/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

Applied Digital (APLD) shares could be positioning for a significant move after the data center operator announced an expanded partnership with artificial intelligence (AI) infrastructure company CoreWeave (CRWV) last week. Valued at a market cap of $4 billion, APLD stock is already up 274% in the previous 12 months.

Applied Digital finalized a new lease agreement for an additional 150 MW at its Polaris Forge 1 Campus in North Dakota, bringing its total anticipated contracted lease revenue to approximately $11 billion. This includes $7 billion from the initial 15-year leases executed in May.

"This new lease agreement with CoreWeave underpins our commitment to building the next generation of AI infrastructure right here in America's heartland," said CEO Wes Cummins. The expanded deal encompasses 400 MW of critical IT capacity across three long-term lease agreements, with the new data center expected to reach full capacity by 2027.

Applied Digital's campus is engineered to scale up to 1 gigawatt over time, leveraging renewable power and North Dakota's climate for sustainability advantages.

Is APLD Stock a Good Buy Right Now?

Applied Digital presents a compelling investment case for exposure to AI infrastructure in 2025. The CoreWeave partnership represents a game-changing moment for APLD stock. With $11 billion in total contracted revenue from long-term leases, Applied Digital has secured predictable cash flows that should drive future growth. The recent 150 MW expansion demonstrates CoreWeave's confidence in APLD's capabilities and validates the Polaris Forge 1 campus concept.

CEO Wes Cummins revealed that APLD has completed onboarding with three investment-grade hyperscalers and is in "advanced negotiations" with another major customer. This diversification beyond CoreWeave reduces concentration risk while positioning it to capture surging AI infrastructure demand.

APLD's operational improvements are noteworthy. It has reduced build times from 24 months to 12-14 months while cutting SKUs by 50%, creating a competitive advantage in a market where speed matters. The North Dakota location offers compelling economics, with projected 30-year savings of $2.7 billion per 100 MW facility compared to traditional data center regions.

Despite the positive momentum, several concerns persist. APLD posted a net loss of $26.6 million in Q4, and while adjusted EBITDA turned positive at $1 million, profitability remains elusive. The company is still awaiting completion of project financing, expected within 4-10 weeks, which creates near-term uncertainty.

The Cloud Services business remains under strategic review, adding complexity to the investment thesis. Additionally, hyperscaler negotiations are notoriously lengthy and complex, making deal timing unpredictable despite management's optimism.

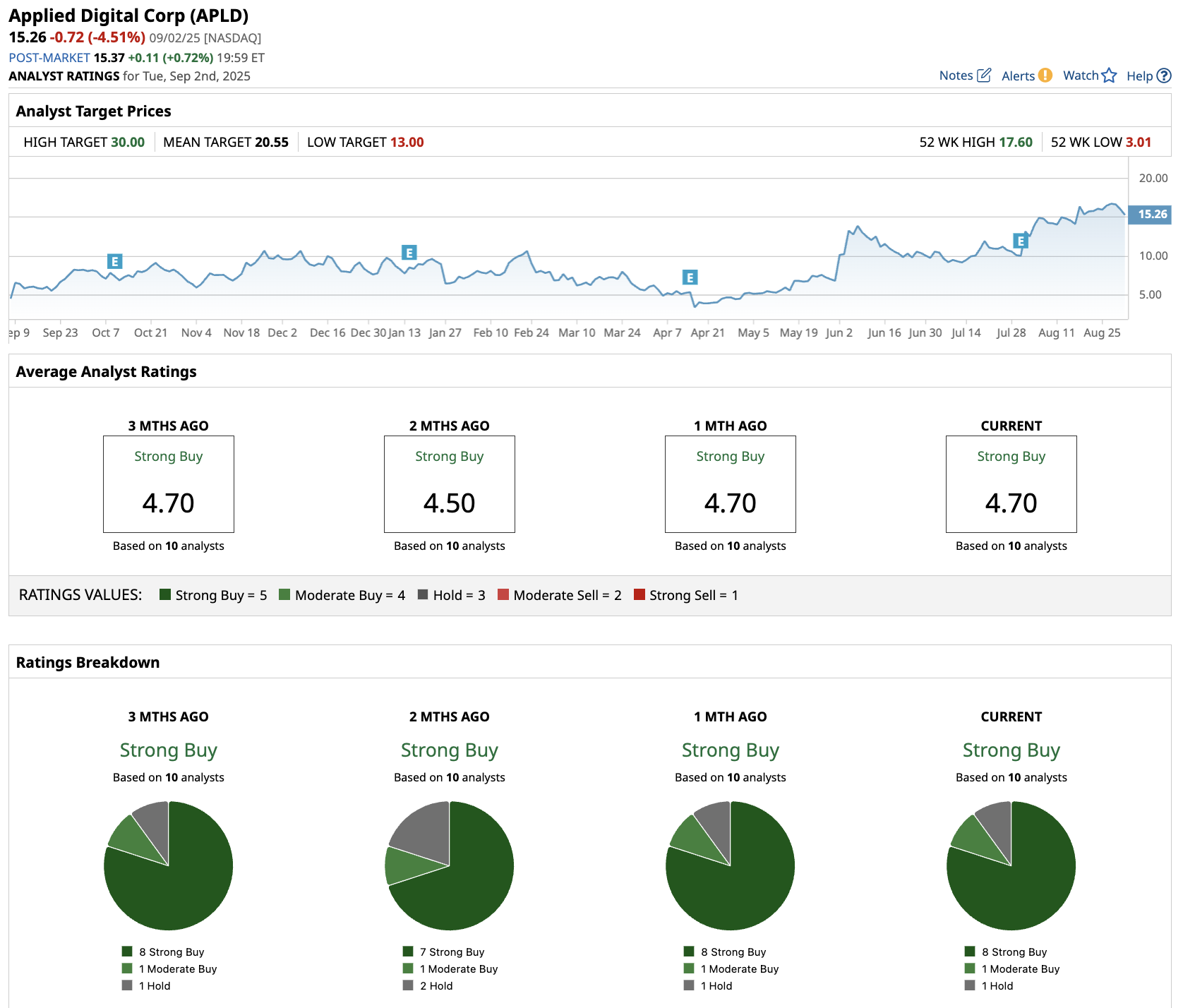

What Is the Target Price for APLD Stock?

Analysts tracking Applied Digital stock forecast revenue to rise from $216 million in fiscal 2025 (ended in May) to $757 million in fiscal 2028. While still unprofitable, APLD stock is forecast to improve adjusted earnings to $0.51 per share in fiscal 2028, compared to an adjusted loss per share of $0.32.

Of the 10 analysts covering APLD stock, eight recommend “Strong Buy,” one recommends “Moderate Buy,” and one recommends “Hold.” The average APLD stock price target is $20.55, indicating a 30% upside potential from current levels.

For investors seeking exposure to AI infrastructure, APLD stock offers compelling long-term potential due to its secured revenue base and pipeline opportunities. However, the stock carries execution risk and requires patience as the company transitions from development to generating operational cash flow.