Houston, Texas-based ConocoPhillips (COP) is one of the world’s largest independent E&P companies based on production and proven reserves. With a market cap of $110.9 billion, ConocoPhillips employs nearly 12,000 people and operates in 13 countries across the Americas, Indo-Pacific, and the EMEA region.

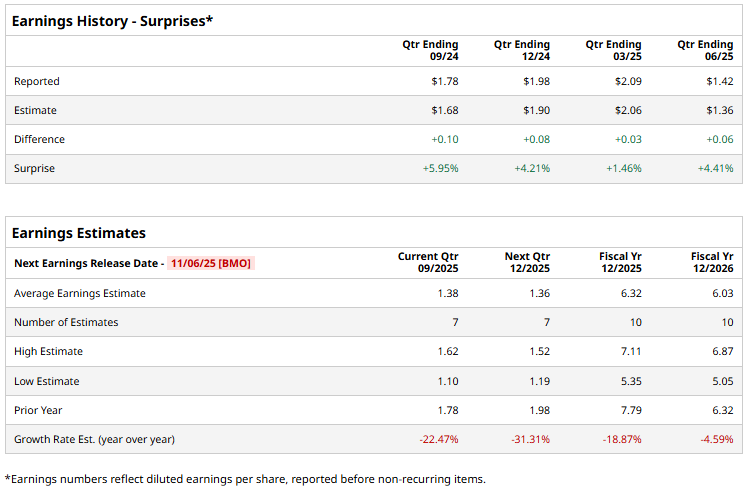

The energy giant is expected to announce its third-quarter earnings before the markets open on Thursday, Nov. 6. Ahead of the event, analysts expect COP to report an adjusted EPS of $1.38, marking a notable 22.4% plunge from $1.78 reported in the year-ago quarter. On a more positive note, the company has a robust earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters

For the full fiscal 2025, ConocoPhillips is expected to report an adjusted EPS of $6.32, down 18.9% from $7.79 reported in 2024. While in fiscal 2026, its earnings are expected to further drop 4.6% year-over-year to $6.03 per share.

COP stock prices have plummeted 19.5% over the past 52 weeks, notably underperforming the Energy Select Sector SPDR Fund’s (XLE) 6.9% decline and the S&P 500 Index’s ($SPX) 13.4% gains during the same time frame.

ConocoPhillips’ stock prices observed a marginal dip in the trading session following the release of its mixed Q2 results on Aug. 7. During the quarter, COP completed the integration of Marathon Oil and remained on track to deliver more than $1 billion in synergies and $1 billion of one-time benefits. Further, it is focused on leveraging its scale and technologies to drive a further $1 billion-plus in company-wide cost reductions and margin enhancements by the end of 2026.

Its topline for the quarter grew 4.3% year-over-year to $14.7 billion, but missed the consensus estimates by 1.3%. Meanwhile, its adjusted EPS came in at $1.42, down 28.3% year-over-year, but 4.4% above the Street’s expectations.

Despite the recent downturn, analysts remain optimistic about ConocoPhillips’ longer-term prospects. The stock maintains a consensus “Strong Buy” rating overall. Of the 28 analysts covering the COP stock, opinions include 18 “Strong Buys,” five “Moderate Buys,” and five “Holds.” Its mean price target of $116.27 suggests a 31.9% upside potential from current price levels.