Last week, two financial services giants, Coinbase (COIN) and Visa (V), were key highlights in Barchart’s Unusual Stock Options Volume screener. However, this data interface covers 500 of the most aberrant securities. Just by logical inference, there’s simply no way that all 500 of these stocks are compelling bullish opportunities. So, it raises the question, which one of these giants deserves your attention?

Unlike typical fare from the financial publication industry, I’m not going to leave you hanging — I have a clear opinion on the matter. But first, we should drill down what we saw in the derivatives arena.

Heading into the weekend, total options volume for COIN stock reached 708,839 contracts, representing a 114.67% lift over the trailing one-month average. Further, call volume stood at 450,671 contracts, while put volume landed at 258,168 contracts. On paper, this dynamic seems favorable for Coinbase.

Drilling into options flow — which focuses exclusively on big block transactions likely placed by institutional investors — the screener revealed that net trade sentiment reached about $2.371 million. However, relative to total gross bearish volume of over $18 million, the net trade sentiment metric wasn’t overwhelmingly significant.

What did make COIN stock extremely conspicuous was its volatility. On Friday, the security lost almost 17% due to Coinbase missing analysts’ estimates for both earnings and revenues. Notably, total transaction revenues decreased 2.1% on a year-over-year basis to $764.3 million in the quarter. The deceleration was pegged to lower consumer and institutional transactions.

On the other end of the spectrum, total options volume for V stock clocked in at 49,931 contracts, representing a 72.51% lift over the trailing one-month average. Here, call volume was only 18,484 contracts while put volume stood at 31,447 contracts.

Still, a similar dynamic materialized in Visa’s options flow screener, which showed net trade sentiment of $88,300. As it turned out, the biggest transactions in terms of dollar volume were for sold (credit-based) puts. Such transactions tend to have neutral-to-bullish posturing.

Using options data, nothing really separates Coinbase from Visa. Sure, the latter did beat earnings expectations. However, it also issued a cautious outlook that sent V stock tumbling.

Why One Name Stands Out From the Other

Although unusual options data is intriguing, it’s difficult to extract a descriptive analysis from derivative market transactions. That’s because unusual options activity is happening pretty much all the time. Since we’re also dealing with continuous scalar signals, it’s impossible to objectively discern whether the activity is “good” or “bad” for bullish retail investors.

Continuous signals are by nature unbounded, meaning that they could rise indefinitely. So, by logical deduction, no falsifiable mechanism exists to determine a share price as a “good discount” or if a company disclosed “bad earnings.” These are relative terms.

As far as I can tell, there’s only one objective truth: at the end of the day, the market is either a net buyer or a net seller. And critically, it can’t be both at the same time.

Through this framework, we can say that in the past 10 weeks, the market voted to buy V stock six times and sell four times. Through this period, the security incurred a downward bias. For brevity, we can label this sequence as 6-4-D.

What’s significant here is that this quantitative signal has only materialized 15 times on a rolling basis since January 2019. Moreover, in 80% of cases, the following week’s price action results in upside, with a median return of 1.63%. In comparison, the chance that a long position in V stock will rise on any given week is 56.4%. Therefore, an incentive exists to take a wager here, assuming that the implications of the 6-4-D hold true.

For COIN stock, the past 10 weeks saw an even split in terms of market sentiment dominance. Overall, the security saw an upward bias and therefore, the sequence can be abbreviated as 5-5-U. Unfortunately, with this signal, the chance that COIN will rise in the following week is only 50%.

To be fair, the baseline probability for COIN stock on any given week is only 46.22%. On a relative scale, investors have an edge. However, it’s a tiny one and without a directional bias, the most realistic options strategy may be an iron condor of some sort.

Iron condors can be awesome vehicles in the right circumstances. At the same time, they tend to be quite expensive due to setting up profitability zones on opposing ends. Therefore, I believe speculators would be better served with Visa stock. It’s boring, yes, but it appears to be giving you a directional edge.

Putting the Numbers Together for V Stock

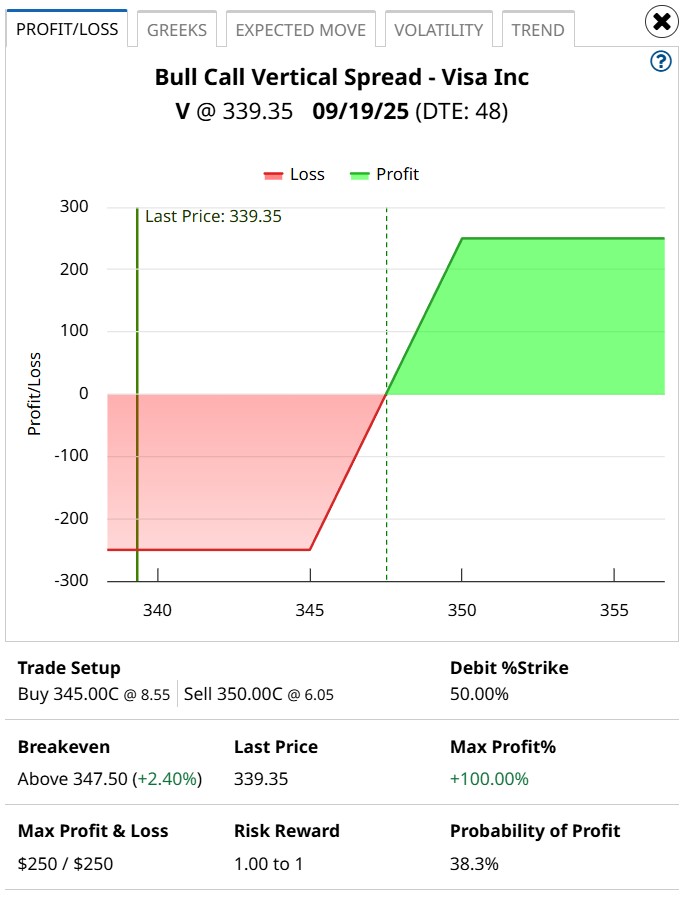

Based on the market intelligence above, a solid idea to consider is the 345/350 bull call spread expiring Sep. 19. This transaction involves buying the $345 call and simultaneously selling the $350 call, for a net debit paid of $250. Should V stock rise through the short strike price ($350) at expiration, the maximum profit is also $250, a payout of 100%.

It goes without saying that much hinges on the statistical reliability of the 6-4-D sequence. Running a one-tailed binomial test reveals a p-value of 0.053. That means there’s a 5.3% chance that the implications of the signal could materialize randomly as opposed to intentionally. That’s right near the cusp of statistical significance, making Visa stock very intriguing.

To be clear, a high confidence level of non-randomness doesn’t necessarily mean that upside odds this week are absolutely 80%. Sentiment regimes can change without warning since the stock market is an open, entropic system. That said, from a descriptive point of view, the odds favor the bulls right now.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.