Daisuke Tanaka, senior consultant at Nomura Research Institute Ltd., spoke to The Yomiuri Shimbun about the current state of and key challenges for cashless payments in Japan. The following is excerpted from the interview.

The Yomiuri Shimbun: What are the merits of cashless payments?

Tanaka: The use of cashless payments is growing. However, with our deep-rooted preference for cash, Japan is somewhat lagging behind other countries. What is necessary to make cashless payments even more widely used?

Essentially, when buying products, the simpler a payment method, the better. An environment has already been established to use credit cards, and such electronic money as Suica is also in use. The development of information technology has made it possible to make payments via smartphones.

Looking at the economy as a whole, there are many merits to going cashless. If the cash individuals keep in such places as closets is converted into financial assets including equities and money in bank accounts, and circulates in society, it will energize the economy.

Lagging behind other nations

Going cashless, businesses can expect benefits such as more efficiency in operations and reduced costs. Last year, major food-service industry firm Royal Holdings Co. opened a restaurant in Tokyo that limits payment to cashless methods including electronic money.

Usually, after a restaurant closes each day, it is necessary to check whether the proceeds and the money left in the registers match, which puts a burden on employees. By going cashless, the employees can do other work instead, and if they can create something new, that will produce economic benefits.

Such a cashless system has been introduced at retail stores as well, though on a small scale, including supermarkets and conveyor-belt sushi chains.

Japan will face a labor shortage in the future due to population decline. The latest moves are in line with the trend of leaving the work that can be done by machines up to machines.

Cashless payment methods also have features like QR codes and biometrics, which are promising for business development. Future trends will utilize a combination of multiple technologies. I think a system will be eventually introduced where you just select products at a store, bring them home and complete payment without noticing.

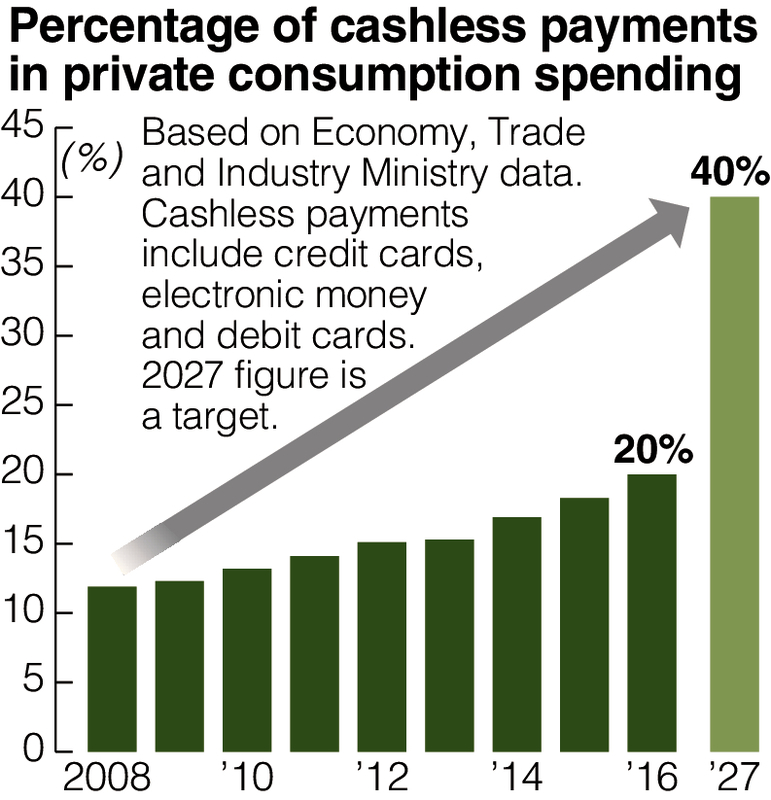

In the Future Investment Strategy compiled last June, the government set a target to double the proportion of cashless payment to about 40 percent in 10 years.

Weddings and funerals

Q: Are there differences between Japan and other countries in terms of the speed at which society embraces cashless payments?

A: The proportion of cashless payment is already 40 percent in the United States, and it is roughly 60 percent in China. So Japan will not be able to catch up with them even if it achieves its target.

Japan has a custom of giving cash gifts at ceremonial occasions such as coming of age ceremonies, weddings, funerals and events related to ancestral worship. Compared to other countries, Japan's paper currency is high in quality, and its anti-counterfeiting measures are solid.

The country's preference for cash can hardly be unrelated to the wide availability of automatic teller machines at such places as convenience stores.

Meanwhile, in countries where the transition to cashless is already advanced, the background and policies are varied from one nation to another.

In the United States, the widespread use of credit cards such as Visa and Mastercard was led by the private sector as transactions that had been carried out with checks -- a culturally accepted payment method up to that point -- became increasingly digitalized.

In China, confidence in cash is low, so the government tried to spread UnionPay cards. As inexpensive smartphones were widely used and e-commerce and social media became more popular, payment via smartphone apps such as WeChat Pay and Alipay became a matter of course. As a result, the transition to cashless payments made progress at the initiative of the private sector.

Currently in Southeast Asian countries, which are working to develop their monetary systems, a variety of taxation regimes and incentives have been approved under the premise that transactions will be cashless. Their lack of technological development may make it easier to innovate systems.

Overcome sectionalism

Q: What are the major challenges for Japan to promote cashless payments?

A: The hurdle for Japan in the future will be to what degree the entities involved are able to keep in step with each other.

While it is necessary for the government to back initiatives by the private sector, including financial institutions, jurisdiction is split with the Economy, Trade and Industry Ministry controlling credit cards, and the Financial Services Agency in charge of prepaid cards and debit cards. Even though they share the same aim of going cashless, their relevant systems and proliferation policies are not consistent with each other.

Businesses are also going cashless individually, using specific technologies such as IC cards and wireless telecommunications, but the future trend will be to combine a number of technologies, including biometrics. It is also necessary for companies such as distributors and payment processors to coordinate with each other to create new payment methods, rather than working alone.

Some have also raised concerns about cybercrimes such as the theft or misuse of personal information related to payments. Naturally, we must develop countermeasures, but cash itself is not necessarily secure. Cash is a suitable means for money laundering, and it runs the risk of becoming a tool of crime.

Japan is at a major turning point as momentum builds up for its transition to a cashless society. If the nation misses this chance, it will be left alone behind the rest of the world.

It is vital not only to educate users and stores, but also to devise incentives for users. I think the time has come for the government to lead the way forward to a cashless society.

Digitalization is making progress not just in the field of payment methods but across all areas including daily life and business. However, the government has not shown the full picture. The government should present a clear outlook on how society will transform.

(This interview was conducted by Yomiuri Shimbun Staff Writer Ayuhiko Sasaki.)

Daisuke Tanaka / Senior Consultant at Nomura Research Institute Ltd.

Since completing graduate school at Kyoto University, Tanaka has provided consulting services related to payment systems, the creation of start-ups and utilization of fintech. He coauthored the book "IT Nabigeta" (Information Technology Navigator).

Read more from The Japan News at https://japannews.yomiuri.co.jp/