Consolidated Edison, Inc. (ED) is a major energy company headquartered in New York. Through its subsidiaries, the company provides regulated electric, gas, and steam services, delivering electricity to millions of customers in New York City and surrounding areas, gas to urban and suburban communities, and steam service in parts of Manhattan. The company has a market cap of around $34.7 billion.

Companies worth $10 billion or more are generally described as “large-cap stocks,” and ED perfectly fits that description, with its market cap exceeding this mark, underscoring its size, influence, and dominance within the regulated electric utilities industry. The company is streamlining operations and focusing on core utility services to enhance long-term reliability and efficiency.

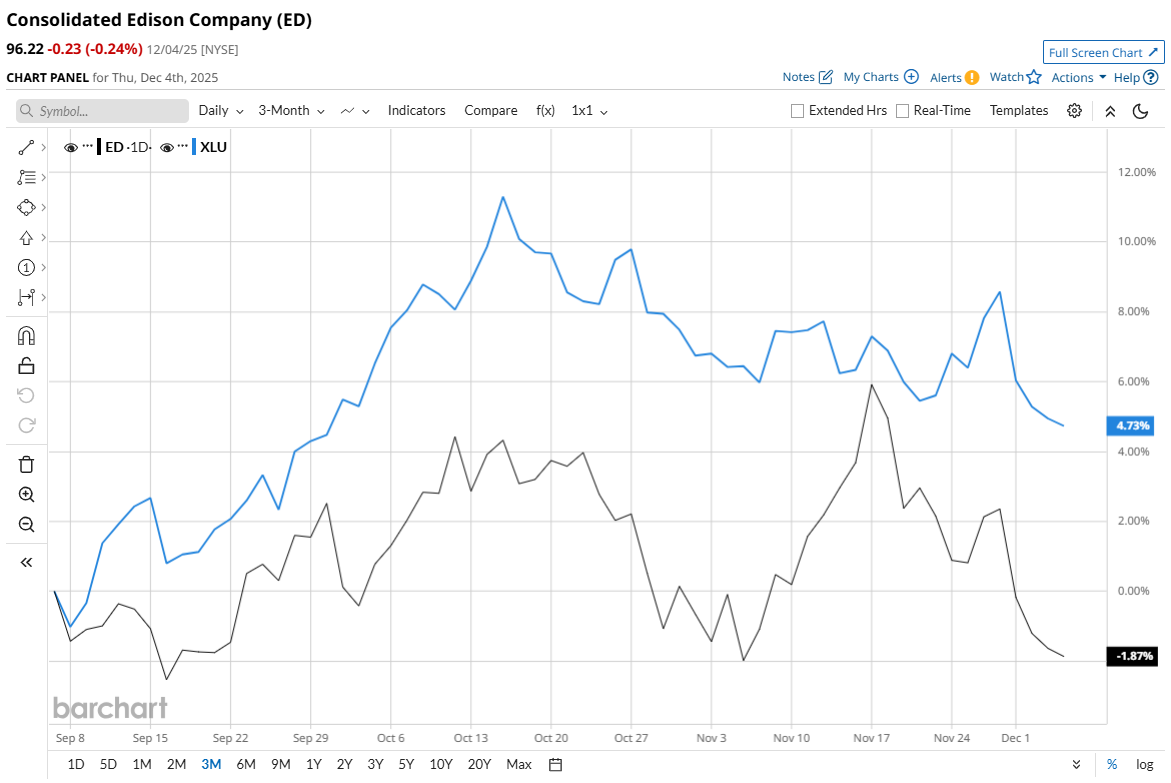

ED has fallen 16.2% from its 52-week high of $114.87, achieved on Apr. 4. Over the past three months, the stock has declined 1.6%, underperforming the Utilities Select Sector SPDR Fund (XLU) 4.4% gains during the same time frame.

In the longer term, the stock rose 7.8% on a YTD basis but declined marginally over the past 52 weeks, underperforming XLU’s YTD gains of 15.5% and 8.7% returns over the past year.

ED's performance has been volatile, leading to an inconsistent trading pattern relative to its 50-day and 200-day moving averages.

The stock’s underperformance can be attributed to concerns over high capital spending, rising debt, and ongoing regulatory and political scrutiny in its core markets. The company is undertaking extensive grid modernization and clean energy projects, requiring heavy upfront investment and leading to share dilution through capital raises.

In the competitive space, WEC Energy Group, Inc. (WEC) has outperformed with 13% rise YTD and an 8.1% gain over the past year.

Wall Street analysts are cautious about ED’s prospects. The stock has a consensus “Hold” rating from the 17 analysts covering it. The mean price target of $104.93 suggests a potential upside of 9.1%.