Coinbase Global, Inc. (COIN) posted significantly lower trading volume in its Q2 results release yesterday. In addition, its adj. net income per share fell by over 93% QoQ. That has sparked huge, unusual volume in COIN call options, mostly from sellers, as COIN stock is down 15% today. Buyers should beware.

COIN is at $321.19, down from $377.76 yesterday and a recent peak of $419.78 on July 18. Clearly, investors aren't happy with the company's results.

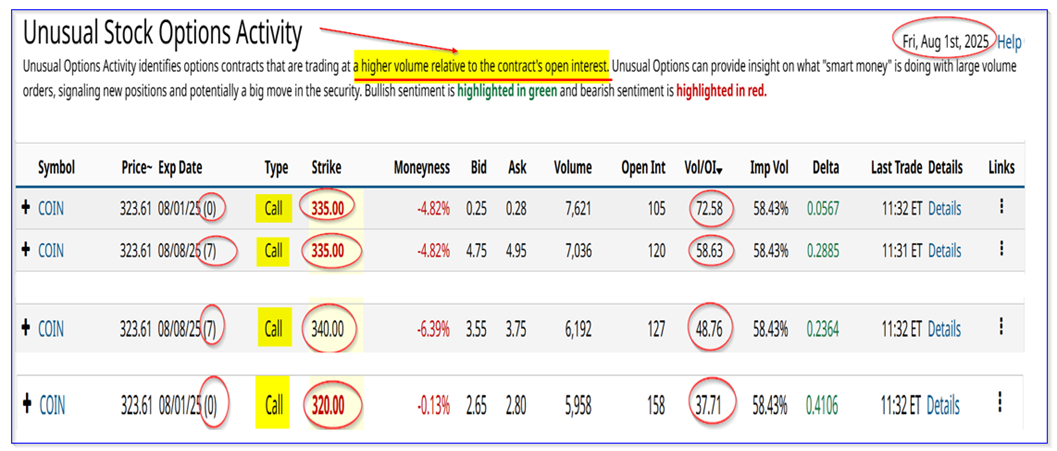

This is evident in today's Barchart Unusual Stock Options Trading Activity Report. It shows that several tranches of call options expiring today and in one week have dominated the unusual trading activity reports.

The Barchart Report shows that between 6,000 and 7,000 call option contracts have traded for today's expiry and Aug. 8 at various strike prices, both above and below today's price.

This implies heavy institutional activity as investors are likely mostly initiating selling action in these calls. Nobody wants to own COIN shares short-term, it seems.

After all, its results did not spark a lot of confidence.

Lousy Q2 Results

Coinbase reported 40% lower trading volumes in Q2 compared to Q1 (i.e., Q/Q), although this was slightly higher than last year. However, year-over-year (Y/Y) results with Coinbase don't matter as trading volume is heavily influenced by diverse events and factors that aren't seasonal.

This led to 39.5% lower Q/Q transaction revenue, although 7% lower subscription sales and higher interest income dampened the total sales decline Q/Q to $1.497 billion, a -26.4% drop.

So, despite Bitcoin rising during the quarter, there has been significantly less interest in crypto trading among investors.

Moreover, analysts and the market were expecting to see almost $100 million higher revenue at $1.593 billion, according to Seeking Alpha. That was a negative 6% downward surprise that seems to have had a shock effect on COIN stock.

This fed through to the bottom line. Not including a gain in unrealized income on its strategic and crypto investments (which the company has not said what coins it now holds), adj. net income per share fell from $1.93 last quarter to just 12 cents.

However, that doesn't include almost $1.5 billion in mostly unrealized gains on its investments, which GAAP rules now require including in earnings per share. The adj. EPS figure shows how well the core underlying business is performing, so excluding unrealized gains seems appropriate here.

This makes it very difficult for investors to be especially ebullient on the prospects or valuation of COIN stock.

Where Does This Leave the Outlook for COIN Stock?

Analysts are not that cheery on COIN stock. For example, Yahoo! Finance reports that almost half of analysts (15/33) have an Underperform rating. Nevertheless, the average price target is still higher at $367.16, although this could likely fall over the next week or so as analysts digest today's report.

Similarly, Stock Analysis says the average price target is $350.18 per share from 27 analysts, and AnaChart.com reports an average of $422.55 from 21 analysts.

Maybe there is good upside in the stock if these targets come to pass. The problem is that after today's report, it's hard to see how that is going to occur.

As a result, investors should be careful investing in COIN stock. This especially applies to the highly speculative short-dated call options as seen in today's Unusual Stock Options Activity Report.