Valued at a market cap of $67.7 billion, Colgate-Palmolive Company (CL) is a global consumer goods giant specializing in oral care, personal care, home care, and pet nutrition, with popular brands like Colgate, Palmolive, Softsoap, and Hill’s Pet Nutrition. Headquartered in New York, the company operates in over 200 countries through Oral, Personal & Home Care and Pet Nutrition segments.

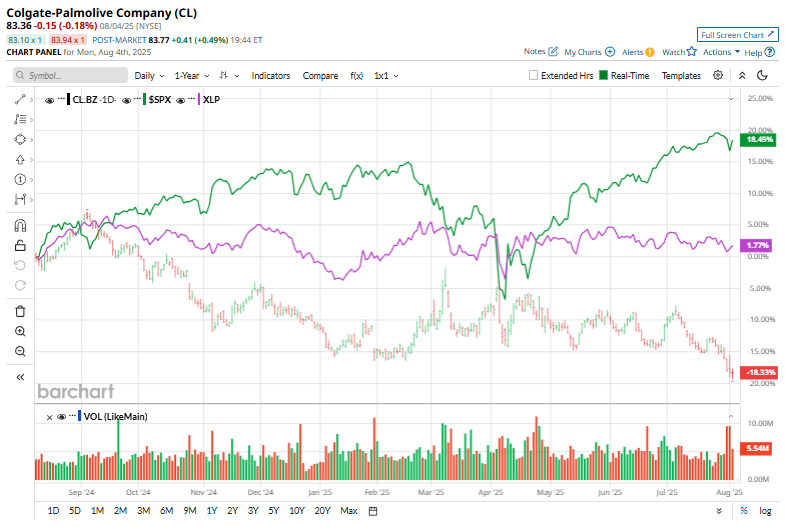

The oral hygiene giant has lagged behind the broader market, declining 18.9% over the past year and 8.3% on a YTD basis. In contrast, the S&P 500 Index ($SPX) has surged 18.4% over the past year and 7.6% in 2025.

Narrowing the focus, CL has also underperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 1.6% gains over the past year and 2.5% rally in 2025.

CL shares slid marginally on Aug. 1 after the company posted its fiscal 2025 second-quarter earnings. It reported net sales of $5.11 billion, up 1% year-over-year, with organic sales growing 1.8%. Adjusted EPS of $0.92 slightly beat analyst expectations. Colgate maintained its global leadership in oral care in 2025, holding a 41.1% share of the toothpaste market and a 32.4% share of the manual toothbrush market.

For the current fiscal year 2025, ending in December, analysts expect CL to report a 1.9% year-over-year increase in adjusted EPS to $3.67. The company has a solid earnings surprise history. It has surpassed the Street’s bottom-line estimates in each of the past four quarters.

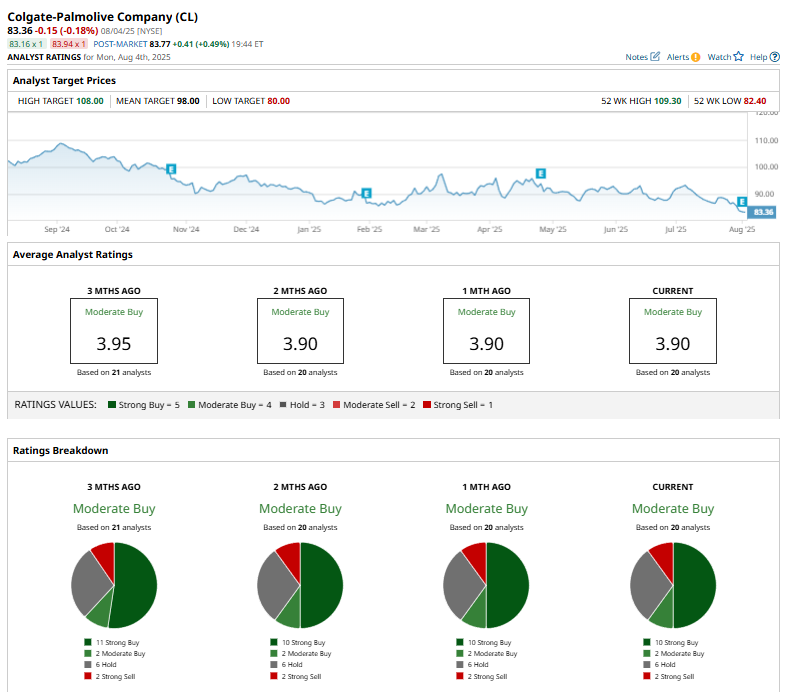

The stock holds a consensus “Moderate Buy” rating overall. Of the 20 analysts covering the CL stock, opinions include 10 “Strong Buys,” two “Moderate Buys,” six “Holds,” and two “Strong Sells.”

This configuration is more bearish than three months ago, when the stock had 11 “Strong Buy” ratings.

On August 4, Citigroup Inc. (C) analyst Filippo Falorni reaffirmed a "Buy" rating on Colgate-Palmolive but lowered the price target from $108 to $105, reflecting a 2.8% reduction.

CL’s mean price target of $98 represents a premium of 17.6% to current price levels, while its Street-high target of $108 suggests a 29.6% potential upside.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.