/The%20CoreWeave%20logo%20displayed%20on%20a%20smartphone%20screen_%20Image%20by%20Robert%20Way%20via%20Shutterstock_.jpg)

CoreWeave (CRWV) shares are down 4% on Friday morning and fell 5% on Thursday despite the artificial intelligence (AI) infrastructure firm announcing a fresh $6.5 billion agreement with OpenAI.

This new deal expands CRWV’s total contract value with the ChatGPT maker to $22.4 billion, and reinforces the trust in its ability to power the most demanding AI workloads at an “unmatched pace.”

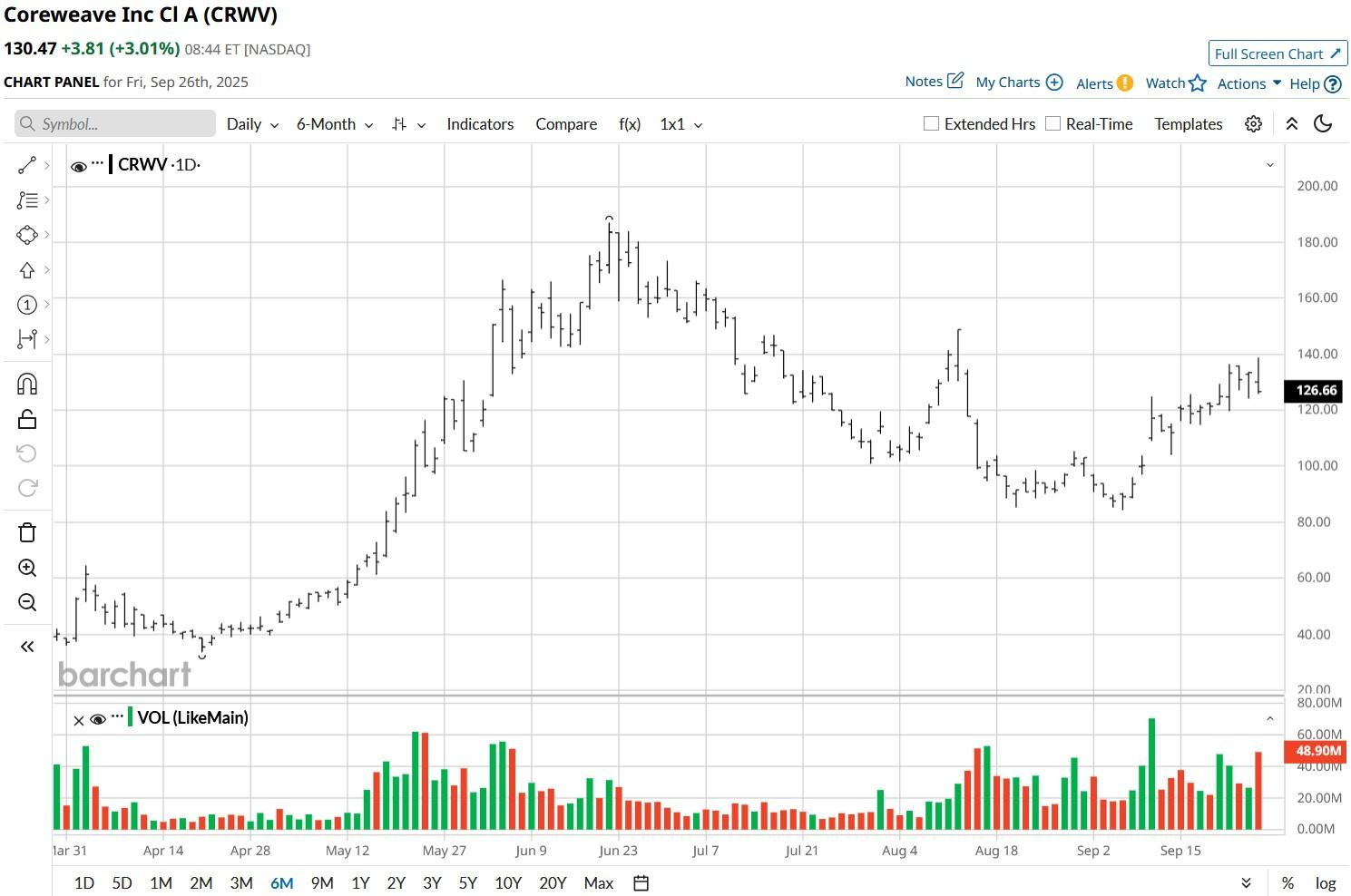

CoreWeave stock is up more than 200% versus its IPO price.

How Much Does This Matter for CoreWeave?

The expanded OpenAI partnership reinforces the company’s role as a foundational AI infrastructure provider.

With more than a quarter-million Nvidia (NVDA) GPUs across 32 data centers, CoreWeave is uniquely positioned to meet the compute demands of next-gen AI models.

Moreover, the announced agreement signals long-term revenue visibility and deep integration into OpenAI’s roadmap, which includes massive data center buildouts and global expansion.

As artificial intelligence workloads grow more complex, the Nasdaq-listed firm’s ability to deliver high-performance inference and training capacity at scale is evolving into a strategic moat.

CRWV Shares Continue to Face Material Headwinds

Despite the headline win, investors are recommended caution since CoreWeave shares face several risks that appear particularly concerning due to their frothy valuation.

For example, experts warn of customer concentration risk – OpenAI and Nvidia could account for most of the company’s revenue by 2027.

Meanwhile, execution risks loom large as CRWV juggles multibillion-dollar data center projects across the U.S. and Europe as well.

Amidst these headwinds, CoreWeave shares are going for a price-sales (P/S) ratio of more than 17x which looks stretched for a business that went public only this year.

With capital intensity rising and competition heating up, investors may want to wait for a pullback in this AI stock before chasing the rally.

Wall Street Recommends Caution in Buying CoreWeave

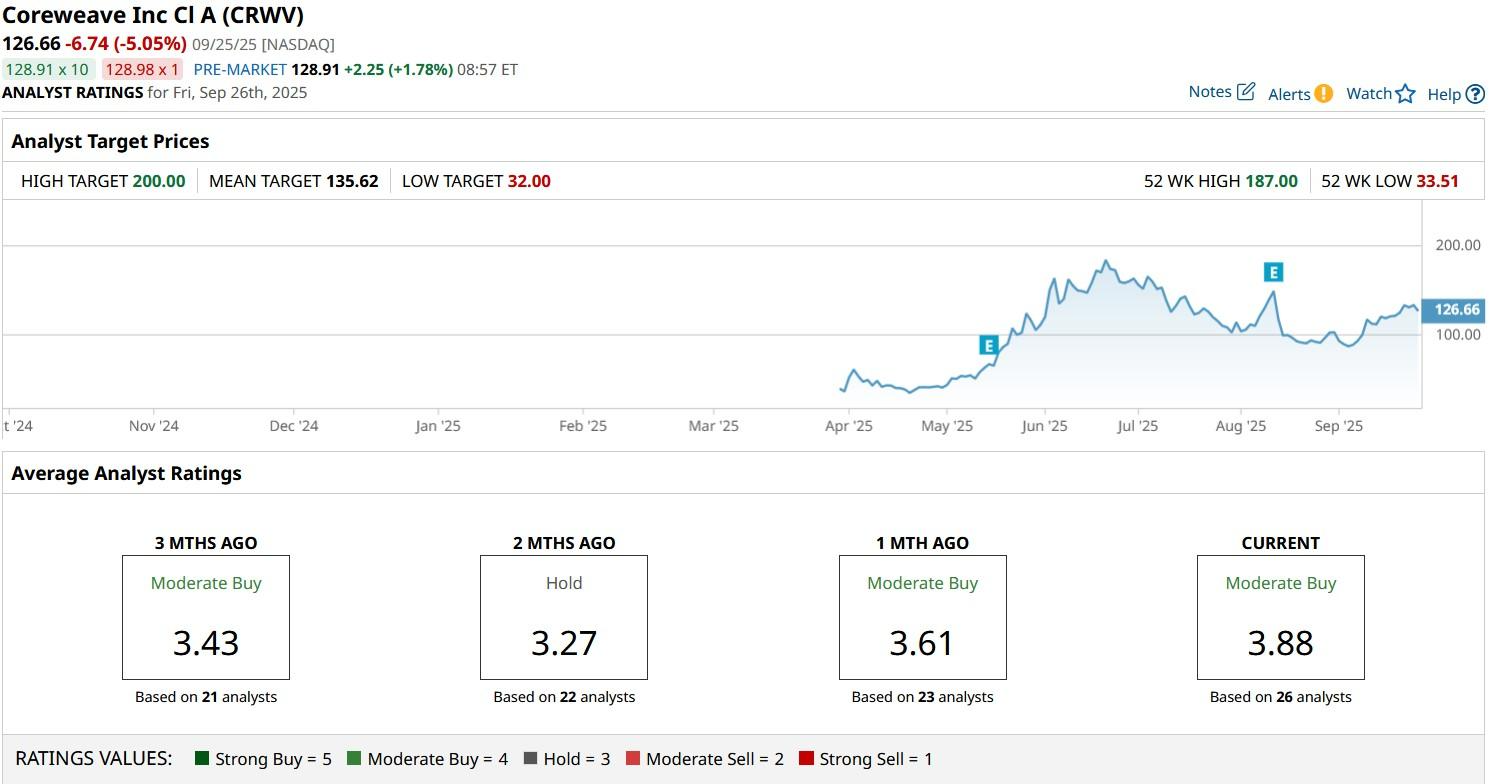

Wall Street analysts also currently favor caution in buying CoreWeave stock at current levels.

According to Barchart, the consensus rating on CRWV shares remains at “Moderate Buy” but the mean target of roughly $135 indicates just 12% upside potential from here.