Four years after the Tamil Nadu government shut Sterlite Copper on charges of pollution following several legal battles, a unit of the Vedanta Group put out an advertisement last week announcing that the Thoothukudi smelter was up for sale. While environmentalists and those who have been against the operation of the plant called this move a “marketing gimmick” and “strategy to get national attention”, industries and micro, small and medium enterprises that rely on copper (a key raw material) are worried that this would further impact businesses in the State.

When operational, Sterlite Copper produced approximately 40% of India’s demand for copper and contributed around ₹2,500 crore to the exchequer. The Thoothukudi plant has an installed capacity of 4,00,000 metric tonnes per annum (MTPA) at the integrated copper smelter and refinery, with another 4,00,000 MTPA under expansion. Apart from copper, Sterlite was the only domestic supplier of phosphoric acid with a capacity of 220,000 metric tonnes. The acid is a key raw material for fertilizers. This particular plant was also the largest supplier of sulphuric acid in Tamil Nadu, which is used in the detergent and chemical industries. After the closure of this plant on May 28, 2018, the prices of all these raw materials shot up.

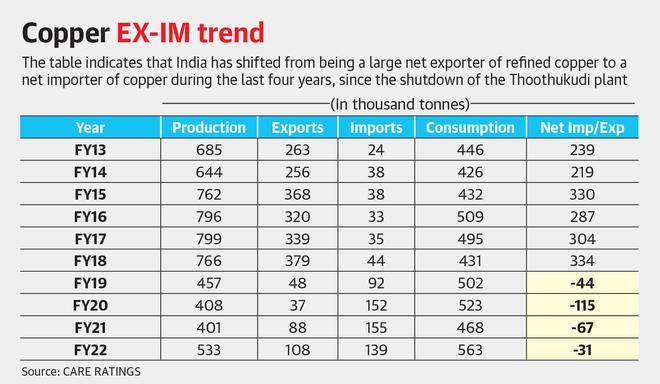

Data provided by Hitesh Avachat, Associate Director, Care Ratings, show that India is importing copper at a historically higher price, close to around $9,600 per tonne, 50% higher than the average prices when India was a net exporter (around $6,500 per tonne).

Forex fluctuations further add to the pain of the Indian copper market. He explains, “If we look at the end-use consumption pattern, more than one-third of copper goes into the electrical segment. What we have observed in the last four years is the wait time for raw material import has increased from a week to almost a month. “This means these companies must invest more in their working capital (to keep a higher inventory of copper). This also results in a significant impact on profitability owing to the inventory carry cost,” he said.

In the last three years, industries in the Coimbatore region have been affected badly by the increase in raw material prices, especially copper, said M.V. Ramesh Babu, president, Coimbatore District Small Industries Association (CODISSIA). “We were thinking that the plant would open some day. This announcement has come as a surprise,” he said. “The Supreme Court should allow the company to restart. The Centre and the State government should support industries but at the same time ensure that they follow stringent pollution-control norms.”

Ar. Rm. Arun, president of the Southern India Chamber of Commerce and Industry (SICCI), said that if there had been any issue in its operation or the treatment of its effluents, the company should have been mandated to rectify the deviations and continue the operations. “Shutting down a plant does not solve the problem. Having shut down the plant, and not allowing any step to be taken, would naturally force the owners to think of what measures they have to take. This plant’s impact on its owners, The Vendanta Group, is minuscule and does not matter much. If the plant is sold, the new owners would have to look into cleaning up any pollution that’s been reported upon, before restarting production.”

Mr. Arun also pointed out that India has now become a net importer of copper from financial year 2018-19 after the closure of the plant. Imports will continue to increase as domestic demand will double from 1 million metric tonnes to 2 million metric tonnes. He further said several industry sectors that need copper, such as electric vehicle, renewable energy, rail and electricity, would all be impacted by copper shortage, import dependence and the corresponding rise in input costs.

After the closure of the plant, many other industries and ancillary units (that depend on raw materials from Sterlite Copper) have also moved out of Tamil Nadu. An industrialist said some of the units were in a wait and watch mode but now with this decision of Sterlite Copper, they would also move out of the State. One of the proprietors of a unit that moved out said, “After Sterlite closed, we started procuring raw materials from other States and it did not make any economic sense. And then the COVID-19 pandemic hurt our businesses further. So we moved our unit closer to the source of raw materials,” he said.

Gunasingh Chelladurai, Director, Bell Group of Companies, and president, Tirunelveli District Chamber of Commerce and Industry, said he had purchased 20 acres of land in Telengana for starting his chemical industry. “Since starting a chemical industry in Thoothukudi is not advisable in the present scenario, we decided to go to Telangana,” he said. He noted that Vedanta’s decision to sell its copper smelter is a wake-up call for the Tamil Nadu government, which is keen on attracting investments to augment employment.

K. Nehru Prakash, president, Thoothukudi District Tiny and Small Industries Association, pointed to the number of trucks and lorries playing between the plant and the port. All of them were affected by the closure. The plant engaged about 1,000 trucks/tankers every day with a consistent load, providing livelihood to around 9,000 drivers and cleaners a month. It had over 650 supply and service partners and helped them generate a business of close to $134 million every year.

After the advertisement was issued, questions have also been raised about who would buy the plant when so many people have protested here. A section of industrialists The Hindu spoke to said the decision of selling the plant was good because this was a black-mark in the region; if a new player comes in, people’s mind and sentiments could change. And more industries would come confidently and invest here. Mr. Hitesh of Care Ratings said buying the plant with an intention to re-start seems like a reverie. “Even after various enquiries, committees and published reports being set to test the impact of soil, air and water pollution, till date, Sterlite itself has not got any relief in terms of re-opening of the plant, except for one occasion to temporarily produce oxygen during the pandemic,” he said.

M. Krishnamurthy, one of the leaders of the Anti-Sterlite Protest Movement, said, “This [the advertisement] is an attempt to hoodwink the people of Thoothukudi and blackmail the governments.” “As of now, the Sterlite Copper complex is nothing but scrap. If a chemical industry wants to wind up its operations and decides to dismantle the unit, it should obtain permission from the Tamil Nadu Pollution Control Board. Without following this mandatory procedure, Vedanta has given this advertisement, which is nothing but an attempt to cheat everyone,” he added.

Another source from one of the anti-Sterlite groups asked what would happen if the Supreme Court were to decide to allow the plant to function and would the company sell. “This is a plan to push the government to act fast and create sympathy among the locals here,” he said.

Ever since the advertisement was published, none of the political parties has reacted. Almost all parties have been against reopening of the plant. The victims of the police firing also continue to oppose re-opening of the plant.

In response to an official email, a Sterlite Copper spokesperson refused to comment. Some who have been associated with the company, off the record, said that four years was a long enough time to answer shareholders and stake-holders. Whether the plant is likely re-open or to be sold, there are definite implications for the conduct of business and the confidence of investors in Tamil Nadu.