/Copart%2C%20Inc%20logo%20on%20website%20-by%20monticello%20via%20Shutterstock.jpg)

Dallas, Texas-based Copart, Inc. (CPRT) provides online auctions and vehicle remarketing services. Valued at $39.3 billion by market cap, the company sells vehicles through its virtual bidding platform, insurance companies, financial institutions, vehicle rental companies, and dealers via platforms such as BluCar and CashForCars.com as well as offers services like salvage estimation, processing, transportation, and title management.

Shares of this global online vehicle auction leader have considerably underperformed the broader market over the past year. CPRT has declined 30.7% over this time frame, while the broader S&P 500 Index ($SPX) has rallied nearly 14.3%. However, in 2026, CPRT stock is up 3.7%, surpassing SPX’s 1.4% rise on a YTD basis.

Narrowing the focus, CPRT’s underperformance is also apparent compared to the Industrial Select Sector SPDR Fund (XLI). The exchange-traded fund has gained about 18.7% over the past year. Moreover, the ETF’s 6.7% gains on a YTD basis outshines the stock’s returns over the same time frame.

CPRT's underperformance is due to cooled growth momentum, making it less attractive compared to faster-growing sectors. Soft used-vehicle market conditions and moderate auction activity have impacted short-term revenue and earnings, dampening investor interest.

For the current fiscal year, ending in July, analysts expect CPRT’s EPS to grow 4.4% to $1.66 on a diluted basis. The company’s earnings surprise history is impressive. It beat or matched the consensus estimate in each of the last four quarters.

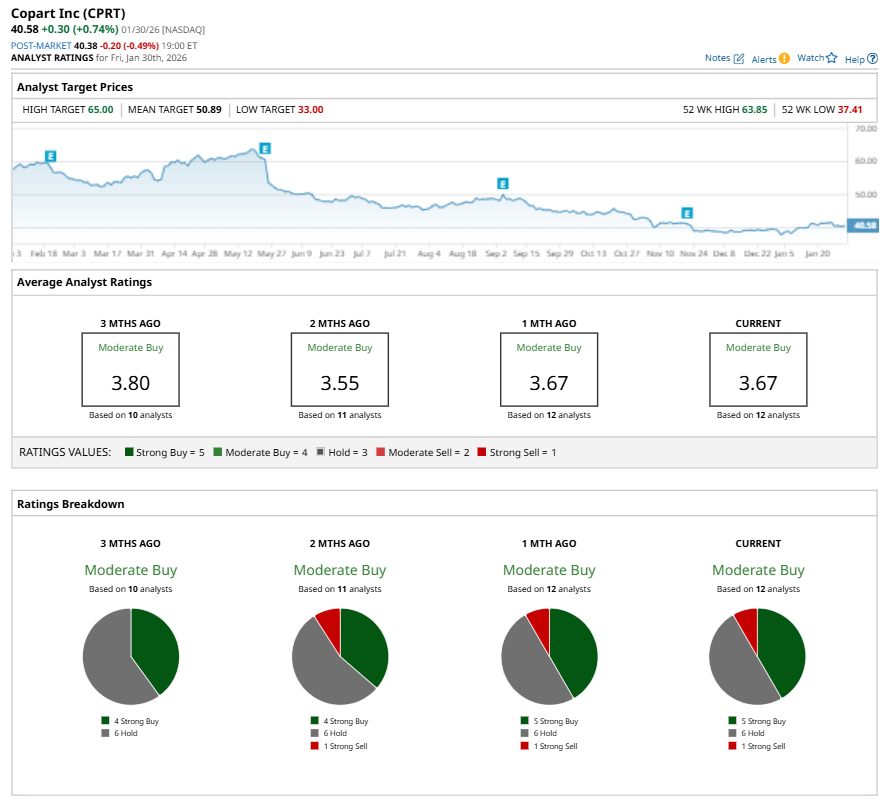

Among the 12 analysts covering CPRT stock, the consensus is a “Moderate Buy.” That’s based on five “Strong Buy” ratings, six “Holds,” and one “Strong Sell.”

This configuration is more bullish than two months ago, with four analysts suggesting a “Strong Buy.”

On Dec. 18, 2025, Barclays PLC (BCS) analyst John Babcock maintained a “Sell” rating on CPRT and set a price target of $33.

The mean price target of $50.89 represents a 25.4% premium to CPRT’s current price levels. The Street-high price target of $65 suggests an ambitious upside potential of 60.2%.