Brian Armstrong, CEO of Coinbase Global Inc. (NASDAQ:COIN), announced on Tuesday the upcoming launch of a first-of-its-kind futures offering that provides exposure to top U.S. tech stocks and cryptocurrency simultaneously.

COIN stock is staying put for now. Track the latest developments here.

Coinbase’s All-In-One Futures

Armstrong took to X on Tuesday to share the news. The new product, dubbed Mag7 + Crypto Equity Index Futures, will be a hybrid index, composed of “Magnificent 7” stocks, including Apple Inc. (NASDAQ:AAPL), Tesla Inc. (NASDAQ:TSLA), Nvidia Corp. (NASDAQ:NVDA), Coinbase’s own shares, iShares Bitcoin Trust ETF (NASDAQ:IBIT) and iShares Ethereum Trust ETF (NASDAQ:ETHA).

Coinbase said the Index will follow an even-weighting methodology, with each of the 10 components representing 10% of the Index. It will be rebalanced quarterly to reflect market changes. The Mag7 + Crypto Equity Index Futures will be monthly, cash-settled contracts.

The product will be launched on Sept. 22. Armstrong stated that the company will introduce more such products as part of its “everything exchange” vision.

See Also: Strategy Just Bought Another 4,048 BTC—How Far Can Corporate Bitcoin Holdings Go?

Coinbase’s Push Into Derivatives

The announcement comes on the heels of Coinbase’s recent expansion of its perpetual futures offering, adding XRP (CRYPTO: XRP) and Solana (CRYPTO: SOL) to its suite, which already consisted of Bitcoin (CRYPTO: BTC) and Ethereum (CRYPTO: ETH)

Price Action: Coinbase shares rose 0.31% in after-hours trading after closing 0.32% lower at $303.56 during Tuesday's regular trading session, according to data from Benzinga Pro. Year-to-date, the stock has gained 22.26%.

Roundhill Magnificent Seven ETF (BATS:MAGS), which provides equal-weight exposure to the “Mag 7” stocks, closed 1.14% lower at $59.11 on Tuesday. Since 2025 began, the ETF has returned 8.62% on investments.

iShares Bitcoin ETF was up 0.33% after-hours, while iShares Ethereum ETF rose 1.30%.

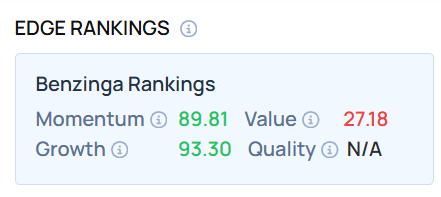

As of this writing, COIN ranked high on Growth, an indicator of a stock's combined historical expansion in earnings and revenue across multiple periods. Visit Benzinga Edge Stock Rankings to compare it to the “Mag 7” tech giants and the cryptocurrency ETFs.

Read Next:

Photo: Camilo Concha / Shutterstock.com

Disclaimer: This content was partially produced with the help of Benzinga Neuro and was reviewed and published by Benzinga editors.