Coinbase Global, Inc. (COIN) stock has hit a bump in the road as Bitcoin is on a downturn. That has led to very unusual call options activity in COIN stock, according to a Barchart report. Is this a buying opportunity?

COIN is at $303.12 in midday trading on Wednesday, Aug. 20, down slightly, but off over 27% from its recent peak of $419.78 on July 18. That was before its recent Q2 earnings release on July 31.

I discussed the company's earnings in a Barchart article on Aug. 1 ("Coinbase Shows Huge Unusual Options Volume After Lower Results"). In short, the results were lousy and investors have not been inspired. You can read my article to see why.

Unusual Options Activity in Call Options

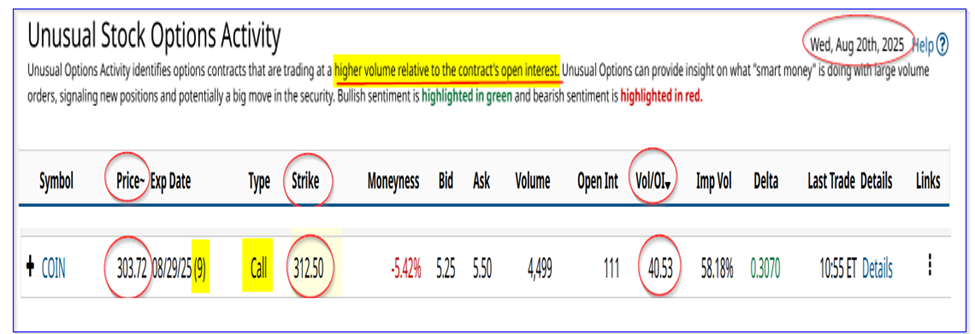

Nevertheless, hope springs eternal. That may have led investors to buy large amounts of call options, as seen in today's Barchart Unusual Stock Options Activity Report.

It shows that almost 4,500 call option contracts have traded for the Aug. 29, 2025, expiry period (9 days to expiry) at the $312.50 call option strike price.

That exercise price is higher than today's price, so it is considered “out-of-the-money.” In other words, COIN stock will have to rise to $318.00, or almost 5% for the investor to hit breakeven:

$312.50 + $5.50 premium = $318.00 breakeven point

$318.00 / $303.12 = 1.049 = +4.9% out-of-the-money

However, given that all options have extrinsic value up until right before their expiration, it's possible that if COIN rises from here, the investor could make money. But that is a gamble or a speculative play.

On the other hand, the investor who sells short these calls is making a good yield. For example, the $5.25 premium received represents over 1.73% of the investment at today's price:

$5.25 / $303.12 = 0.017319 = 1.73% yield

That is a very good return over the next 9 days. Moreover, even if the stock rises to $312.50, the investor would be able to make an additional 3.09% over the next 9 days. So, the total potential realized gain would be 4.82%.

As a result, investors may want to copy these short-sellers as this covered call yield play is very attractive here. For example, buying COIN stock here and selling short OTM calls provides some downside protection due to the income received:

$303.23 - $5.25 premium income = $297.87 breakeven

That is 1.73% below today's price. However, if COIN falls below this point in the next 9 days, the investor's long investment could end up with an unrealized loss.

Bitcoin Correlation

So, is this a good play? Maybe, but keep in mind that COIN stock tends to correlate with the price moves of Bitcoin (^BTCUSD).

For example, BTC is down today as well at $114,000 or so, and well off its high point of $122,860 on Aug. 13.

The reason is that much of Coinbase's revenue comes from cryptocurrency trading. For example, transaction revenue in Q2 was $763 million, down 39%, representing 53.8% of its total revenue (the rest was subscriptions).

So, the ups and downs in Bitcoin affect its transaction revenue quite heavily. The higher Bitcoin climbs, the higher the company's transaction revenue rises.

The bottom line is that there is a large correlation between COIN stock and BTC.

So, if you think BTC will turn around from here, buying COIN call options like these (despite their short expiry period) might be a good play. But, just keep in mind that this is a very speculative play.

A more conservative, yet not without downside risk, play is to sell short out-of-the-money (OTM) call options. Investors can turn to Barchart's Options Education Center to learn more about the risks associated with covered call options.