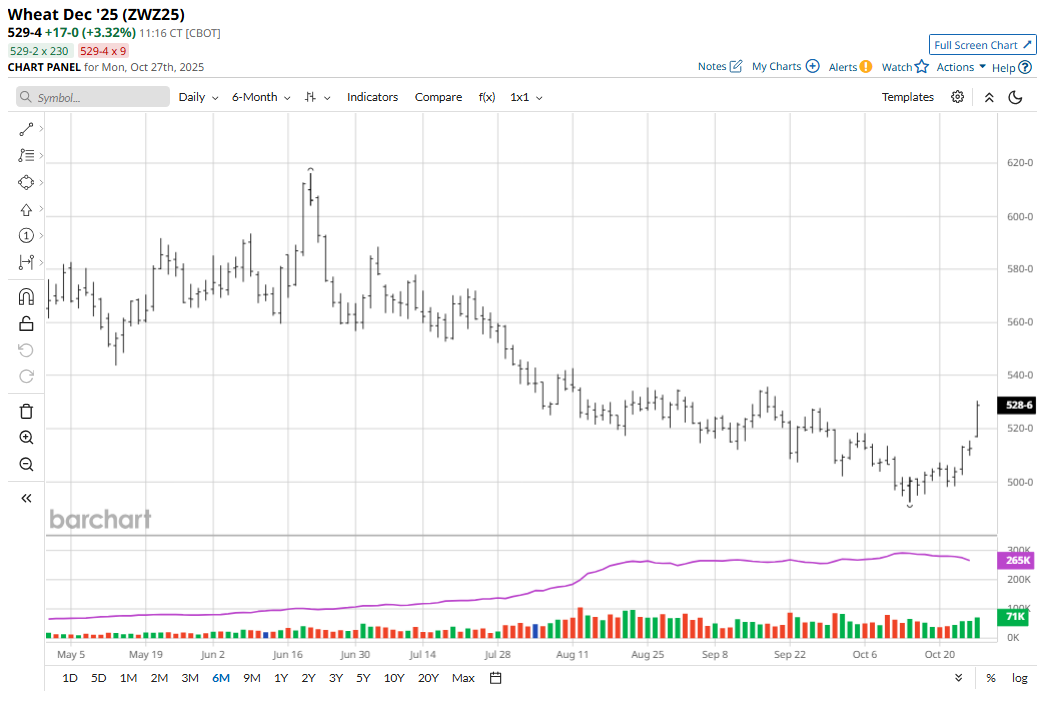

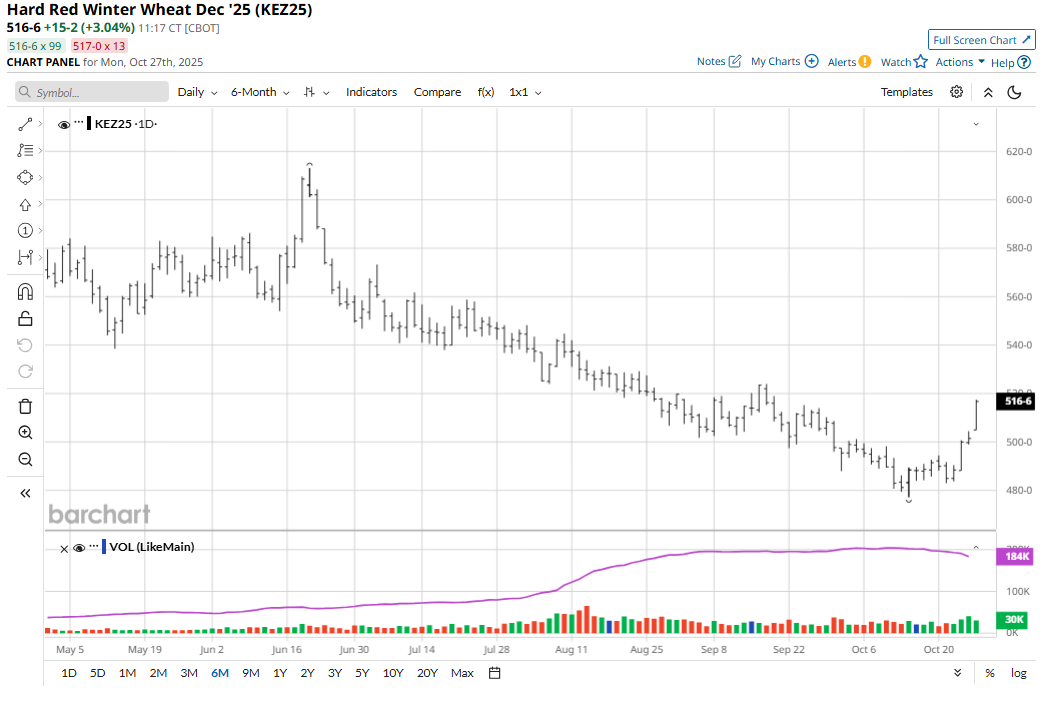

December soft red winter wheat (ZWZ25) futures hit a nearly three-week high on Friday and for the week gained 8 3/4 cents a bushel. December hard red winter wheat (KEZ25) also hit a three-week high on Friday and was up 10 cents for the week. December soybean meal (ZMZ25) futures on Friday hit a seven-week high and were $13.10 per ton higher on the week.

Importantly, these three markets had been serious laggards during the recent rallies in corn and soybean futures. Now that the overall grain futures complex is in better alignment on trending price direction, the grain market bulls are more confident that grains and soy complex prices can continue to grind sideways to higher in the coming weeks. Let’s break each market down further.

Corn Sees Selling Pressure Friday Amid Limit-Down Trade in Cattle

Friday’s losses in December corn (ZCZ25) futures, which last Thursday hit a four-week high, somewhat dented bullishness in the corn market. Friday’s corn losses likely stemmed in part from limit-down losses in the live (LEZ25) and feeder cattle (GFF26) futures markets on Friday. However, it’s unlikely that any further extreme price weakness in cattle futures will be sustainable, which would take away that bearish element for corn.

The U.S. corn harvest will be winding down in the next two or three weeks, which will also see commercial hedge selling abate. That’s a price-friendly element for corn. However, the extended U.S. government shutdown continues to see a data void that’s not bullish for the grain markets. But I look for the U.S. lawmaker impasse to come to an end and see the U.S. government reopening within the next couple of weeks. Reason: Air traffic controllers are not getting paid and are not at all happy about it. Any significant and expansive air travel delays will anger tens of thousands of voters.

Strong domestic and export demand for U.S. corn continues to bolster cash corn basis levels in the country, while producers continue to hold off for more profitable price levels amid generally disappointing corn yields. Meanwhile, U.S. ethanol exports are poised to hit a record high for the second straight year, according to the Energy Information Administration.

Soybean Futures Prices Now Trending Higher

Last week was a good one for the soybean (ZSX25) and meal futures bulls, including Friday’s technically bullish weekly high close December meal. Some upbeat comments from Chinese trade officials late last week helped support buying interest in the soybean and meal markets.

This week’s scheduled summit between President Donald Trump and Chinese President Xi Jinping, likely on Thursday, may be the most important event of the year for the soybean market. Trump has said more Chinese purchases of U.S. soybeans is near the top of his list of objectives for the meeting. Recent upbeat comments from both sides, regarding an acceptable trade deal, encouraged the soy complex bulls this week.

The U.S. soybean harvest is entering its final stages, which also means waning commercial hedge selling pressure from soybeans coming out of the field and into local elevators.

Export demand for U.S. soybeans, hopefully fresh economic data from the USDA in the coming weeks, or sooner as the U.S. government reopens, and weather in Brazil and Argentina as their growing seasons are under way, will be main fundamental topics for soybean traders in the next few months. Concern remains for some of Brazil’s soybean country due to some dryness that is prevailing. Improving rainfall will come in early November, weather forecasters say, but until then pockets of dryness will occur.

Rebounding Wheat Prices Are Arguably the Most Important Development for Grain Market Bulls

It would have been difficult for the corn and soybean futures markets to extend their recent price rallies if the winter wheat markets were still languishing near their contract lows. That’s why last week’s impressive gains in SRW and HRW wheat futures were so important for the grain bulls.

The technically bullish weekly high close in December HRW for the second Friday in a row sets up follow-through buying interest from the chart-based speculators in both markets early this week.

There were so-far unfounded rumors in the wheat markets last week that China may be poised to purchase more U.S. wheat. Next week’s scheduled summit meeting between President Donald Trump and Chinese President Xi Jinping will be closely watched by wheat traders, too. A positive outcome from the summit could set the tone for more Chinese buying of U.S. wheat in the coming weeks and months, and in turn be one more positive element in turning around the wheat futures markets.

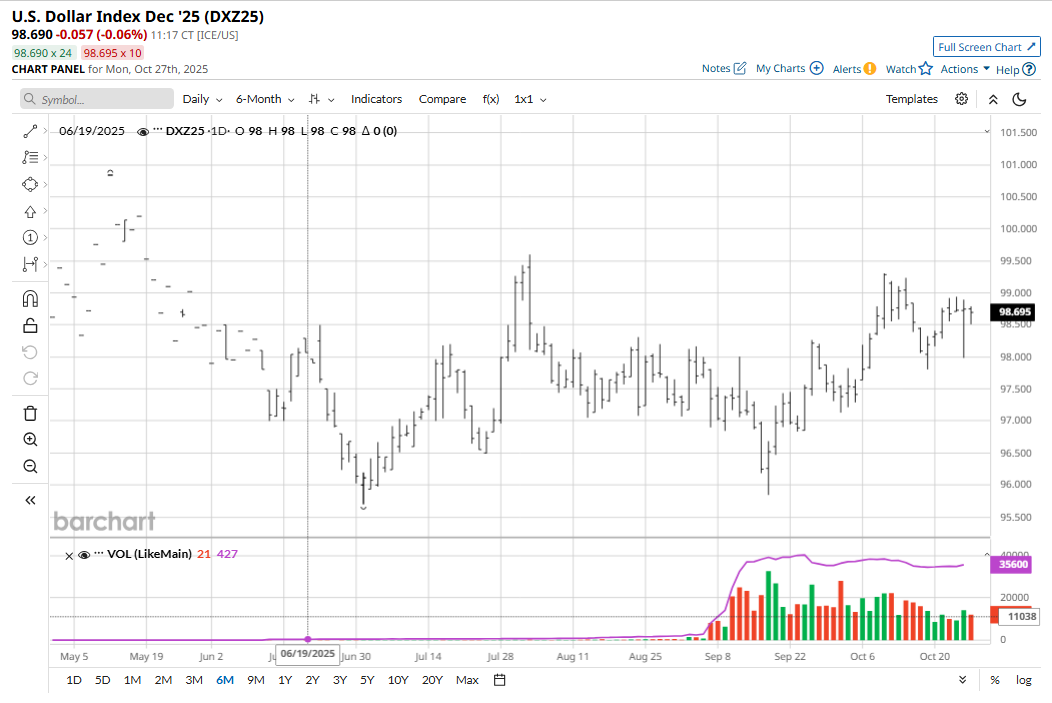

Grain Traders Will Continue to Monitor the U.S. Dollar Index

The U.S. dollar index ($DXY) has seen some hiccups recently but remains in a price uptrend that began in mid-September. That’s been a negative “outside market” for grain futures. The USDX will be an important outside market for the grains in the months ahead. Continued strength in the USDX would be bearish for U.S. grains, making their export prices less competitive on the global trade markets.

Tell me what you think. I really enjoy getting emails from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.