Bitcoin (BTCUSD) hit a new all-time high of over $126,000 on Oct. 6, adding another big milestone to this year’s rally across crypto. At the same time, stablecoins are scaling fast, with B2B stablecoin payments jumping 30x to $3 billion in monthly volume this year, and total stablecoin market cap nearing $300 billion. That surge is pulling in major players, with Visa (V) testing stablecoin prefunding to speed up business payouts as traditional payment firms rush to keep pace with this shift.

Coinbase (COIN) has also ridden this momentum, scoring almost 95% gains over the last six months, a sign of how well it’s positioned in this market. Reports now say Coinbase and Mastercard (MA) are in advanced talks to buy London-based BVNK, a stablecoin infrastructure firm, in a deal that could land between $1.5 billion and $2.5 billion. A move like this could reshape Coinbase’s role in stablecoins right as its Q3 2025 earnings approach in the coming weeks.

There is still plenty of volatility in Bitcoin, and stablecoin rules are still being worked out under frameworks like the GENIUS Act, so the question is simple. Could a BVNK deal be the catalyst that turns COIN into a must-own fintech stock for 2025, or is the market already too optimistic? Let’s find out.

Coinbase’s Financial Pulse

Coinbase is the largest U.S. crypto exchange, running a broad platform for spot, futures, and options trading, along with a growing lineup of blockchain-based services.

Over the past year, COIN has stood out, up 75.52% over 52 weeks and 38.79% year-to-date (YTD), showing solid investor confidence tied to strategic moves and deals.

Even so, the forward P/E of 85.68x is far above the sector’s 10.85x, which means the market expects strong growth and is paying a premium for it.

Recent numbers tell a mixed story. In Q2 2025, net operating EPS was $0.12, missing estimates by nearly 90% and down 88.8% year-over-year (YoY) due to rising costs. Total trading volume reached $237 million, up 4.9% from last year, and revenue rose 3.2% to $1.5 billion, just shy of expectations. Transaction revenue fell 2.1% to $764.3 million as consumer and institutional activity cooled a bit, while subscription and services revenue grew 9.5% to $655.8 million, helped by stronger stablecoin income.

Costs were the pressure point, up 37.5% to $1.5 billion as the company spent more on technology, marketing, and operations. Adjusted EBITDA was $512 million, down 3.2% YoY, showing some margin strain. Even so, with a market cap near $91.7 billion, annual sales of $6.56 billion, and net income of $2.58 billion, Coinbase remains on solid footing, leaning into stablecoin growth and institutional services to back up a rich valuation.

Can a BVNK Deal Redefine Coinbase’s Growth Story?

Coinbase is reportedly pursuing London-based BVNK at a price between $1.5 billion and $2.5 billion, a move that signals a push to build stablecoin infrastructure at a global scale. Multiple sources say Coinbase and Mastercard are both in advanced talks, and Coinbase currently appears ahead in the bidding. If this closes, it would be the largest stablecoin acquisition to date. That would expand Coinbase’s role in blockchain payments and strengthen its position against both fintech players and established financial firms.

This possible deal follows a series of steps aimed at stablecoins and institutions. Earlier this year, Coinbase acquired Deribit, a leading crypto options platform. The acquisition helped lift derivatives trading volume above $800 billion. It also opened more cross-selling with institutions by bringing spot, futures, and options under one platform.

In Canada, Coinbase invested in Stablecorp, the issuer of the QCAD stablecoin, as part of a push into regulated stablecoin markets. The deal aligns with a plan to modernize finance and adds exposure to a crypto-friendly base of nearly five million Canadians. It came after Coinbase registered with the Canadian Securities Administrators as a Restricted Dealer in April 2024, which supports regulatory credibility and a role in Canada’s Value Referenced Crypto Asset framework.

Coinbase also deepened its banking ties through a partnership with PNC Bank (PNC). The collaboration brings Coinbase’s Crypto as a Service platform into PNC’s offerings, allowing PNC’s retail and institutional clients to access secure crypto trading and custody. It further positions Coinbase as a practical bridge between traditional banking and blockchain-based financial services.

What Analysts See Ahead for COIN

Management expects Q3 2025 subscription and services revenue to land somewhere between $665 million and $745 million, with higher average crypto prices and strong stablecoin growth leading the way. The current earnings expectations for the September quarter are 1.01 per share, with full-year 2025 at 4.17, pointing to a YoY growth of nearly 63% as Coinbase focuses more on steady income streams from recurring services and stablecoins.

On the analyst side, Citizens JMP’s Devin Ryan stands out, keeping his “Buy” rating and targeting $440 per share, which is about 23% higher than the current price of $357. Ryan’s optimism is mainly drawn from Coinbase’s expanding work with institutions and its buildout of stablecoin infrastructure, especially if the BVNK acquisition closes. Bank of America Securities prefers to keep its “Hold” rating but remains interested, which shows there’s broad belief in Coinbase’s role in shaping crypto infrastructure for institutions even from more cautious buyers. A BVNK deal and clearer payment flow could be important levers.

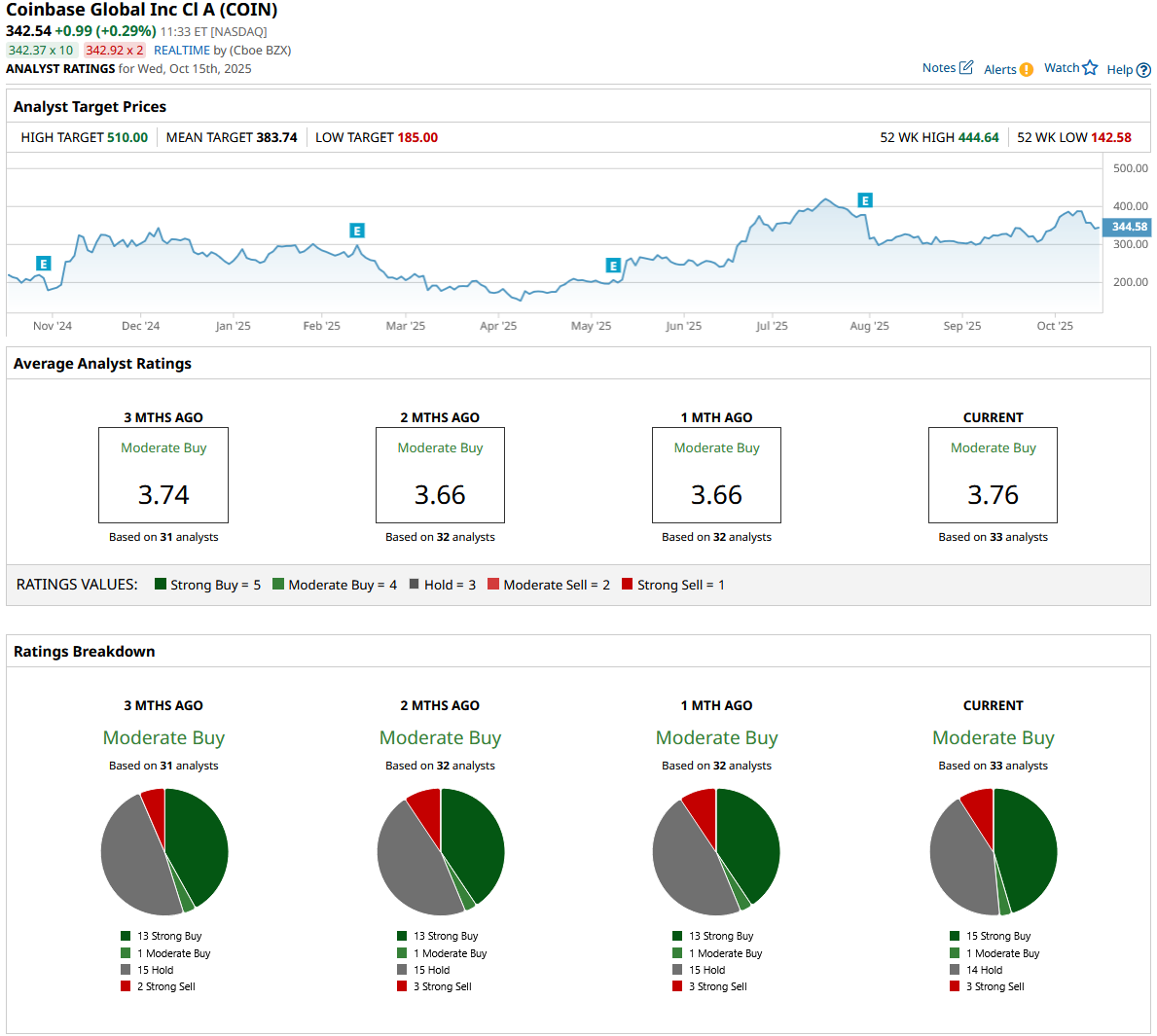

Overall, 33 analysts cover Coinbase, and the group leans to a consensus “Moderate Buy” rating, settling on an average price target of $383.74. That gives the stock a potential upside of about 11% from its current level.

Conclusion

Given Coinbase’s accelerating push into stablecoin rails, the advanced BVNK talks, and near-term guidance that leans on subscription and stablecoin economics, COIN looks like a buy-on-execution story with clear catalysts into and beyond the Oct. 30 print. The setup favors upside if guidance lands toward the high end and a BVNK deal closes on sensible terms, but the premium multiple means misses will sting. Most likely, shares grind higher into earnings and on any positive BVNK headlines, with dips getting bought; absent a deal or if guidance softens, expect a choppy, range-bound tape rather than a breakdown.