Shares of Coinbase Global Inc (NASDAQ:COIN) are trading lower Thursday afternoon as investors position themselves ahead of the company’s third-quarter earnings release, scheduled for after the market close. Here’s what investors need to know.

- COIN is encountering selling pressure. Get the market research here.

What To Know: Wall Street is anticipating a strong report, with consensus estimates pointing to earnings per share of $1.09 on revenue of $1.78 billion. This would mark a significant increase from the same period last year, driven by higher crypto trading volumes during the quarter.

Beyond the headline numbers, investors will be scrutinizing the company’s efforts to diversify its revenue streams. Key areas of focus include growth in staking, derivatives and the company’s layer-2 solution, Base.

The earnings come amid a backdrop of positive developments for the exchange. Earlier this week, Coinbase announced a major partnership with Citi to streamline digital asset payments for institutional clients.

Furthermore, CEO Brian Armstrong recently stated he is “bullish” on the prospects of key crypto legislation passing in the U.S. by the end of the year, a move that would provide much-needed regulatory clarity.

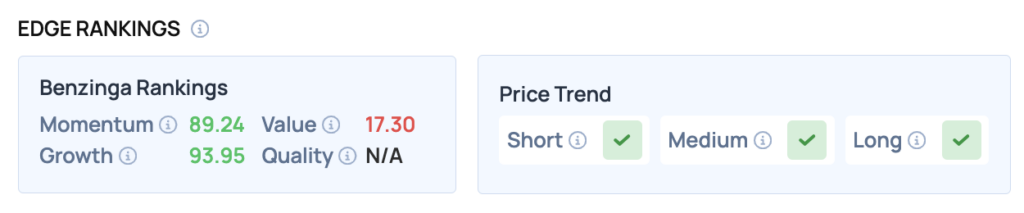

Benzinga Edge Rankings: Despite the day’s dip, Benzinga Edge rankings show the stock holds exceptionally high scores for both Growth (93.95) and Momentum (89.24).

COIN Price Action: Coinbase Global shares were down 2.69% at $339.22 at the time of publication on Thursday, according to Benzinga Pro data.

Read Also: Michael Saylor Targets $150,000 For Bitcoin As Strategy Breaks New Ground With S&P Rating

How To Buy COIN Stock

By now you're likely curious about how to participate in the market for Coinbase – be it to purchase shares, or even attempt to bet against the company.

Buying shares is typically done through a brokerage account. You can find a list of possible trading platforms here. Many will allow you to buy “fractional shares,” which allows you to own portions of stock without buying an entire share.

If you're looking to bet against a company, the process is more complex. You'll need access to an options trading platform, or a broker who will allow you to “go short” a share of stock by lending you the shares to sell. The process of shorting a stock can be found at this resource. Otherwise, if your broker allows you to trade options, you can either buy a put option, or sell a call option at a strike price above where shares are currently trading – either way it allows you to profit off of the share price decline.

Image: Shutterstock