With a market cap of $123.6 billion, ConocoPhillips (COP) is a leading global energy company primarily engaged in the exploration, production, transportation, and marketing of oil and natural gas. With a strong portfolio spanning conventional and unconventional plays, oil sands, and LNG developments, the company operates across North America, Europe, Asia, and Australia.

Companies valued at more than $10 billion are generally considered “large-cap” stocks, and ConocoPhillips fits this criterion perfectly. Headquartered in Houston, Texas, ConocoPhillips is recognized as the world’s largest independent exploration and production company by proved reserves and production.

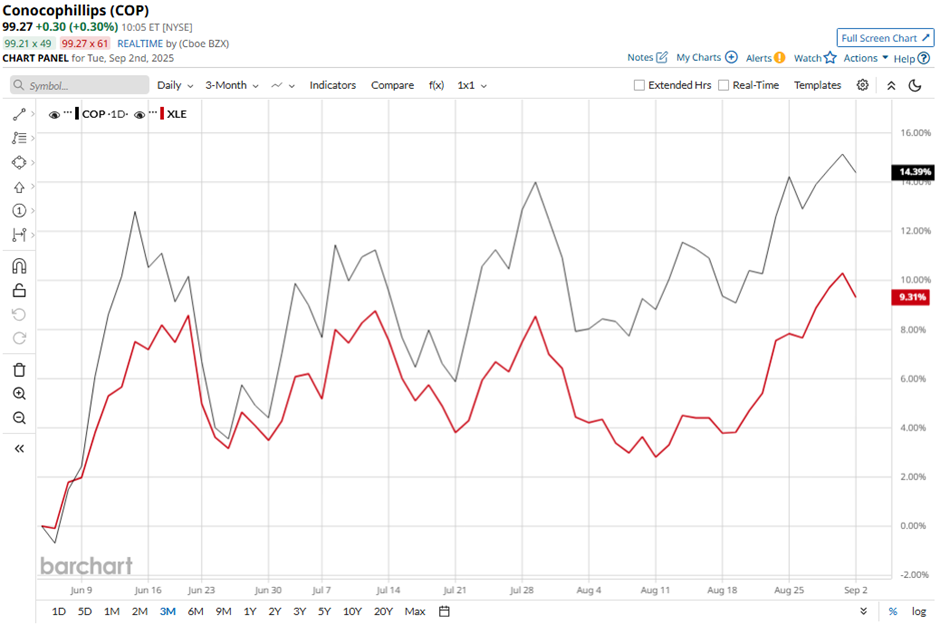

However, shares of ConocoPhillips have dipped 14.5% from its 52-week high of $116.08. Over the past three months, the stock has risen 14.5%, which outpaced the Energy Select Sector SPDR Fund’s (XLE) increase of 8.6% during the same period.

In the long term, COP stock is up marginally on a YTD basis, lagging behind XLE’s 4.7% gain. Moreover, shares of the energy company have decreased 12.8% over the past 52 weeks, compared to XLE’s 1.7% decline over the same time frame.

COP stock has been trading mostly below its 200-day moving average since last year. Nevertheless, the stock has climbed above its 50-day moving average since early June.

Despite reporting Q2 2025 stronger-than-expected adjusted EPS of $1.42, ConocoPhillips shares fell marginally on Aug. 7 as revenue of $14.7 billion came in below forecasts. Investors were also cautious as the company’s realized prices dropped 19% year-over-year to $45.77 per BOE, reflecting weaker crude markets despite higher production. Additionally, guidance for Q3 output of 2.33 MMBOED - 2.37 MMBOED signaled a sequential dip from Q2’s 2.39 MMBOED, tempering the upbeat earnings surprise.

In comparison, COP stock has lagged behind The Williams Companies, Inc. (WMB). WMB stock has risen 25.8% over the past 52 weeks and 6.4% on a YTD basis.

Despite the stock’s weak performance over the past year, analysts are bullish about its prospects. COP stock has a consensus rating of “Strong Buy” from the 28 analysts covering the stock, and the mean price target of $116.69 represents a premium of 17.7% to current levels.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.