Shares of AI infrastructure provider CoreWeave Inc (NASDAQ:CRWV) are trading lower Tuesday despite a lack of specific news for the session. The stock appears to be under pressure as investors weigh recent heavy insider selling against the company's aggressive expansion plans. Here’s what investors need to know.

What To Know: Last week, top executives sold over $1 billion in stock following a more than 250% rally, a move that coincided with sharp criticism from famed short-seller Jim Chanos. He questioned CoreWeave's long-term profitability, suggesting rapid GPU depreciation could lead to a near-zero return on invested capital.

Countering this bearish sentiment is the company's recent strategic acquisition of UK-based Monolith AI to expand into manufacturing and R&D sectors. This builds on high-profile partnerships with Nvidia, OpenAI and Meta. With significant insider sales and short-seller scrutiny on one side, and strategic growth on the other, investors are carefully assessing CRWV's future trajectory.

Broader market sentiment is also weighing on the stock, following renewed U.S.-China trade tensions. President Donald Trump’s tariff threats late last week created significant market uncertainty, analysts say, sparking a flight from higher-risk growth stocks.

Because the AI sector is heavily reliant on the semiconductor supply chain, which is linked to Asia, geopolitical tensions create a significant headwind. The risk-off mood encourages investors to sell volatile, high-growth names like CRWV in favor of safer assets, regardless of company fundamentals.

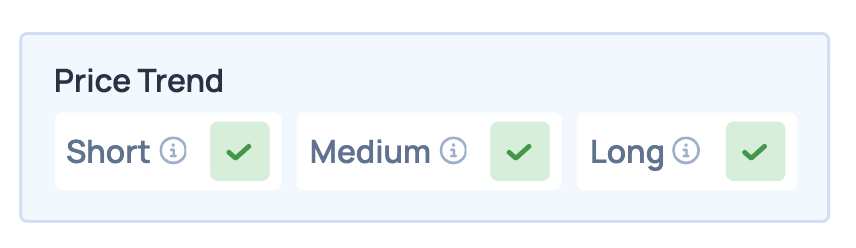

Benzinga Edge Rankings: Despite today’s pullback, Benzinga Edge price trend analysis for CRWV remains bullish across short-, medium- and long-term outlooks.

CRWV Price Action: CoreWeave shares were down 4.14% at $135.76 at the time of publication Tuesday, according to Benzinga Pro. The stock is trading within its 52-week range of $33.51 to $187.00.

The stock is trading above its 50-day moving average of $115.56 and its 200-day moving average of $106.57, indicating a longer-term bullish trend, but the recent price action suggests a potential pullback. Key support levels can be observed around the 100-day moving average at $127.17, while resistance is evident near the recent high of $139.24.

Read Also: Navitas Semiconductor Stock Soars On Nvidia Architecture Update: What Investors Need To Know

How To Buy CRWV Stock

Besides going to a brokerage platform to purchase a share – or fractional share – of stock, you can also gain access to shares either by buying an exchange traded fund (ETF) that holds the stock itself, or by allocating yourself to a strategy in your 401(k) that would seek to acquire shares in a mutual fund or other instrument.

For example, in CoreWeave’s case, it is in the Information Technology sector. An ETF will likely hold shares in many liquid and large companies that help track that sector, allowing an investor to gain exposure to the trends within that segment.

Image: Shutterstock